We knew it was nothing new

Cryptic ball: Miami looks new, though.

If yesterday's FOMC minutes did wreak some havoc, it is fair to say the markets overreacted - just as anticipated in the last newsletter. Let's understand why and what are the implications for crypto over the next few days.

- Firstly, the S&P 500 dumped right after the minutes were released, having pumped right before the event - a clear sign of manipulation. After all, no one had even had the time to digest the subtleties of these 12 dense pages.

- Naturally, this led cryptoassets to dump - with bitcoin and most alts finding a bottom around the daily close, at midnight UTC. This morning, once traders slept through the matter, the agreement was that it was time to "rebound".

- After all, the Fed only said what we knew: that the balance sheet will be shrunk at a significant pace and that the Fed may raise interest rates by a half-percentage point instead of 0.25%, as it just did this March. Again, not news.

- So, why did the market fall? It's all about the uncertainty. I told you that we could bleed even on such an expected announcement because there are also no reasons to pump - notwithstanding some interesting attempts to pump the crypto leader during today's Bitcoin 2022 conference in Miami.

- We also had Janet Yellen, US Treasury Secretary, giving a "really good speech" about crypto regulation, recognising the "transformative" potential of our industry, while at the same time calling for "responsible innovation". Not bad.

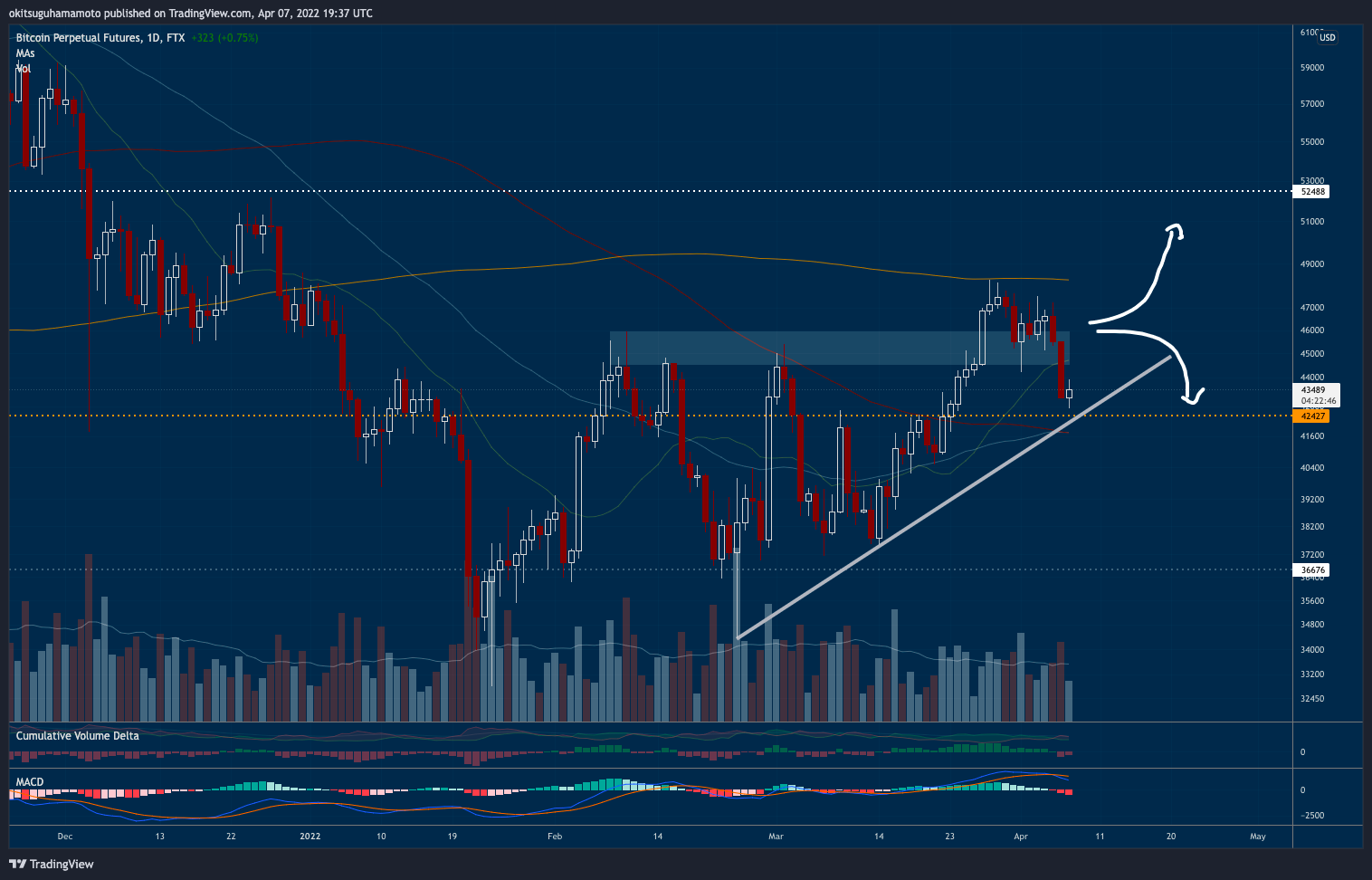

- With this in mind, I continue to expect the next months to be reasonably smooth, hopefully forming a nice uptrend. It's possible BTC still tests $42k this weekend if we get the typical Sunday FUD, but if it holds we're safe to go.

Just note that when I mean safe to go one needs to understand global markets are only safe to the extent the US and EU governments are able to tame inflation. If prices get out of control, families will feel they have less purchasing power. That's compounded by higher mortgage costs, which will hurt families without savings. And all this will hurt corporate profits, which would surely hurt stonks!

Chart art: Miami will inspire bulls.

Three things: yield will spook bears.

- The DeFi Edge summarises "everything you need to know about Tokenomics". Another must!

- Kamikaz helps you "evaluate an altcoin and build an investment thesis".

- Yearn Finance explains Ethereum's new "Tokenized Vault Standard, or ERC-4626", aka the "gold standard for any sort of interest-bearing token"!

Tweet tip: inflation fears will subside.

Meme moment: the ride will be fun.

FV Bank: meet us in Miami.

Get started: learn more about FV Bank.

Get started: download the B21 Crypto app!