The Jackson Stole symposium

Cryptic ball: just listen to it.

It was a weak weekend, indeed. Things look grim, but not all is lost. As explained Friday, bitcoin and ether had to keep their structure of higher highs and higher lows intact. While ETH is still on track, bitcoin looks less enticing. What about?

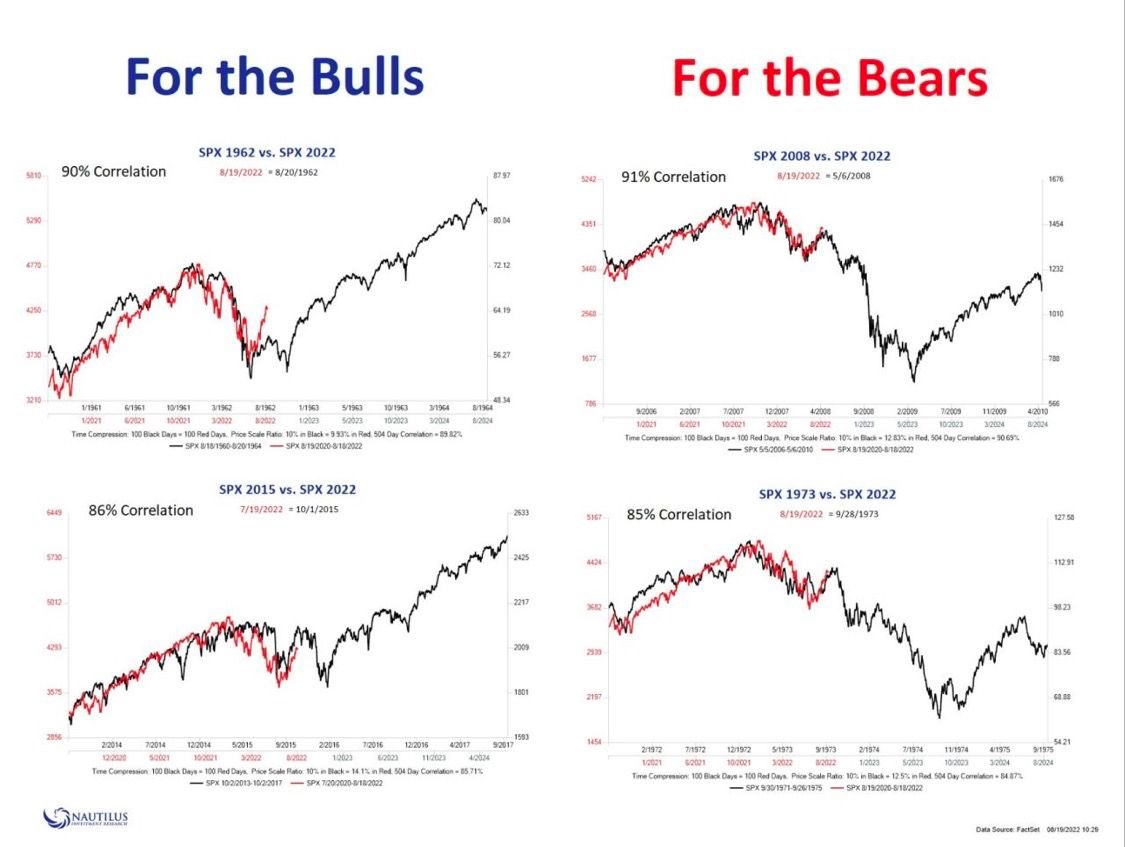

- Last Friday, stocks started a minor dump after four weeks of straight gains. This was expected, and equities are still showing remarkable strength in this bounce. However, it seems bitcoin threw in the towel as it fell 10% that day!

- Ether followed, falling nearly 15%. The rest of the weekend was smooth across the board but this kind of dump doesn't bode well for a generalised recovery. Yes, ETH will continue to benefit from the narrative around the Merge.

- But even that upgrade can be suffer from a "buy the rumour, sell the news" kind of effect, once it is activated in mid-September. For now, the current dump was caused by the Jackson Hole symposium I've been talking about.

- This week, from Thursday to Saturday, central bankers and finance ministers from around the world will be gathered in Wyoming to "reassess the constraints on the economy and policy". And the markets are listening.

- Jerome Powell, the US Fed's chair, will also give an important speech, but I'm expecting the whole shebang to be a nothing burger. Why? I believe we're just experiencing generalised fear so that more big players can buy the dip.

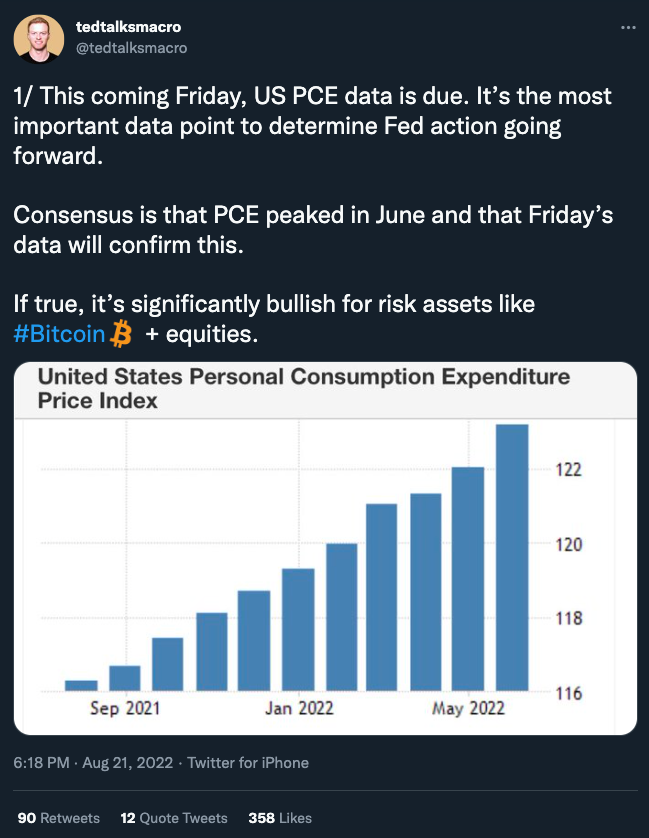

- Macro data is looking good and while the risk of a severe winter in Europe can potentially impact global markets, I'm not sure it would be more impactful fork risk assets than the Fed tightening up. But let's keep an eye out for that!

Meanwhile, I'm expecting crypto and tech stocks will be sluggish until we overcome the Jackson Hole spectacle and until potentially positive inflation data is released this Friday. Just remember ETH can still easily fall until $1.4k!

Chart art: just stay away from it.

Three things: just web2 it.

- Casey Newton explains why the viral NFT project Loot is still thriving.

- CMS Intern explains how crypto hacks happen in three levels of depth.

- Kanav Kariya explains why web2 may be solve web3's design issues.

Tweet tip: just wait for it.

Meme moment: just ignore it.

FV Bank: new monthly newsletter.

Get started: download the B21 Crypto app!