Feel the funding

Cryptic ball: did you have a plan?

Friday's subject line should have been "dump or dump not, there is no try", right? The newsletter was sent out at 15h26 UTC time and, 15 minutes after, bitcoin broke the diagonal trend line I've been highlighting for weeks, initiating the second most significant dump of 2021. The orange coin fell up to 25% in less than 12 hours, dragging the entire market with it in the typical leverage flush caused by the cascade of liquidated longs that tend to occur in crypto's inefficient markets.

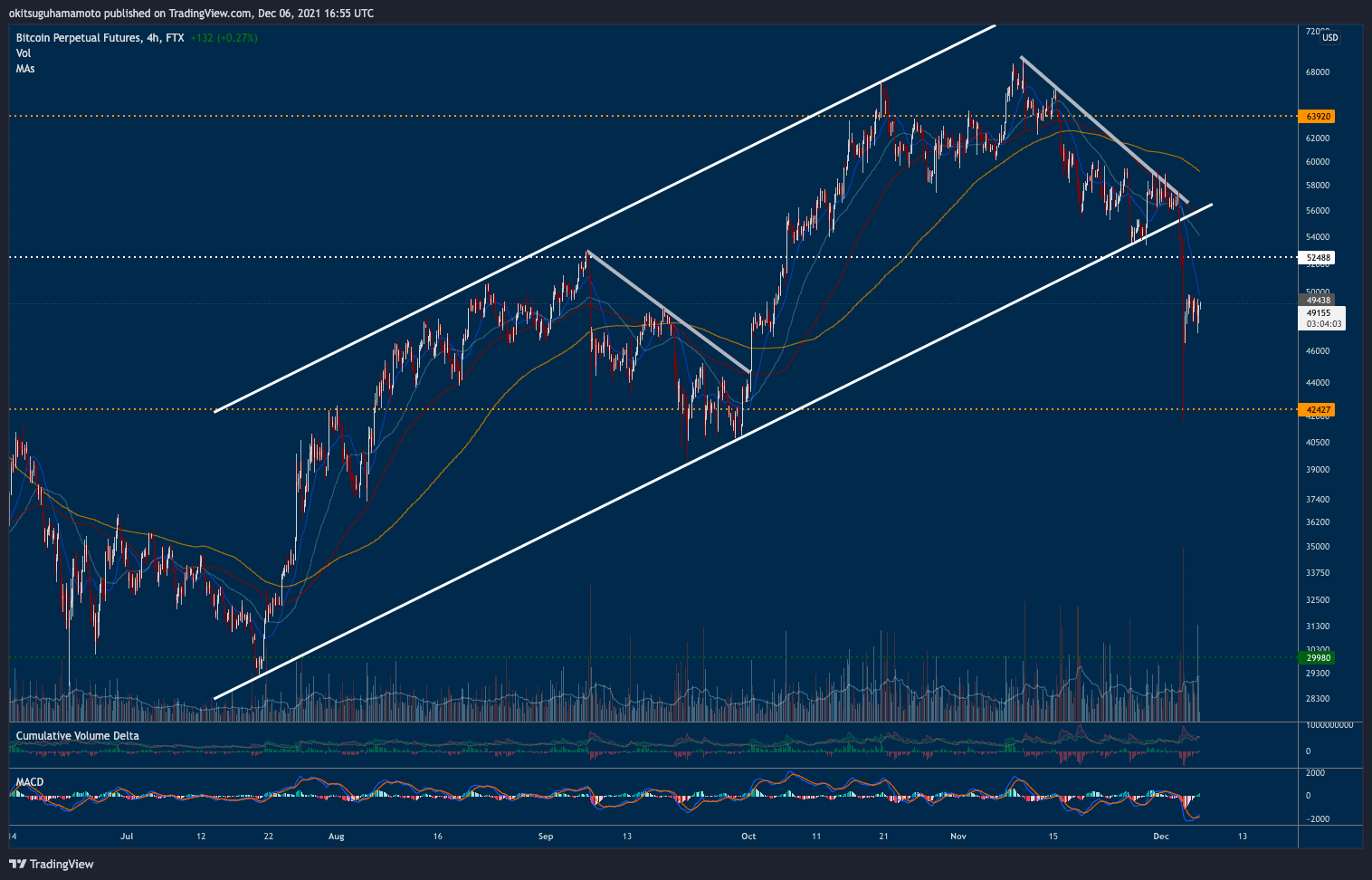

Now, from last Monday to Wednesday I wrote about the possibility that the bounce since the fall from $69k was a dead cat one, showing how it was key to reclaim $60k by the end of the week - with the help of the diagonal trend shown in today's Chart Art. Thursday we got the second failure at conquering $60k and I told you should have a plan in case we got closer to $53k. Friday I shared I was still feeling a lot of uncertainty related to the reaction of North American equities to the impact of COVID on the economy - and it seems I wasn't the only one who sold before closing shop for the weekend, so I hope you were short with me!

Because this dump gives us the clean slate we needed to enter the next leg up in the bull cycle, which I feel could be the last before a prolonged bear market - albeit one not as serious as the one from 2018-19. If you read Ben Lilly's post I shared Friday, you'll understand why we're now ready to bloom. If not, just remember capitulation happens at extreme fear levels, and that's what we saw this weekend. After all, following capitulation we tend to go sideways for a while and then resume the longer-term trend - which remains intact (at least for now).

So, here's what we need to pay attention to for the week ahead. First, sentiment is still very bearish but that's not bad. As Ryan Selkis insightfully jokes in today's Tweet Tip, that's a hint that we're not experiencing the euphoria needed for a market top - at least for now. Secondly, the crypto market quickly bounced +18% from Saturday's lows. LUNA even bounced +50% towards a new all-time high yesterday! This shows how even after overleveraged traders were rinsed there's demand for quality alts - at least until equity markets remain "healthy".

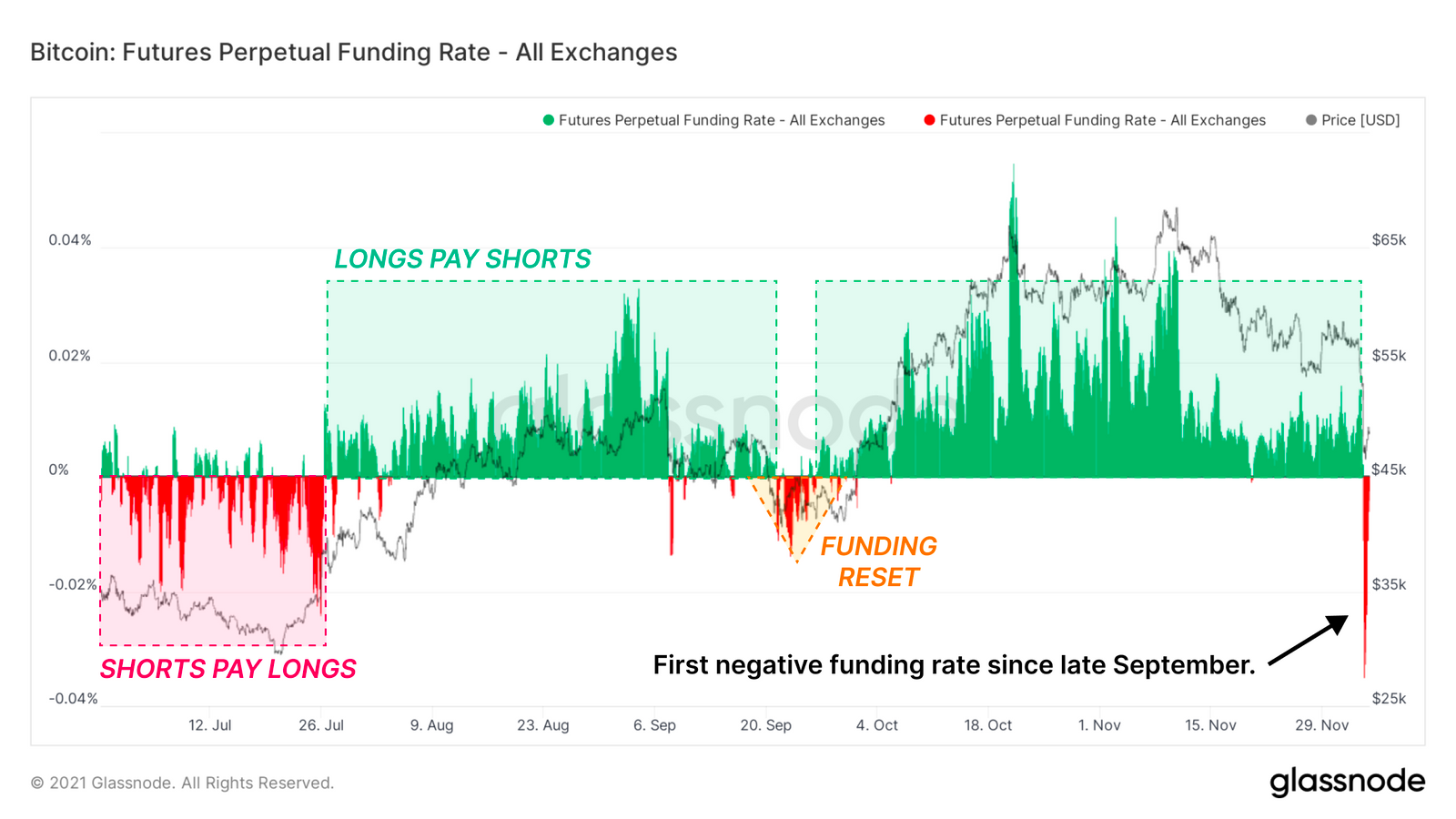

Lastly, funding rates have now fully reset - as you can see in today's visual block - and as long as funding remains positive (which has just turned green again some hours ago), then the bull run is on. Additionally, Glassnode Insights, one of the few outlets I trust regarding on-chain analytics, just released a great post showing hodlers are not selling and how that's different from what happened in May's top. It's time to be greedy again, even if December may prove to be rather uneventful, as most are slow to adjust their bias after this weekend's exciting action!

Chart art: did you follow the chart?

Visual Block: did you feel the funding?

Three things: are you gonna make it?

- Vitalik Buterin discusses the "many paths toward building a scalable and secure long-term blockchain ecosystem".

- Ben Munster tells the story of eGirl Capital, a cryptoasset VC firm "staffed almost entirely by anonymous cartoon characters".

- Daniel Tenner explains why not all gonna make it, but shares some great tips to maximise your chances of feeling like WAGMI.

Tweet tip: are you going to panic?

Meme moment: are you going to sell the bottom?

Meme moment, part 2: are you going to laugh?

B21 Card: get yours today.

Get started: download the B21 Crypto app!