To protect investors, protect innovation

Cryptic ball: it's amazing the impact of the US in crypto.

As anticipated, bitcoin has found support at $37.5k, albeit having needed to test that level one more time this morning. The leading cryptoasset is now 5% above the daily low, while ether sprung up 10%, achieving its highest price since early June. The move was fuelled by a combination of technicals, explained yesterday, and of new fundamentals, which improved the confidence of the bulls.

The latter revolve around recent remarks by Gary Gensler, the new chair of the US SEC. Formerly the chairman of the CTCF during Obama's administration and a Professor at the MIT, Gensler has taught a popular "Blockchain and money" course there (it's available online too). However, yesterday, on the occasion of an annual national security conference for global leaders, the SEC chairman sounded bearish.

In prepared remarks and in an exclusive interview to Bloomberg, both must-reads, it was argued that there's a lot of hype in the space, although some innovations, like Bitcoin, are "real". And that investors in the cryptosphere aren't protected, so regulators must act to protect people against fraud. While this can be good if it provides clarity and efficiency, it's often the case that regulation does neither.

Fortunately, the crypto market soon found some peace after Gensler clarified his position on an interview on CNBC early this Wednesday morning. The key question was about the balance between regulation and innovation, and it became explicit that the SEC is committed to protect innovation and not only investors, as long as basic rules are met, and is also subtly helping educate fellow policymakers.

Chart art: it's amazing how quick crypto bounces.

Market musings: it's amazing how buying rumours works.

For now, this balance between innovation and regulation suffices, but expect the topic to resurface later this year once action is taken. And note that tokens other than BTC and ETH will likely suffer with new SEC regulation, given that only those two were able to escape being formally considered securities a couple years ago. Alas, regulation may even be the catalyst for the next dump, and not the US Fed.

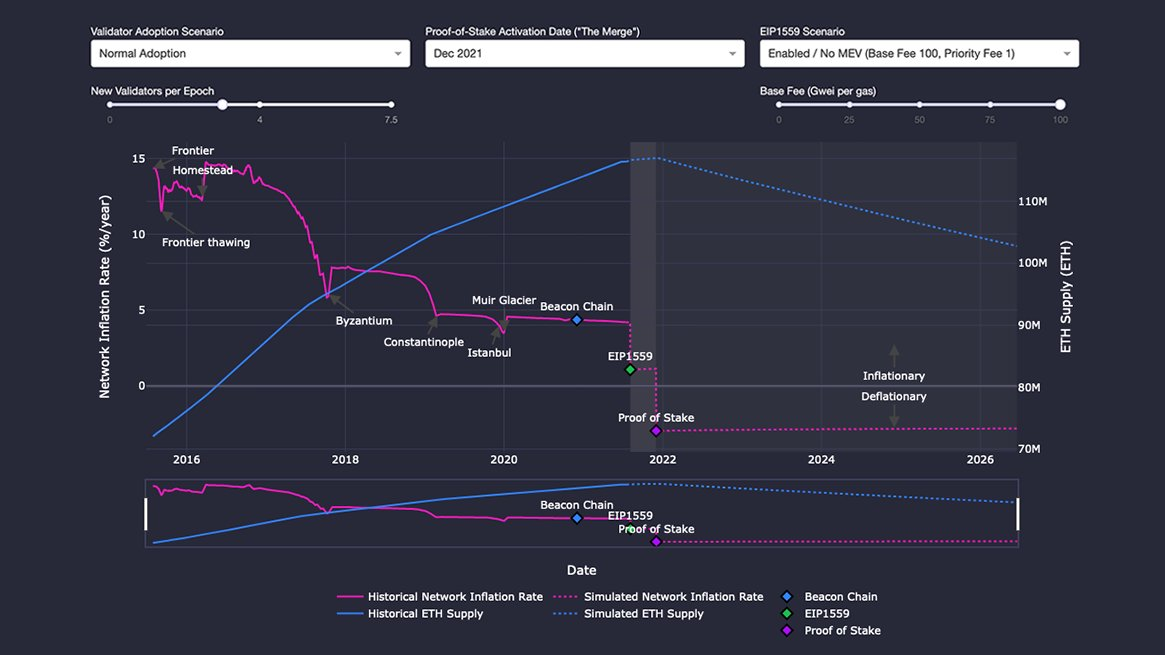

Anyway, that's all long term and we'll keep updating you on those topics, especially given that analysts are expecting the US central bank to react to the recent strong stock market earnings by further threatening to taper the emergency monetary stimulus still underway. Meanwhile, the next days will be all about Ethereum and the anticipated EIP-1559, which will (potentially) reduce ether's supply.

That improvement proposal will introduce new rules for transaction fees which will make them more stable while making the amount of ether available on the market increase or decrease according to network demand. So, if Ethereum continues to be the leading dApps blockchain then it's likely there will be less ether to buy, potentially contributing to a faster appreciation in its price. Just note that its effects will take many months to be felt, so expect volatility over the next hours!

Visual block: it's amazing how Ethereum's policy changes.

Three things: it's amazing how the metaverse is not here today.

- Confused about EIP-1559? We've shared some in-depth explainers above and earlier, but Korpi's short and sweet Twitter thread has all you need to know!

- Confused about US SEC's chairman various remarks? Just watch CNBC's 90-second edit to the most important answer provided by Gary Gensler today.

- Confused about DeFi? Consensys produced an excellent report which also touches Ethereum's scaling debate. Learn all about decentralised finance here.

Tweet tip: it's amazing how the wild west is Washington instead.

Meme moment: it's amazing how high is ETH's hype.

New token on B21: welcome, Polygon!

Get started: download the B21 Crypto app!