Untitled Rock #72

Cryptic ball: two scenarios.

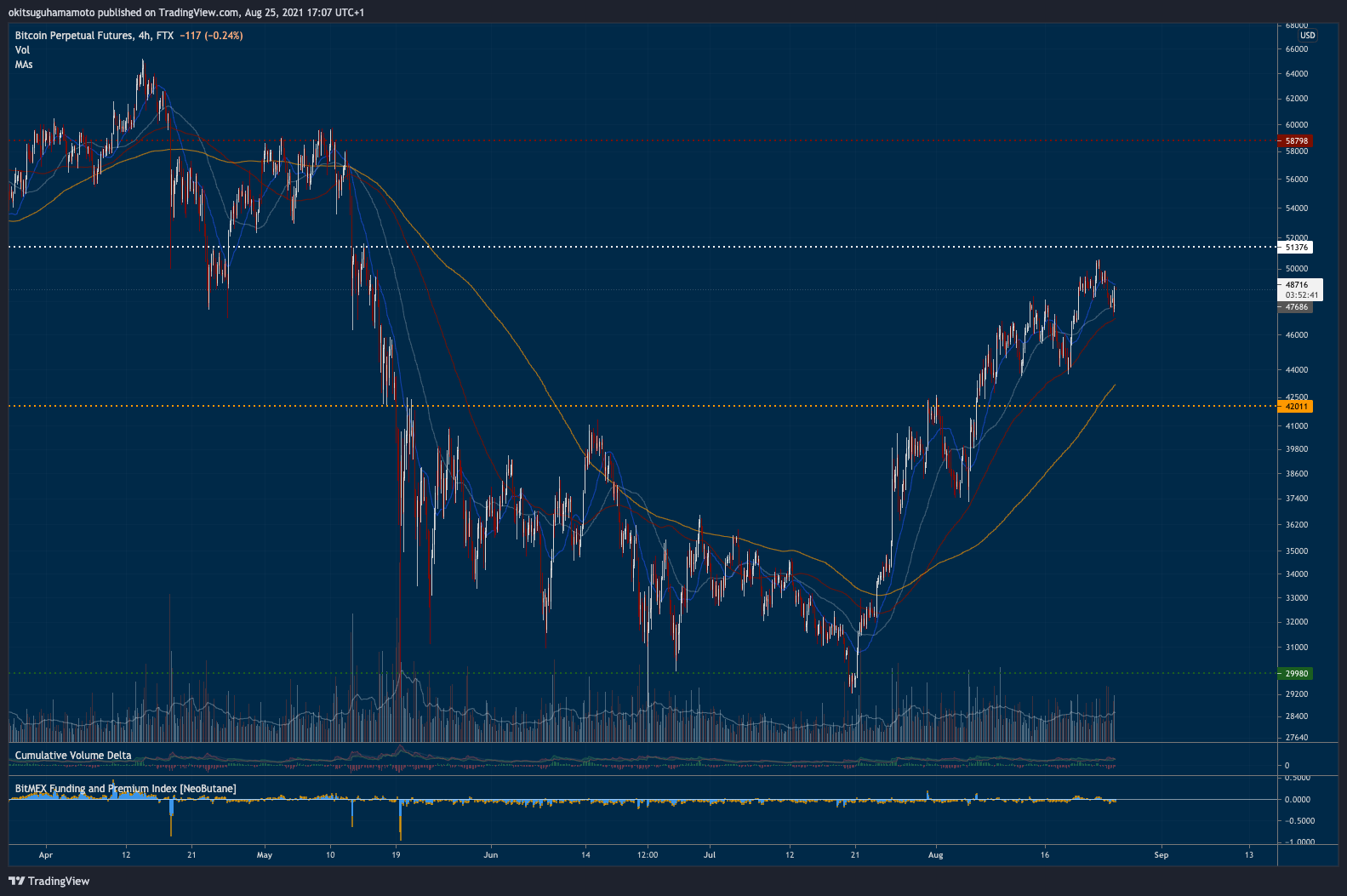

Not much has changed since Monday, with Bitcoin only down 1% since the newsletter was sent peak. Still, the original cryptoasset and the overall market fell up to 6% yesterday from this week's peak. Was this the short-lived dip we talked about or are we in for the red week scenario? So far, BTC remains healthy, and will continue to be seen as such until it breaks the 4-hour 100-period moving average.

If that happens, expect the orange coin to drop to $43k, maybe even testing $42k if sellers get aggressive. That would drag alternative tokens too, likely also provoking a more bearish weekend. However, if today's bounce is real and bulls overcome $50.6k then it's likely BTC pumps straight to $59k by the end of the month - with your favourite alts following the leader. Isn't that a simple trading plan for the rest of the week? Just be careful with what's happening in the stock market!

Chart art: healthy uptrend.

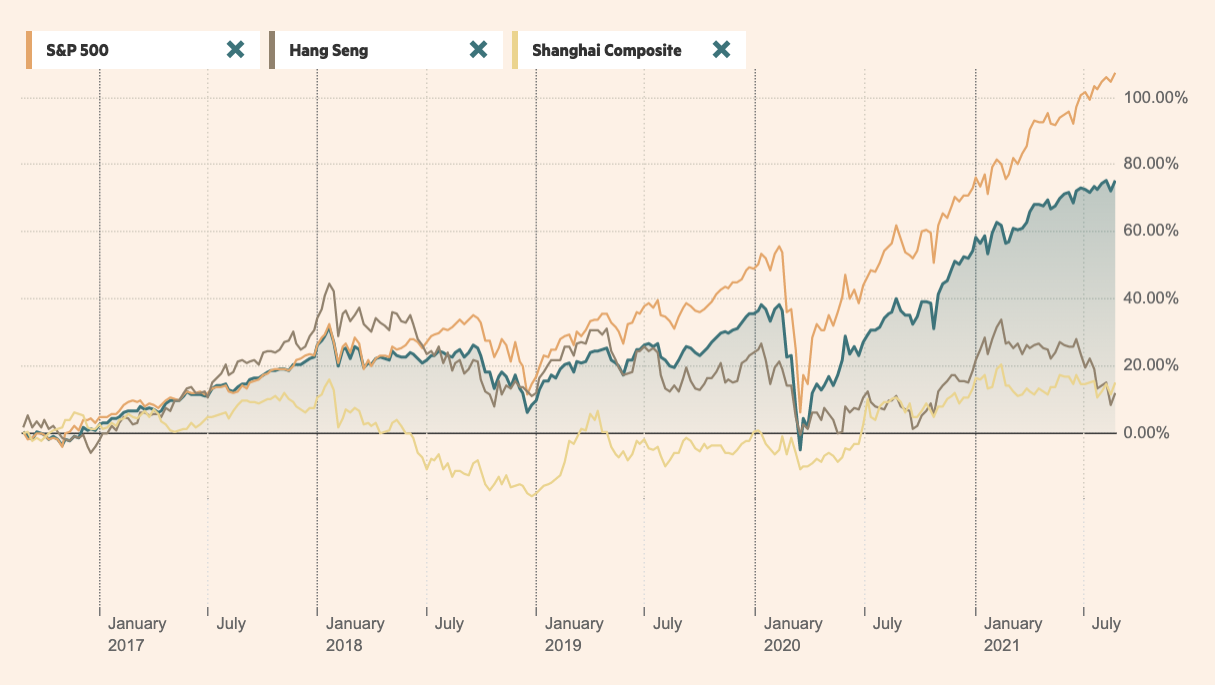

Market musings: equities bubble.

Looking at traditional markets, while Asian equities remain "fragile", both Nasdaq and S&P 500 have just broke through new all-time highs. It seems western investors are bullish in anticipation of tomorrow's Jackson Hole Symposium, where the Chairman of the US Fed will likely comment on the third wave of COVID cases and how that impacts the tightening of its supportive monetary policy.

If the commentary is unfavourable and tapering is hinted, then it's likely both meme stocks and cryptoassets suffer in September, until other forces establish a new trend. Conversely, if the fear that vaccines won't prevent record-high hospitalisations this winter prevails, forcing the central bank to maintain its commitment to pamper the economy, then watch as these risk-on assets continue pumping into a traditional year-end seasonal rally (before a 2022 crash?)!

Visual block: western euphoria.

Three things: no NFTs.

- The US Congress has voted the infrastructure bill without the crypto-related amendments demanded by the community. But Ron Hammond explains why the fight isn't over.

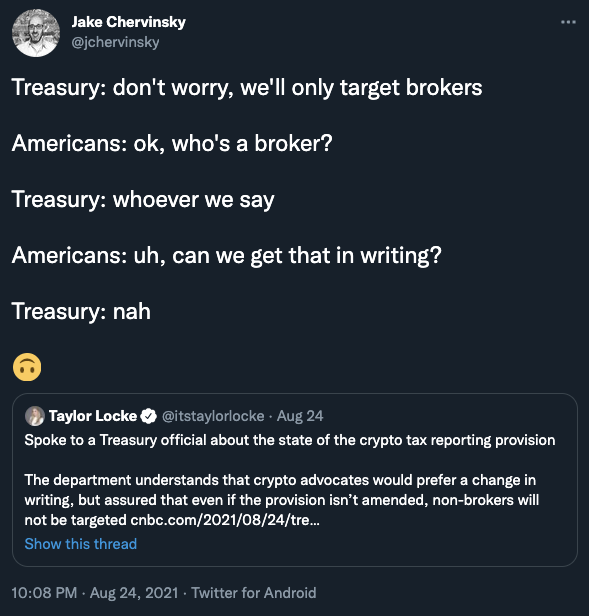

- The US Treasury claimed it "will not target non-brokers, such as miners, hardware developers and others, even if the provision isn’t amended". But Jerry Brito explains why that's problematic.

- Ethereum keeps moving to fight off competition and out-innovate regulators. That's why @CroissantETH just laid out "the top 23 innovations on ETH that may completely change the way we use the network".

Tweet tip: taper talk.

Meme moment: beautiful politics.

B21 International Cards: works worldwide.

Get started: download the B21 Crypto app!