To freedom!

Cryptic ball: to the Bahamas!

As explained Friday, this was to be a risky weekend. So it was without surprise that bitcoin failed to break $40k for three times and then fell up to 5% this morning - bouncing back a little over the past hours. So, what's the playbook for this week?

- Overall, we're still struggling with a bearish backdrop on the macro front. I do believe that the Fed will tone down once (and if) it's clear inflation has peaked in order to continue propping up the economy. The question is when.

- With the exception of the DeFi Summer of 2020, the warmest season of the year in the Northern Hemisphere is typically muted across all markets. So our chances of a serious bounce become lower as June's solstice approaches.

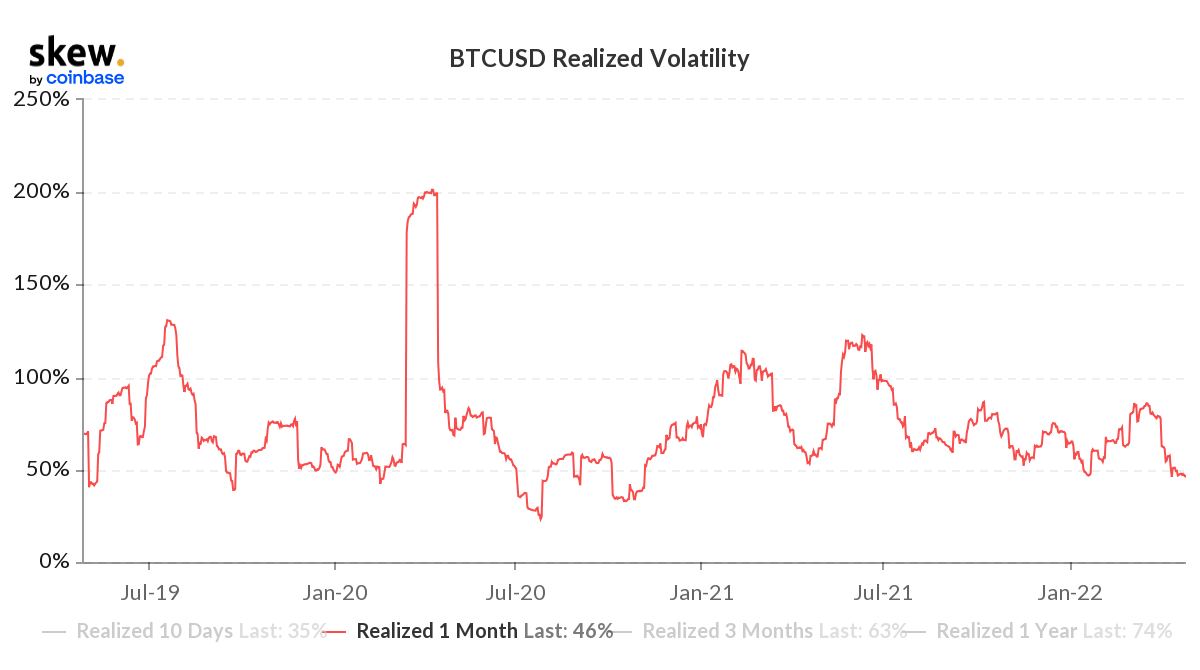

Moreover, BTC and ETH trading volumes are at their lowest since last July, while bitcoin's realised volatility just hit a 17-month low. In other words, few people are interested in the markets right now and that doesn't help.

- Fortunately, if in 2018 such lacklustre activity was the beginning of the end, these days things are different. Institutions are here and they start to perceive bitcoin and other cryptoassets to be intrinsically valuable.

- As explained by Jurrien Timmer, director of Global Macro at Fidelity (which manages $4 trillion in assets), bitcoin is indeed getting boring but that's good as it signals institutions are buying the dips (and shorting euphoria too)!

What this means for a regular trader is that it's unlikely we get massive opportunities this Q2. As I often said at the beginning of the year, Q1 was likely going to be bearish (it was) and Q2 should provide a chance for recovery.

- After that, we should get the bulls back for the end of the year party. And while now this chance of recovery seems slim, i.e. I'm more inclined we continue to see sideways ranges for some months, I also believe the market is healthy.

- As I'm landing in the Bahamas for this week's conference I can't help but wonder how far this industry has come in such a short time. Yes, Elon managed to pump DOGE a bit again, but we're getting more resilient by the day!

Let's just hope the stock market carnage doesn't entice bears again. Because of the S&P 500 drops more than 2% from the current level, we must get ready for some serious volatility. If that happens, expect bitcoin to test $36k first and then $32k!

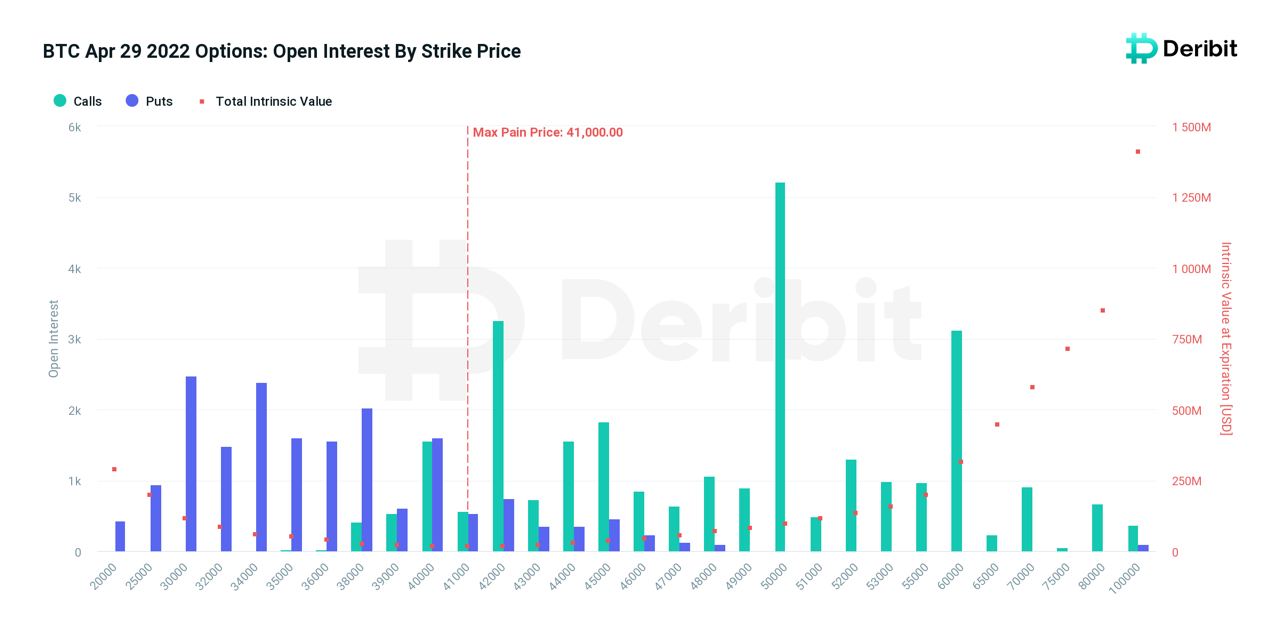

Chart art: to boredom land!

Three things: to sustainable yields!

- Jurrien Timmer explains how bitcoin is being adopted by institutions.

- Ming Zhao explains "what happens to DeFi yields if bear market?"

- Nat Ellison explains "how to launch a token, or tokenomics 104".

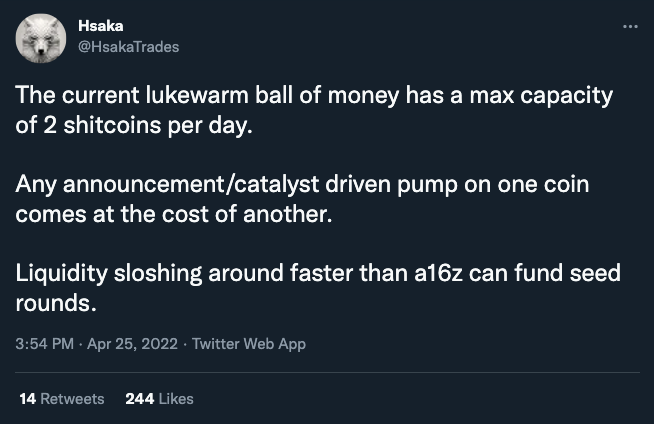

Tweet tip: to the rotators!

Meme moment: to the coupon course!

FV Bank: meet us at Crypto Bahamas.

Get started: learn more about FV Bank.

Get started: download the B21 Crypto app!