Down the FOMO hole

Cryptic ball: stay neutral.

As explained Wednesday, this week's ongoing dip - impacting +80% of the top 100 alts - makes us feel we'll find a bottom soon, which could pave the way for a better second half of September. As also expected, SOL continued its decline and we're targetting the first possible bounce around the $110-$120 level, in what could be an ugly weekend across the board. So, what to do over the next days?

Some OTC desks have reported Thursday as one of the summer's slowest days in what concerns Asian flows, with the rest of the markets in pure profit-taking mode. The Hong Kong stock market also hit a yearly low, attributed to fears that a Chinese real estate giant might default very soon and impact other markets. And you all know how Asia is an important demand driver for cryptoassets, right?

Chart art: until bitcoin makes up its mind.

Market musings: stay in the game.

To be clear regarding the previous section, we don't anticipate much volatility this weekend. But this slow bleed makes us feel like being neutral. Indeed, some alts like Avalanche's AVAX and Cosmos' ATOM (two other popular "Ethereum killers") are rocking this week with 40% to 45% appreciations. However, most of the market seems pretty dull - so we prefer to avoid being long or short. Why?

As the saying goes, you should never short a dull market. Just make sure you protect your profits too. And, as usual, take advantage of the calm waters to dive down your favourite rabbit holes. If you still don't understand DeFi, consider checking The Economist's take at it. Despite the funny jokes, this magazine first covered Bitcoin in 2013 and made it its cover in 2015 - which created huge spikes in Google searches back then. Now you guess what will spike next.

Visual block: until more fall down the rabbit hole.

Three things: stay bullish.

- CMS Holdings is one of this industry's most popular investment firms. Learn more about what his co-founder thinks about crypto in this great interview.

- Trading options is mostly an institutions game, but it shouldn't be. Learn more about this sophisticated world with Defi Pulse's good introduction.

- Layer 2 scaling solutions are key for the future of DeFi. While we disagree with those who argue these projects are undervalued, we strongly recommend this article from Bankless, covering different ways to be exposed to them.

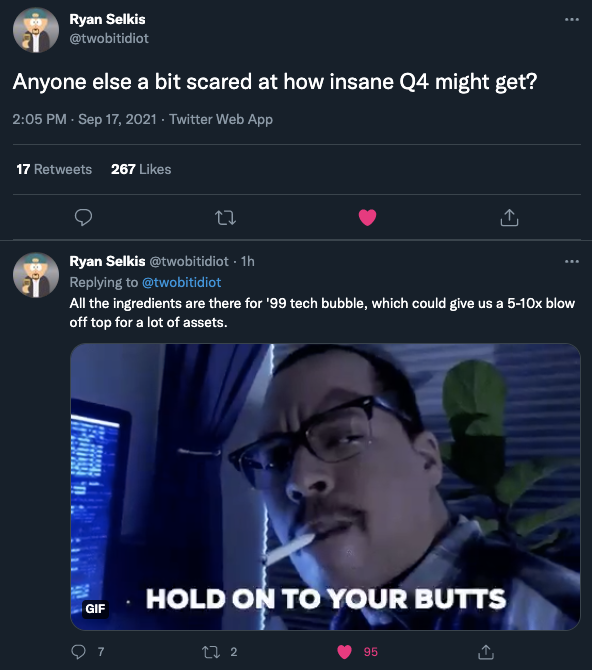

Tweet tip: until the next blow-off top.

Meme moment: stay fungible.

B21 International Card: powered by Visa.

Get started: download the B21 Crypto app!