“I have often amused myself with thinking how different a place London is to different people”

Cryptic ball: "in London, everyone is different".

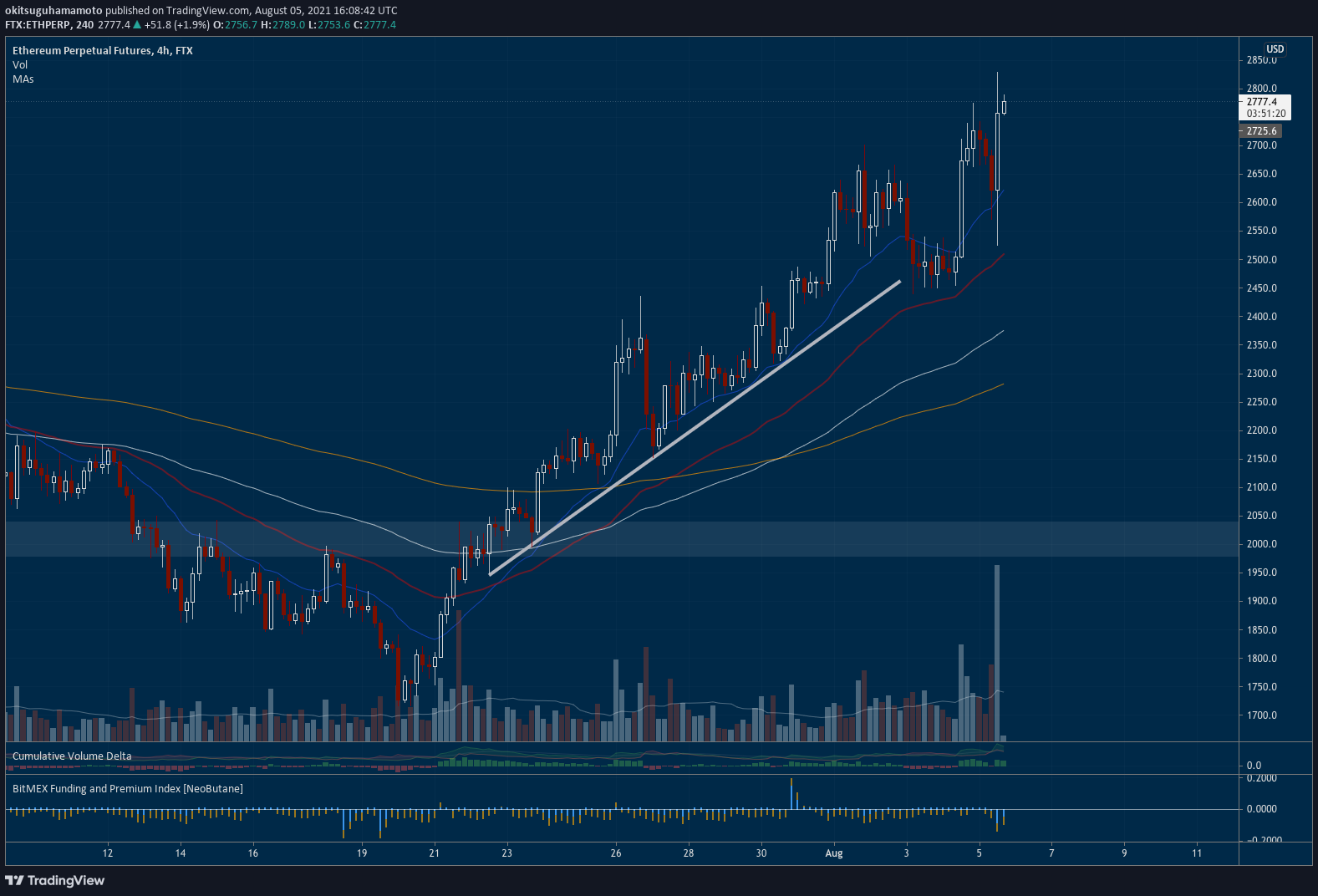

We've told you to expect a spike in volatility and that's what we got! What a day, with ether printing a 10% pump in the past four hours after dropping 6% in the previous four. The rest of the cryptomarket is following, including bitcoin, as today is all about the leading blockchain for decentralised applications. This is because of the extensively covered London hard fork, which was implemented very smoothly.

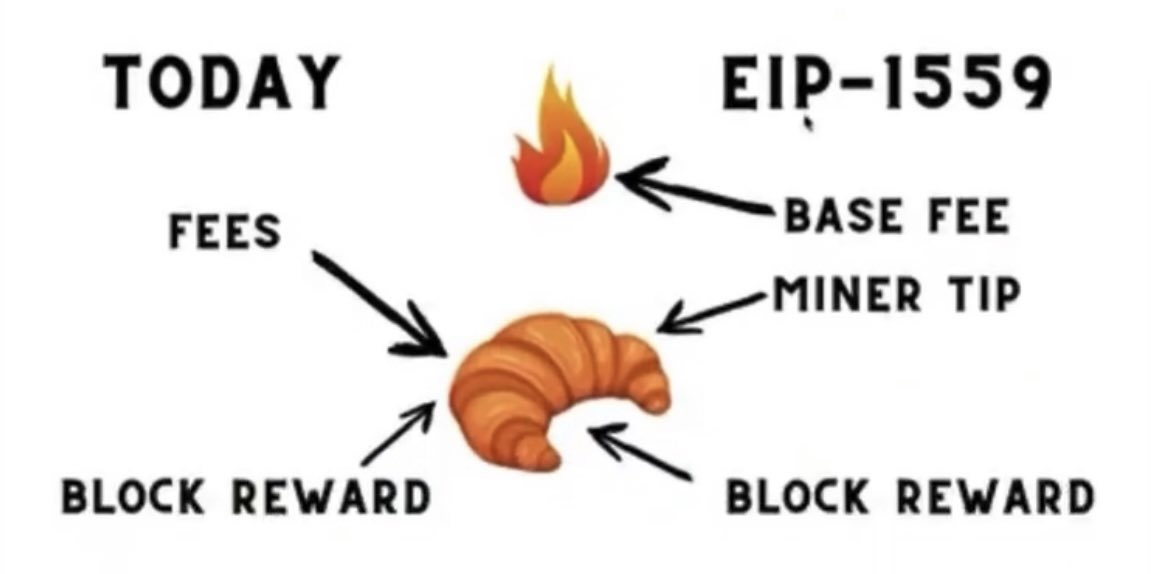

Such a successful upgrade is being hailed as a big deal in mainstream media. But, as explained yesterday, it's more hype than revolution - although it's definitely a great improvement (perhaps the second most important of all hard forks so far) which paves the away for major changes in the beginning of 2022, that will prepare Ethereum for proper scaling. And, trading-wise, what are the implications?

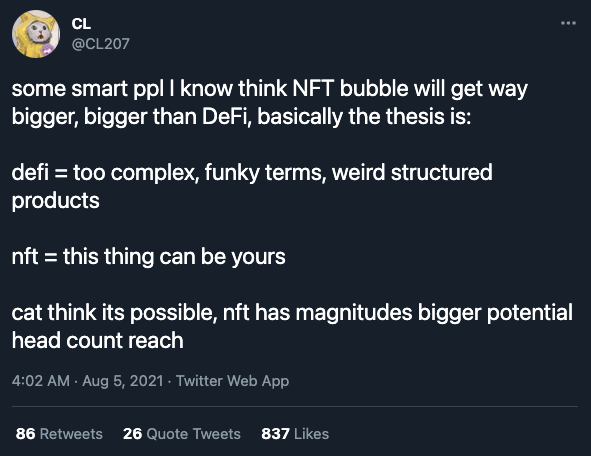

Well, ether (the currency used to pay gas fees on Ethereum, which are incurred when you want to run computations on this blockchain) typically appreciates when there's more demand for it, especially for speculative purposes. In 2016 and 2017, it rose more than 100x due to ICOs. In 2020/2021, it nearly did a 50x due to shitcoin trading on decentralised exchanges, and other DeFi use cases.

However, such peaks in demand also congested the network, raising gas fees beyond reasonable. This prompted bears to bet against ETH, contributing to major crashes in ether's price. With the activation of London, this upgrade will incentivise lower gas fees as users won't be able to bid like before. Without the auction mechanism, it is expected that Ethereum becomes more affordable, as it should be, which eventually will diminish the arguments for bears to go short!

Chart art: "and that means anyone can fit in".

Market musings: “money can’t buy you happiness".

For the weekend ahead, we expect ether to test $3k, consequently driving up the prices of alts, and even of bitcoin (it's rarely the case that BTC follows ETH, so this would be interesting to follow). Note ether has only been above that price for slightly more than 15 days, so we don't expect it to break easily. Instead, we anticipate some selling at that point and a cycling of profits into alts and NFTs.

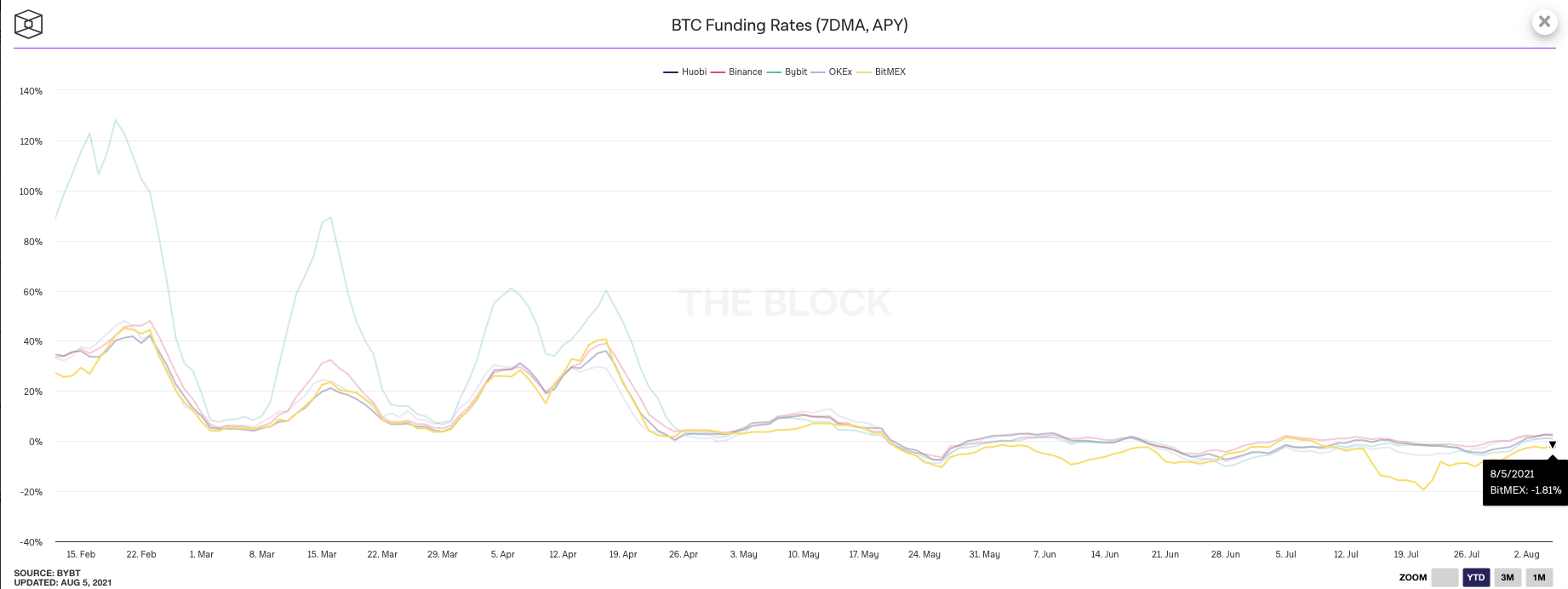

If bulls get wild and we resume UpOnly mode before traders return from holidays, then it's time to get wild. However, that's unlikely. Mining giants aren't very happy with London and with Ethereum 2.0, which will be activated next year, as these diminish their income and will eventually cut it completely. So, it's probable they will act against this immediate enthusiasm. Keep following funding rates and note Josh Olszewicz's reminder that ETH may see a local high in October/November.

Visual block: "but it can buy you a ticket to London".

Three things: "nothing is certain in London but expense".

- Glassnode reports that "NFTs and Gaming lead the ETH rally".

- Eli Tan wrote a must-read "crypto guide to the metaverse".

- Jacob Robinson shared a comprehensive list of "Crypto Law Twitter".

Tweet tip: note the change to PoS only happens in 2022.

Meme moment: foux du fafa, foux du fafa fafa.

New token on B21: welcome, Polygon!

Get started: download the B21 Crypto app!