Ever the grand dump

Cryptic ball: things look shaky.

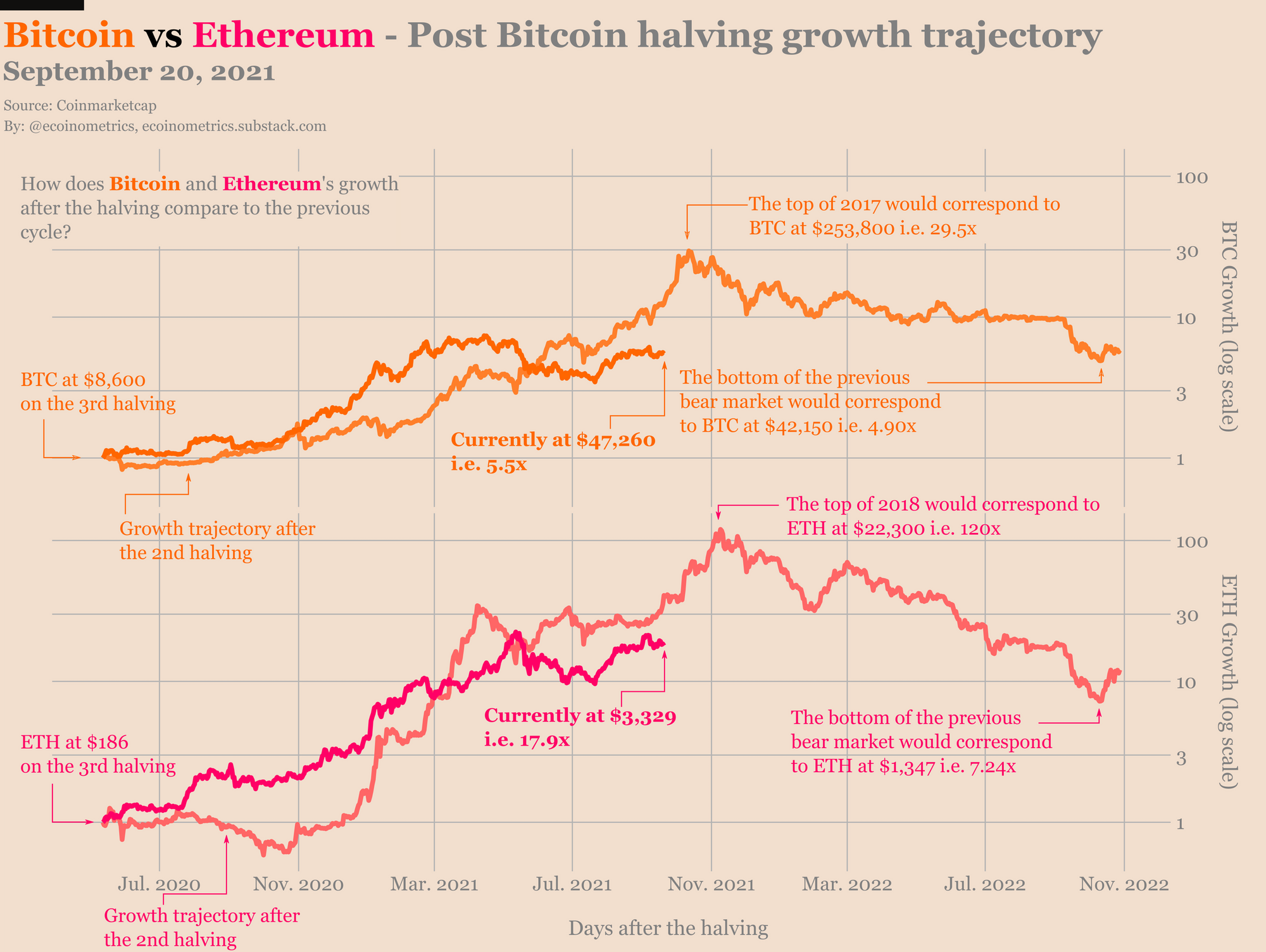

We hate to be right when prices crash, but Friday we told you were going neutral, hedged, and flat towards this weekend. And Saturday and Sunday weren't volatile, indeed. But right after the weekly close, bitcoin dumped 10% and bounced right at the key $42k level, which we have been talking about since April! It dragged down the rest of the market, which fell up to 13%, with some tokens losing 19%!

What next? Well, Friday we also mused about how this slow bleed made us feel like we would find a bottom soon. Is this it or not? Today's rinse has indeed hurt many, although the fear level hasn't changed much. What's key now concerns two things that have caught our eye recently, and seem to be correlated with this bearishness: the SEC's actions and sentiment regarding global equities, given that the correlation between BTC and the S&P500 is at a yearly high. Read along!

Chart art: but this is a good dip.

Market musings: however, equities rule right now.

First, news just came out as we're writing this newsletter that Coinbase is abandoning plans to launch its Lend program. If you remember September 7th's dip, we attributed it to possible insider trading regarding the fact the US SEC was threatening the popular exchange regarding that same launch. Coincidence? Maybe not. Anyway, there are other fundamental reasons for the crash.

As widely reported, global markets are heating up to unsustainable levels. Last week concerns were rising and, this morning, Asian markets woke up in the red with the prolonged fall of Evergrande. The sell-off has extended to Europe and America, with the S&P 500 falling 2% (which seems a minor drop, but it's the first lower low since last year!) and talks of a natural gas crisis scaring traders in the old continent. So, from a technical perspective, we believe $42k is going to hold. But it will be up to the Fed to prop up the markets one more time and allow bulls around the world to feel safe enough to roam free again, unaware of their caged farms.

Visual block: and only long-held beliefs can save us.

Three things: so keep studying the market!

- If you want to learn more about the current instability in global markets, we recommend you Doomberg's great analysis: "Is this finally it"?

- If you want to to understand why the "future of venture capital will be decentralised", we recommend you Joel John's great essay on the topic.

- Still confused about NFTs? Vanity Fair's Nick Bilton sat down with Fred Ehrsam for "the only NFT explainer you really need, from a true believer".

Tweet tip: don't do anything foolish.

Meme moment: and remain young and stable!

B21 Crypto Card: get your free card today.

Get started: download the B21 Crypto app!