Some general theory

Cryptic ball: thinking about Keynes.

The other day I was reading someone claiming that QE was doomed to fail because it was invented in Japan and the monetary experiment didn't save the archipelago's economy, having created decades of stagnation. Is that the case?

Well, it's possible the West is now facing economic stagnation (after decades in a cultural limbo, I dare to say). But if traditional assets get boring I posit that an emerging asset class such as crypto would surely pump in that context.

How is this related to the markets today? Well, there's this psychological mechanism called the Sudden Wealth Syndrome - coined in the DotCom bubble but very common in crypto too - that makes us feel like punishment is on the cards after the winds blew in our favour beyond one's wildest dreams.

And while you know how I like to entertain bearish takes to put my biases in check and to make sure you are aware of the alternative scenarios that most people often don't talk about, there's something else we must consider. Right now, the common take is that higher interest rates will bust credit markets. This paired with higher inflation will hurt consumers in a way that can only trigger a recession.

But the higher-order consequences of this are already being "priced in" by politicians and policymakers who want to avoid the disaster. Fine, I agree they can burn the ship once and for all with whatever new pony they come up next. And I agree there's not much leeway left to manipulate the markets. Still, there's no need to punish yourself thinking this is 2018 all over again. I remember that formative period fondly and I'm seeing some similarities, but not many.

And, most importantly, there's a high possibility that the fear of an economy-wide recession is indeed unfounded. Yes, overpriced tech stocks are suffering. And there's also a lot of bloat in cryptoassets. But bitcoin is weathering the crisis quite nicely for now. And as soon as the economy bounces a bit everything will pump again because that's what will get the man in the high castle re-elected.

Now, if you skimmed to the end, it's time to say the orange cryptoasset has barely moved since yesterday's newsletter went out, but I'm anticipating a continuation of the pump over the next days. Let's just hope $42k is broken on high volume so that bears suffer and bulls can finally have a try at $52k before the summer arrives.

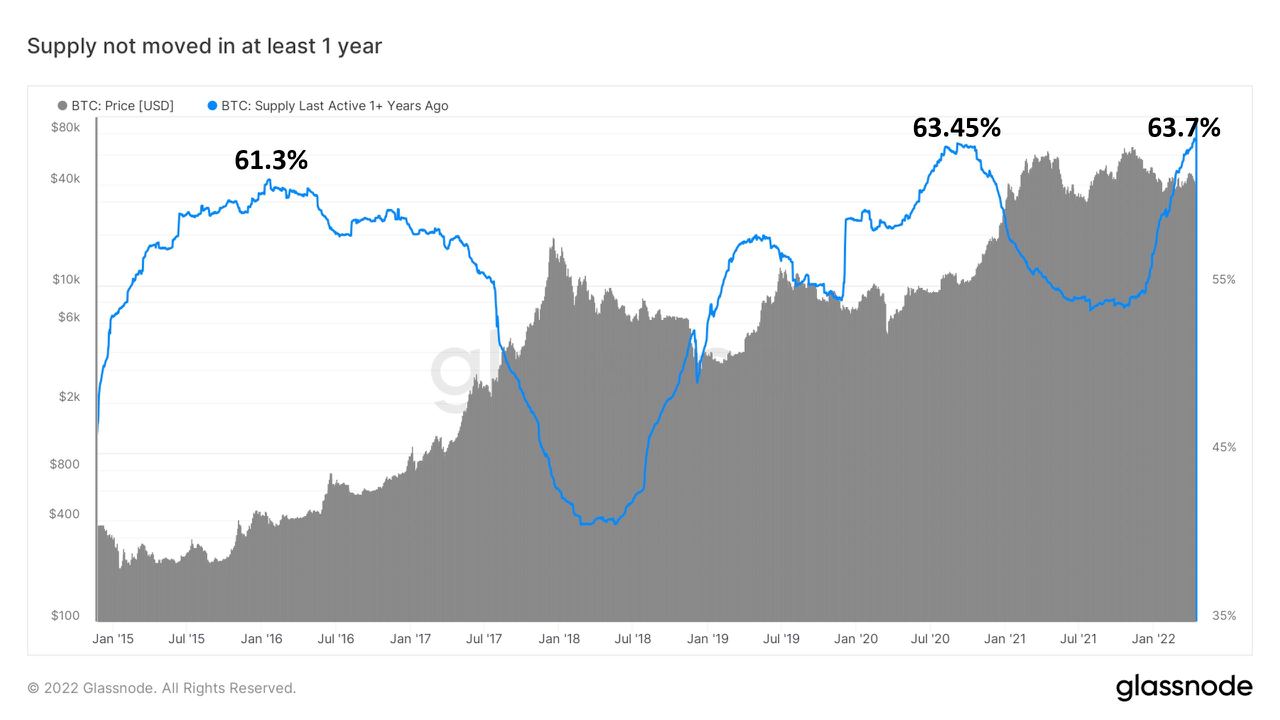

Chart art: thinking about hodling.

Three things: thinking about eulogies.

- Miles Jenning argues web3 could turn Twitter into a public utility.

- Tamara Frankel writes "an esoteric eulogy for the DeFi Summer". What an absolute must-read!

- Kamikaz shares some "truths and alpha about alts and Crypto Twitter".

Tweet tip: thinking about the truth.

Meme moment: thinking about beauty.

FV Bank: meet us at Crypto Bahamas.

Get started: learn more about FV Bank.

Get started: download the B21 Crypto app!