Right or left, instead of right or wrong

Cryptic ball: keep watching funding rates.

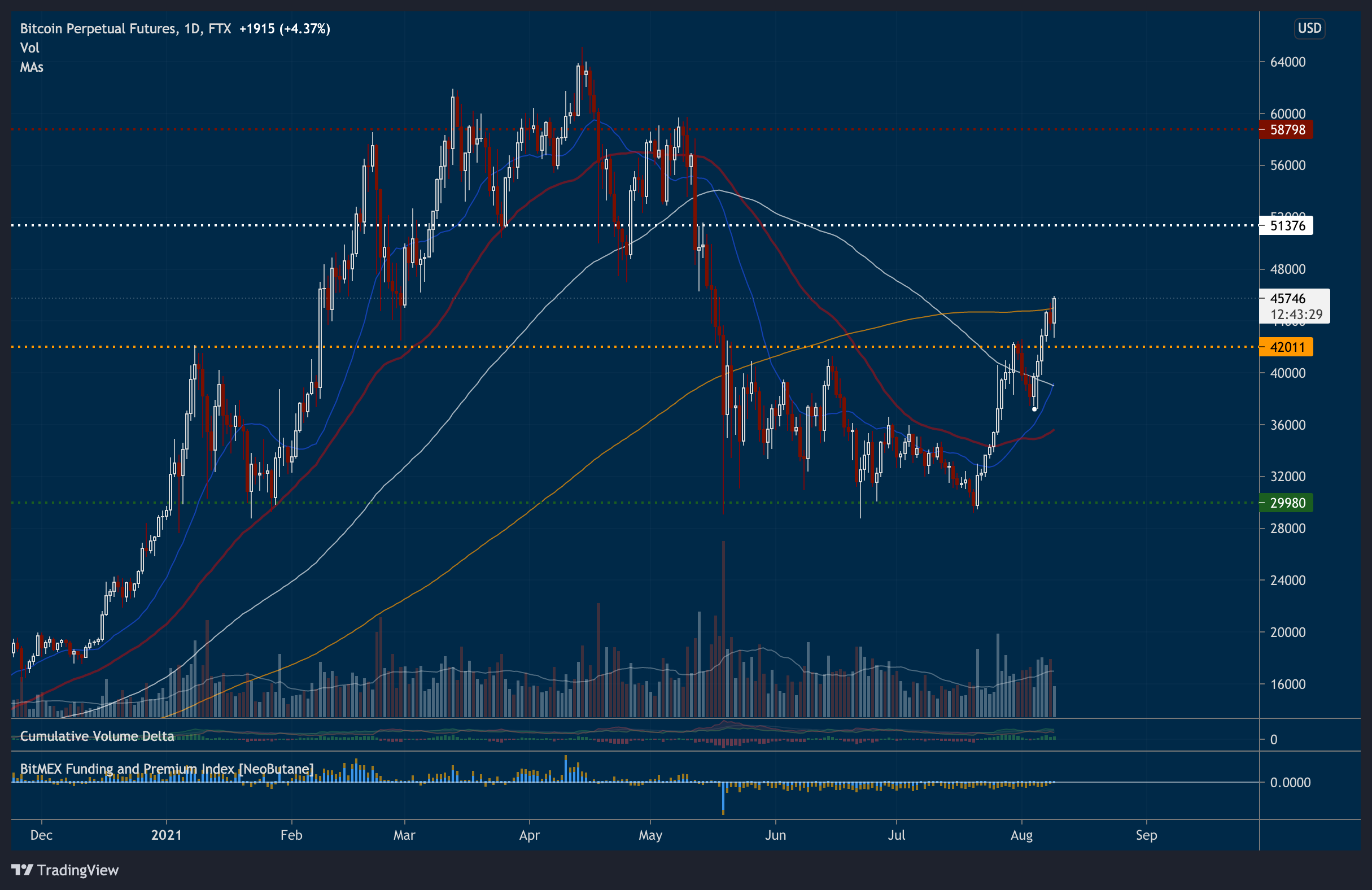

And we're back on UpOnly mode. Friday, around 15h15 UTC, bitcoin started pumping hard (6% in one hour) and 30 minutes later ether began to follow. The orange coin managed to finally break free of the ignominious range that defined the end of spring, crushing through the $42k resistance which first propelled the liquidation cascade we saw on May 19th - when BTC dropped 20% in a day and bounced 45% on the following one, just to slowly grind everyone's gears.

But is that the case? Ether had also conquered $3k on Saturday, but yesterday lost it. We believe that's fine because the pump was propelled by leveraged traders, based on the divergence between the cumulative volume delta for buy and sell orders on spot vs. future markets. This difference between buy and sell orders (often only market orders, to highlight the aggressiveness of market participants), helps one assess where did the buy and sell pressure originated.

In other words, for now it seems bulls are safe as the fact that ETH dumped a bit was due to the incentive to liquidate those late longs. This is further evidenced by the fact Friday we saw the second-highest volume of short liquidations in the past month, and yesterday we saw the second-highest volume of long liquidations in the past week (as over the past month not many longs were liquidated any way, which is an healthy sign for this new bullish phase). Onwards and upwards!

Chart art: keep watching liquidations.

Market musings: keep watching the US Senate.

The bullish case gets even more help due to the positive market reaction in face of a controversial US Senate bill that was (kind of) passed this Sunday night. This bipartisan effort aimed at raising funds for infrastructure started being discussed last week, with various senators trying to push it through before Friday. All was fine until a cryptoasset-related provision was poorly introduced at the 11th hour.

Fortunately, the industry's lobbyists managed to explain the technical problem to some Senators, which provided amendments that, after much debate, are at least finally understood - even if there was no chance to vote them in (yet). This issue is really helding up the trillion-dollar bill, and, if not properly resolved, it will implement unfeasible reporting requirements on several cryptoasset actors.

The latest draft brings the issue back to square one, but there's still some time left - so keep following the matter in real-time on Twitter (because media can't catch-up, really). Overall, we believe the resilience being shown by bulls in the face of extreme uncertainty is a great sign of strength. So, even if the Senate wrecks havoc later today in the final passage of the bill (there's only a small chance it doesn't), we are hopeful the market has priced in its consequences. But watch the volatility!

Visual block: keep watching the 200D MA.

Three things: keep watching the good news.

- It's not all bad news in the cryptoshere. Kevin Rooke reports Bitcoin's "Lightning Network Is Bigger Than You Think".

- It's not all bad news with NFTs. The NFT artist pplpleasr tells the story of "how crypto changed her life". Did it also change yours?

- It's not all bad news in the USA. The newspaper owned by Jeff Bezos explains "how cryptocurrency became a powerful force in Washington".

Tweet tip: sub-title

"Let’s tax the hell out of something we know nothing about, so we can pass a giant bill we haven’t read, and spend the American people’s money on stuff we can’t afford." - Ted Cruz

— Alex Krüger (@krugermacro) August 9, 2021

Great to see someone of his stature take this stance. This could get him over 20M votes some day. https://t.co/kqi8QWVK3Q

Meme moment: keep watching NFTs.

New token on B21: welcome, Polygon!

Get started: download the B21 Crypto app!