Hopril

Cryptic ball: just a bias.

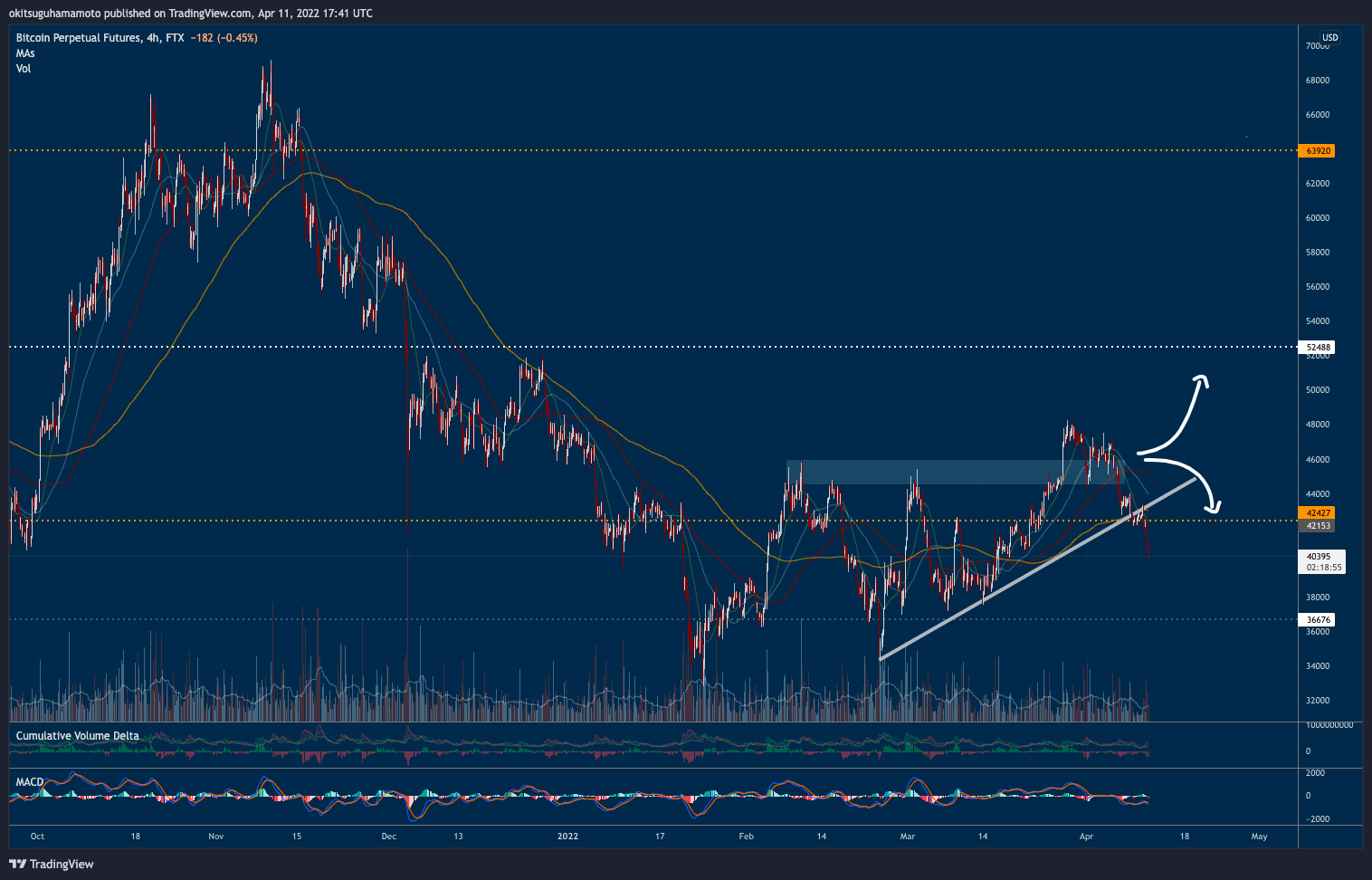

Just like anticipated this Friday, we did get a small bounce of $42k this Saturday. But then, as also explained, it was very likely that such support level would break this weekend and $40k was the next area to watch. Well, bitcoin bears have just spent the last hour testing that area and we have reasons to be concerned.

- First, check the updated chart that I've been sharing over the past weeks. It's very clear bitcoin is now back to its previous range. And while the uptrend formed since February's lows hasn't been broken yet, falling below $40k will make it very hard even for the most optimistic bulls to go long now.

- While I'm still optimistic this is not a 2018-2019 type of bear market, I'm not expressing my belief in longs for more than some weeks at a time. There are some speculative alt plays one can engage but apart from that this is a market for traders now and you must understand one's bias must change quickly.

- For this week, my bias is moderately negative. Remember that in the last two weeks of March such a bias was clearly bullish and last week it was neutral. Now, bulls really need to conquer $42k again and bears need the original cryptoasset to fall below $40k and stay there for more than a couple of hours.

- Lastly, remember there's still some hopium for those who believe $40k will hold. Even I want to believe this is just a bear trap designed to lull pessimistic traders into going short, therefore filling the large orders of major players, before we continue up - at least until summer arrives. But that's just hopium.

- After all, Arthur Hayes just dropped his latest article today, arguing it's very probable bitcoin and ether will test $30k and $2.5k, respectively, by the end of June! I agree (especially if we're talking end of August), but it's still possible the current dead cat bounce continues for a while more. And that's also hopium.

Lastly, remember that in the short-term bitcoin and crypto won't react well to an economic crisis. But many individuals and organisations believe that in the long-term they better be exposed to the digital version of gold to weather out any black swan event created by our "historically indebted global economic system".

Chart art: just a failure.

Three things: just a trap.

- Arthur Hayes explains the Q-Trap. Nice summary here.

- Ben Sparks explains the Ethereum Virtual Machine.

- Croissant explains how to find alpha in Etherscan.

Tweet tip: just a correlation.

Meme moment: just a manta.

FV Bank: just a great team.

Get started: learn more about FV Bank.

Get started: download the B21 Crypto app!