The Jackson Cajole

Cryptic ball: don't listen to it.

Bitcoin and ether are bouncing - slightly - while stocks kept falling. That's good news, even if not exactly stellar. More worryingly, this Monday US equities had their worse day since June. Reasons to worry or business as usual?

- Firstly, it's interesting to see that last Friday's dump in the cryptoshere anticipated that crash in stonks. It amplifies the narrative that bitcoin, as a 24/7 global asset, is a new bellwether for investor sentiment.

- Secondly, it's true that concerns about Europe's economy and the upcoming winter, given the current energy crisis, are mounting. But, as said earlier, I remain convinced these issues don't present a contagion risk for risk assets.

- On the contrary, record-high inflation in the UK - with Citibank expecting it to hit 18% "in early 2023" - will surely remember people of how important it is to invest their savings instead of having them parked under the mattress.

- Lastly, I'm inclined to believe Jerome Powell and his fellow central bankers will provide nuanced-enough statements this end of the week, during the Jackson Hole symposium, to allow the summer rally to continue. Let's hope I'm right!

Chart art: don't stay away from it.

Three things: just web3 it.

- Ryan Berckmans shares "a short essay on web3 fundamentals".

- Eric Wall makes "the case for social slashing", aka blockchain censoring.

- Westie argues "the Fat App Thesis is here to stay".

Tweet tip: just do it.

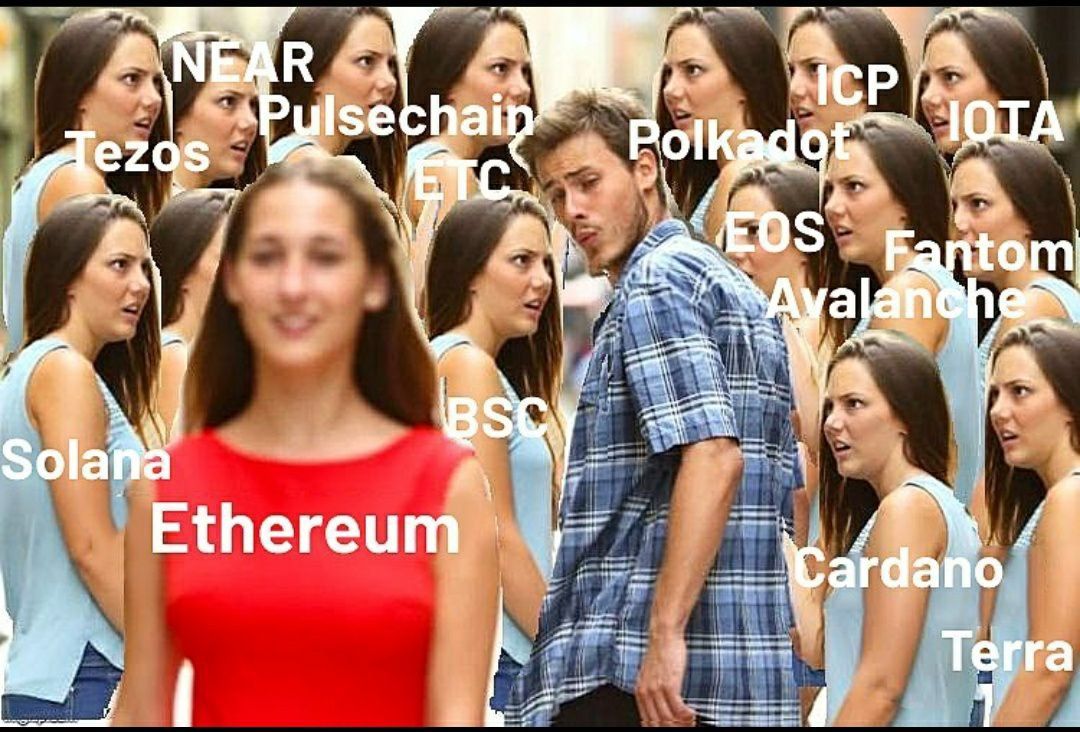

Meme moment: just pay attention to it.

FV Bank: new monthly newsletter.

Get started: download the B21 Crypto app!