Don't fall in the Jackson Hole

Cryptic ball: profit taking is normal.

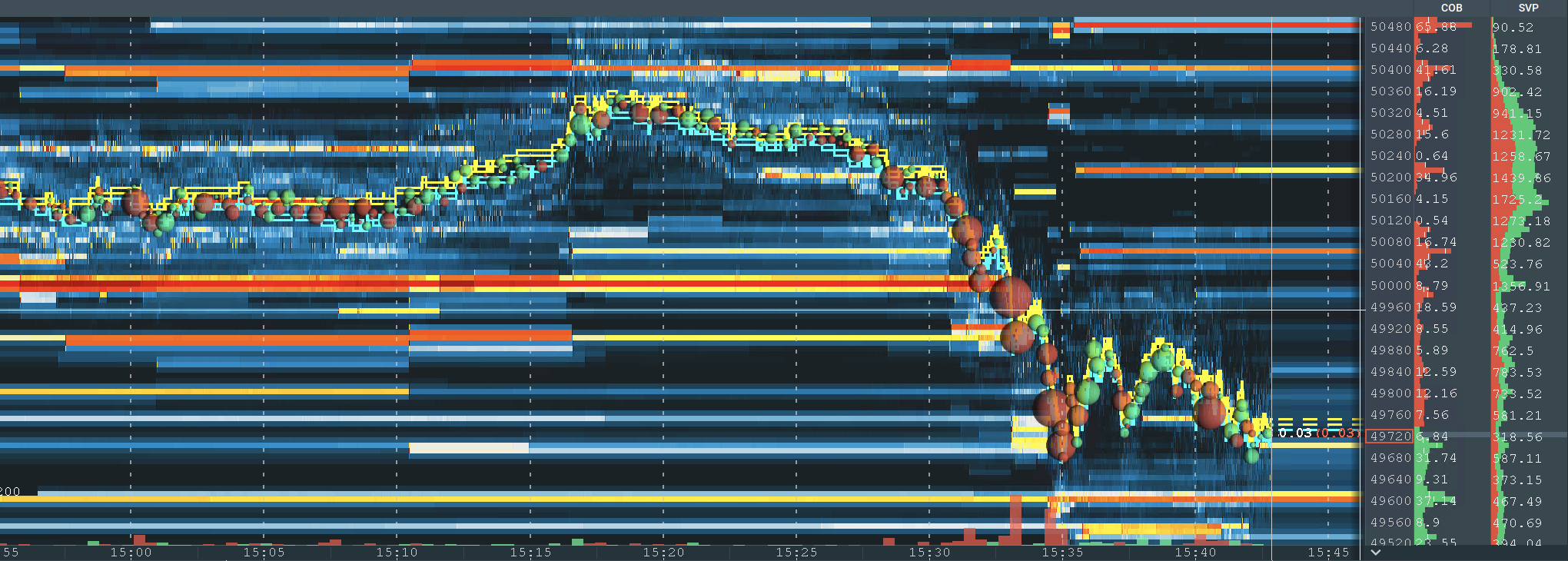

Friday we anticipated bitcoin was going to test $51k this Sunday and it reached $50.5k in the early hours of the week, a new high since May 15th. Not bad, right? However, as we write, the original cryptoasset has fallen below $50k, in what's looking like a typical run over of stop orders placed below the milestone level by those who were late to long the break-out. Should you be afraid or not?

Overall, despite the dip, this still looks like a strong move. Indeed, sentiment on Crypto Twitter is overly bullish and that typically warrants caution. But bulls are backed up by a torrent of sexy news. And yes, it's true BTC appreciated 50% in the past month, with some alts more than tripling in value (we're looking at you, AVAX, LUNA, and RUNE). But even if bitcoin ends August with a red week that's fine - it has been in the green since mid-July after all, so that would be normal.

Chart art: hunting stops is normal.

Market musings: delaying tapering is normal.

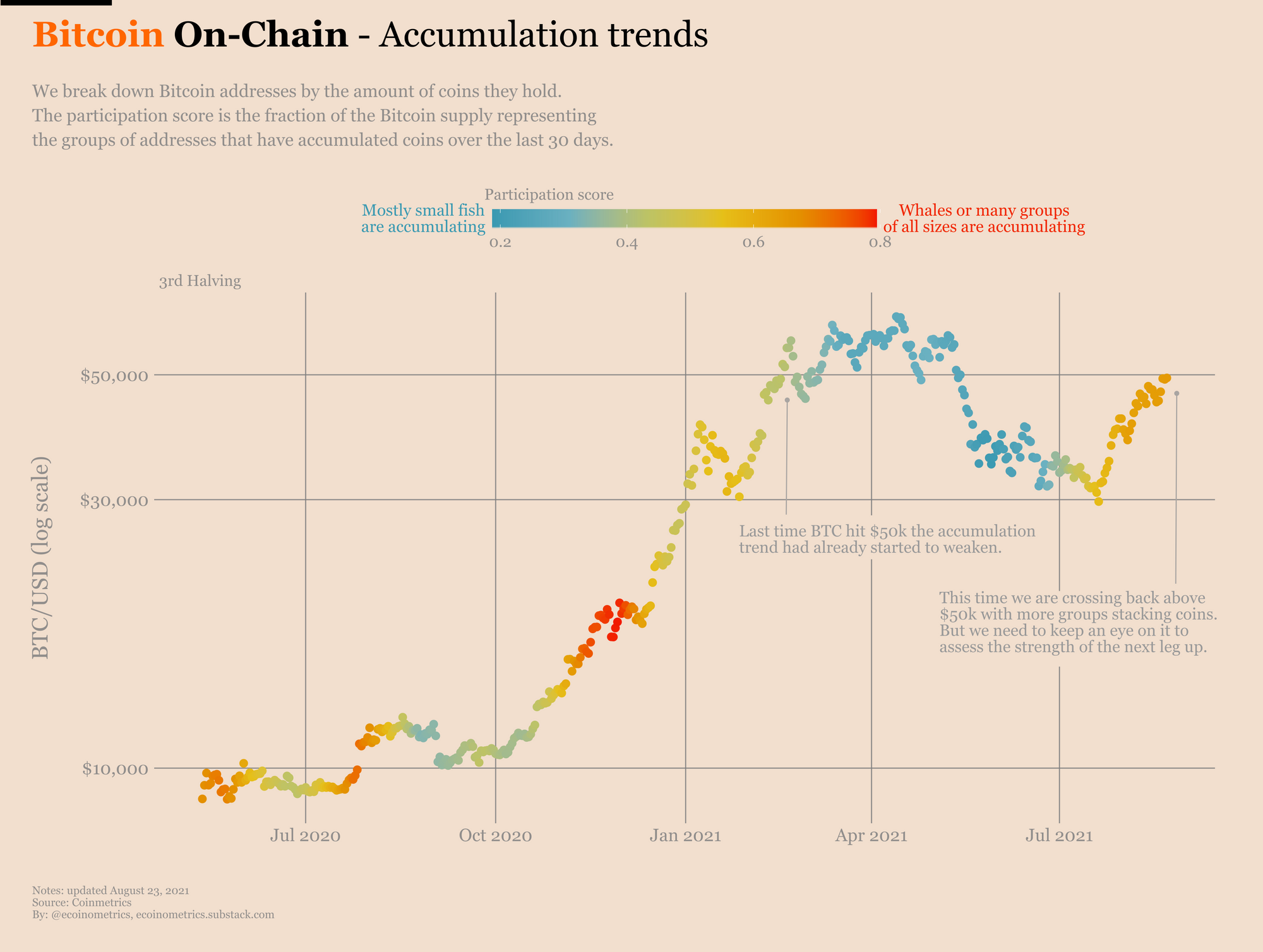

Moreover, it's fine that bitcoin cools a bit, as long as longs as alts don't lose their steam. While some traders are expecting BTC to test $42k in September, we believe the momentum is too strong for that, as you can see in today's visual block. However, we recognise that the last time bitcoin pumped for six straight weeks was last November, so it's possible we start seeing some profit taking this week or right after the monthly close - even if any dip will surely be short-lived.

Lastly, it's important to anticipate a major event happening this Friday: the Jackson Hole Economic Symposium. It's organised by the Kansas City Federal Reserve and many expect the Chairman of the US Fed to provide an update regarding the tapering of its monthly asset purchases. So far, the consensus is that any tapering decisions will be postponed to November, given COVID's third wave. That would be bullish for all markets, but let's wait to read between the lines.

Visual block: accumulation is normal.

Three things: turning networks into economies is normal.

- Chris Dixon is on a roll. Check his latest thread about the new era of the internet where networks are upgraded into economies.

- Star Atlas is all the hype. Check Mario Bern's latest thread about the play-to-earn, blockchain-based video game that everyone's talking about.

- Vitalik Buterin loves defying established economic principles. Check his latest post with possible solutions for a common problem in pricing theory.

Tweet tip: thinking long-term is normal.

Meme moment: buying NFTs is normal like.

New token on B21: welcome, Dogecoin!

Get started: download the B21 Crypto app!