Geomethrical runner-up

Cryptic ball: NFTs can run, and some can even hide.

Another day, another hyped NFT drop responsible for crazy high gas prices on Ethereum. Some people wasted more than one ETH due to failed transactions! But that's normal in the nicely odd market we're in, where NFTs seem to be designed for quick flips like in the old days of the ICO mania. And this is just the beginning, right? Meanwhile, Wednesday's scenarios remain valid for the weekend ahead.

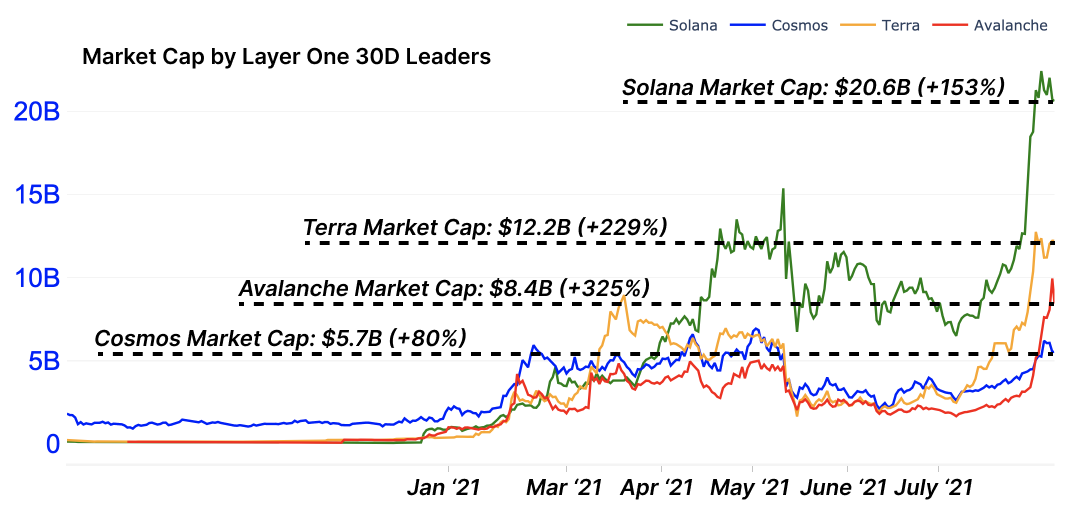

For now, bitcoin has bounced above the 100MA on the 4h chart and looks like it will attempt a test of $51k. The move doesn't look strong, and it's being led not by ether, but by SOL, an alternative cryptoasset we have thoroughly covered here and which keeps breaking new all-time highs. But is this pump strong enough to carry the rest of the market with it? So far, only ADA and LUNA are reacting accordingly, so keep an eye on ETH and other major coins to see if they wake up!

Chart art: smart contract blockchains are feeling the sun.

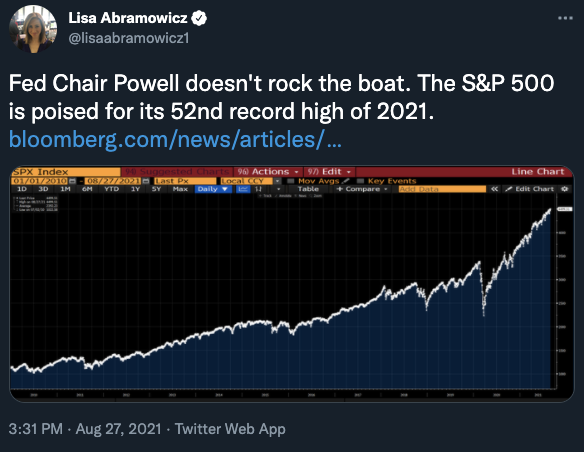

Market musings: the stock market bubble just won't burst.

Meanwhile, the Jackson Hole Symposium is behind us and that might calm the markets a bit, allowing more upside in the cryptosphere. Even though Jerome Powell, Chairman of the US Fed, "sent a strong signal Fed could dial back stimulus this year", the fact is that the S&P 500 and Nasdaq both achieved new ATHs today!

It seems such bullish interpretation was caused by additional remarks that more hawkish measures would need to wait for the real economy to improve. In other words, the party will go on for a couple more months, at least. The implications for the crypto market is that, aside from some end of month volatility (keep following funding rates and open interest for clues directional clues), it seems we're in for a great end of Q3 and a spectacular Q4. After that, there are two hypothesis.

One, which we've covered before, is that the space will repeat 2013's cycle, which had a double pump similar the one we're living now, followed by a blow-off top when the bubble becomes unsustainable (i.e. when lambo NFTs become more expensive than lambos themselves). The other, endorsed by Willy Woo, a popular analyst (who is sometimes very wrong), suggests a more sustainable, yet wild rise!

Visual block: the higher it climbs the harder it will fall, not.

Three things: one can't really learn with others' mistakes, right?

- Learn why Surojit Chatterjee, a major USA exchange's Chief Product Officer, believes cryptoassets are key for emerging markets.

- Understand how "OnlyFans shows the banking system is politicised", with Nic Carter's great overview of the whole situation.

- Watch out for new forms of scams and social manipulation, with Sohrob Farudi's sad episode where he was tricked out of 250 ETH in NFTs.

Tweet tip: just do it, just do it.

Meme moment: what about all the other runner-ups?

B21 International Cards: paying with crypto is now easier.

Get started: download the B21 Crypto app!