Absolutely essential

Cryptic ball: tamed expectations.

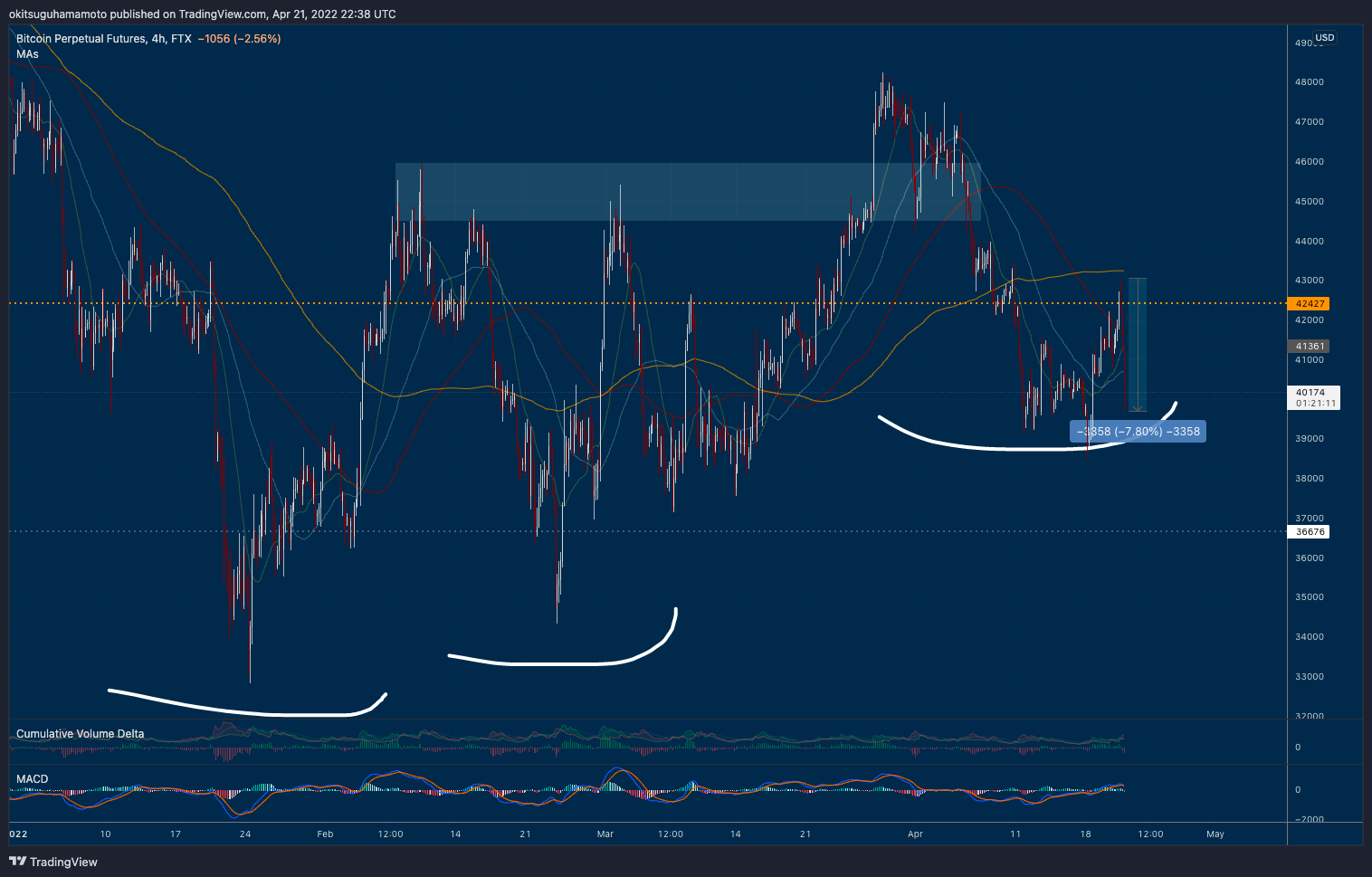

US markets just reversed this week's gains, with the major equity indexes falling 1.5% to 2%, a significant percentage in that asset class. And it seems bitcoin bulls also lost their balls, having failed to overcome $42k. As usual, what's next?

- While the original cryptoasset is only down 3% on the day, which is relatively normal, it fell up to 8% since noon UTC this Thursday! And this daily close proved to be eventful, with bulls and bears fighting hard for $40k. So far, it seems bulls survived the round, but the weekend ahead will be key.

- As explained Tuesday, if we were to lose that level then my newfound optimism would need to be revisited - or at least contextualised. To be fair, similar failures of comparable breakouts also happened in January and February and bitcoin eventually recovered. And, as argued yesterday, it's all a matter of how priced in the bearish news are, and of understanding its short-term impact.

- In other words, not all is lost for now. But this clear rejection at such a key level, even if justified by the stock market correlation, doesn't bode well for bulls - who need to prove they have the stamina to spring back up.

- Conversely, if bears manage to push the orange coin to $39k again, then it will be tough to save us from the carnage. Maybe Terra's LFG fund can continue to buy cheap bitcoin and provide support for all of us. But how long can that go?

- After all, on the other side of the trade we need bulls to show up with consistency. And with Powell threatening to hike interest rates by 0.5% in May it's unclear how many market participants will be comfortable buying soon.

Chart art: tamed breakouts.

Three things: tamed apes.

- Cobie muses about "the death of staking", or at least the useless type promoted by the likes of BAYC's Ape Coin DAO in particular, but also DAOs and "coin-voting communities" in general. Another must-read!

- The DeFi Edge shares his thoughts on NEAR, "the most hyped Layer-1 right now". It covers most things you need to know about this protocol, including the main issues and risks if you decide to invest.

- Nic Carter explains why "algorithmic stablecoins is among the worst of all the bad ideas the crypto industry has come up". A very brief but important take on what could push us all into a multi-year bear market.

Tweet tip: tamed hopes.

Meme moment: tamed careers.

FV Bank: meet us at Crypto Bahamas.

Get started: learn more about FV Bank.

Get started: download the B21 Crypto app!