The Newsletter Merge

Weekly musing: 542 days later.

Dear readers, I started this newsletter on the 31st of March, 2021. Now I'm changing email providers and format: you'll get my emails twice a week, with one weekly reflection on the topic du jour and another with the usual market update.

- Right now both cryptoassets and the major US stock indexes are approaching their yearly lows, achieved in June. Fortunately, yesterday's FOMC meeting at the US Fed wasn't that hawkish - even if Powell finally upped his game.

- The world's most powerful central banker clarified the Fed won't pivot to a less hawkish stance soon as it can't rish losing the fight against inflation. As that means the economy will suffer in the process, it's clear prices won't pump soon.

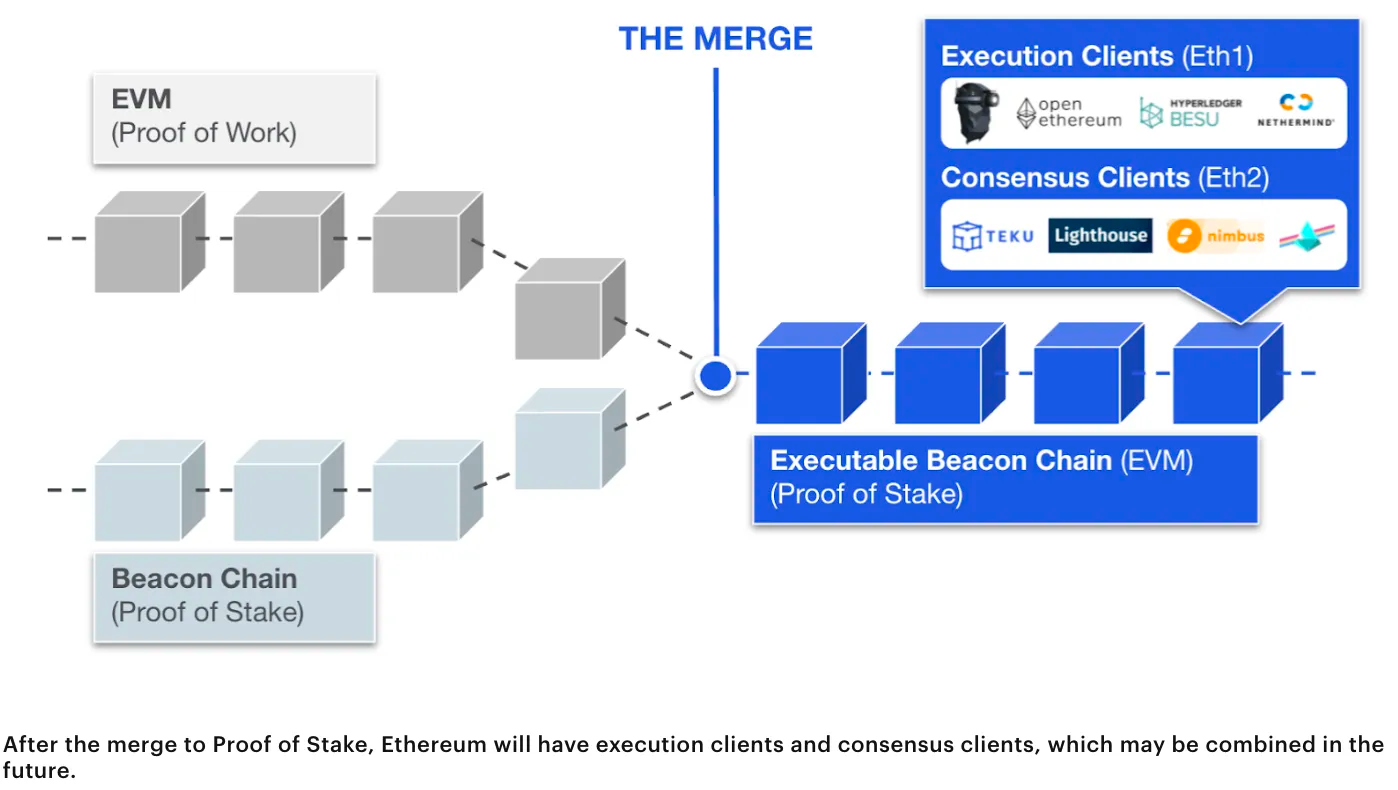

- Which means it's time to talk about Ethereum's Merge instead - also in honour of this newsletter's own upgrade. As recently reminded, I first talked about the Merge back in May 2021 and have been extensively covering it ever since.

- But, one week after the move to Proof-of-Stake there's an angle I should reinforce: the unwind is not over yet. Because even though this was a successful implementation from a technical perspective, the narrative is now dead.

- While before ETH had the mystic anticipation of the Merge going on for its price, which helped it pump much more than BTC and other Layer 1's, now it's just a very correlated asset to the rest of global markets.

- Since last September 15th, when the consensus mechanism was changed, ETH has already suffered a 25% price drop vs. bitcoin's 6% fall. As more and more people understand this was a sell-the-news event, a reflexive cycle will begin.

- Compounded by an harsh winter ahead of us, perhaps even worse than what I was considering in some market updates I shared since July, this means there are large incentives to short ETH again after the funding reset of the past days.

- Due to the interconnectedness of the mostly Ethereum-based DeFi ecosystem, there are also many interesting liquidation levels to tap into within the various lending protocols that are mostly used for leverage purposes.

- Let's hope I'm wrong, but if we keep getting more bearish sparks from the macro environment, then we're surely in for another dark year ahead. After all, there haven't been many signs of capitulation in the global markets. Yet!

Chart art: 25% lower.

Visual block: 7 days after

Three things: 50% lower.

- Matti writes about "the next big crypto narrative". A must.

- Jordi Alexander writes about "the dark art of shorting". Also a must.

- Sam Bankman-Fried writes about "his lessons from FTX". A must!

Tweet tip: 1720 days after.

Meme moment: 75% lower.

FV Bank: always on the verge.