The Jackson Scroll

Cryptic ball: so it begins.

It seems my expectation that the Jackson Hole symposium is going to provide a dovish view of the economy, allowing the rally to continue, is being priced in by the market - with both stonks and crypto continuing to bounce. Let's analyse.

- Ether is back at the key $1.7k level, which if conquered should provide plenty of support over the next couple of weeks. Bitcoin also looks poised to break out of the $21.5k resistance, allowing for another test of $25k next.

- US stocks have pumped Wednesday and continue to do so today, indicating global traders are optimistic toward Jerome Powell's speech this Friday in the grand meeting of central bankers in Wyoming which started today.

- To add fuel to the fire, Richard Thaler, the 2017 recipient of the Nobel Price in Economics, argues the US economy is far from a recession - quite the contrary, it seems. The Zero Hedge crowd surely disagrees but what can we do?

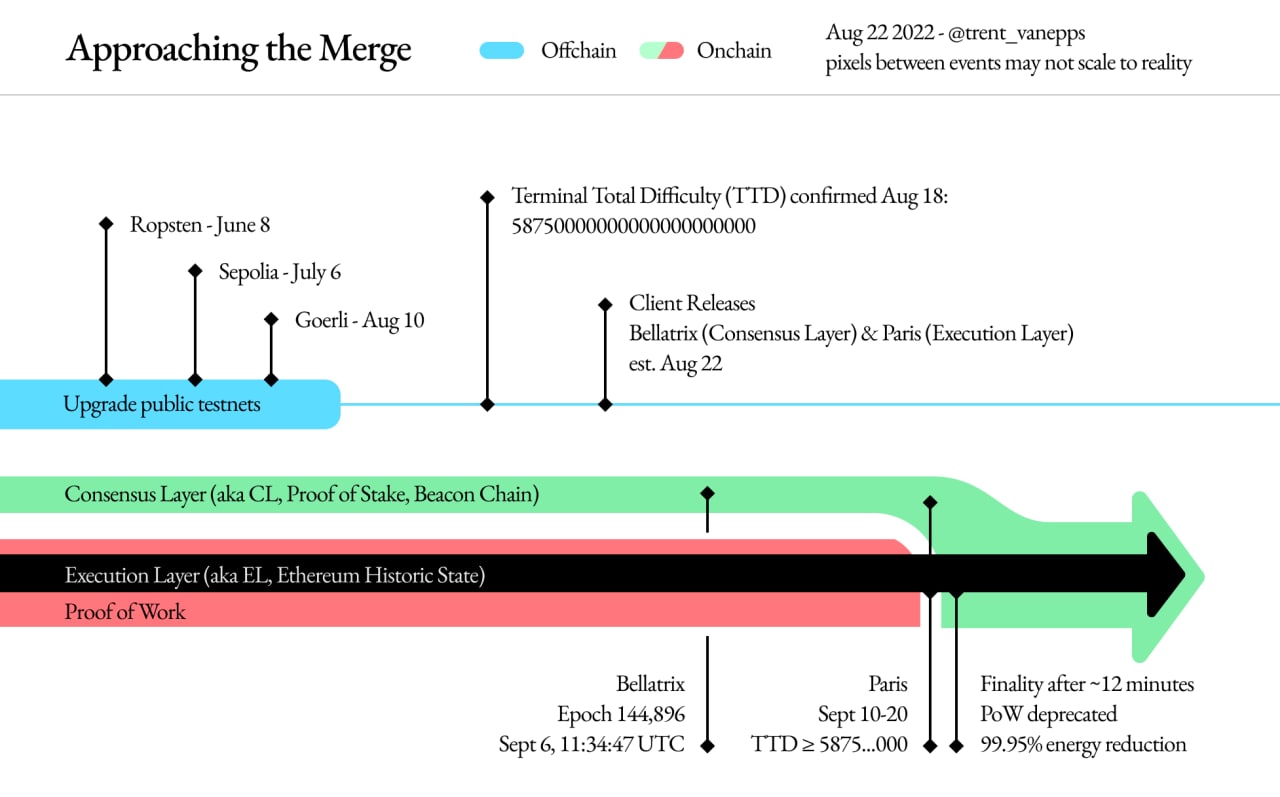

- Lastly, once this macro debacle is out of the way - at least until September's FOMC meeting - I'm hoping to see ether pumping a bit more, on top of the narratives around the upcoming Merge upgrade, also due in mid-September.

Still, for all the hype around it, I strongly recommend today's recommended read on the topic. I've been arguing we may dump after the Merge is implemented, due to a "sell the news" effect, just like BTC suffered before, and more people agree!

Chart art: so it merges.

Three things: so it hypes.

- Jordi Alexander argues Ethereum's Merge is "overhyped". Must-read!

- TokenData updated its report on the "State of Crypto M&A 2022".

- Sabo shared "resources for those in crypto wanting to start coding".

Tweet tip: so it cops.

Meme moment: so it memes.

FV Bank: new monthly newsletter.

Get started: download the B21 Crypto app!