Feeling a bit Meta

Cryptic ball: feeling a bit dumpy.

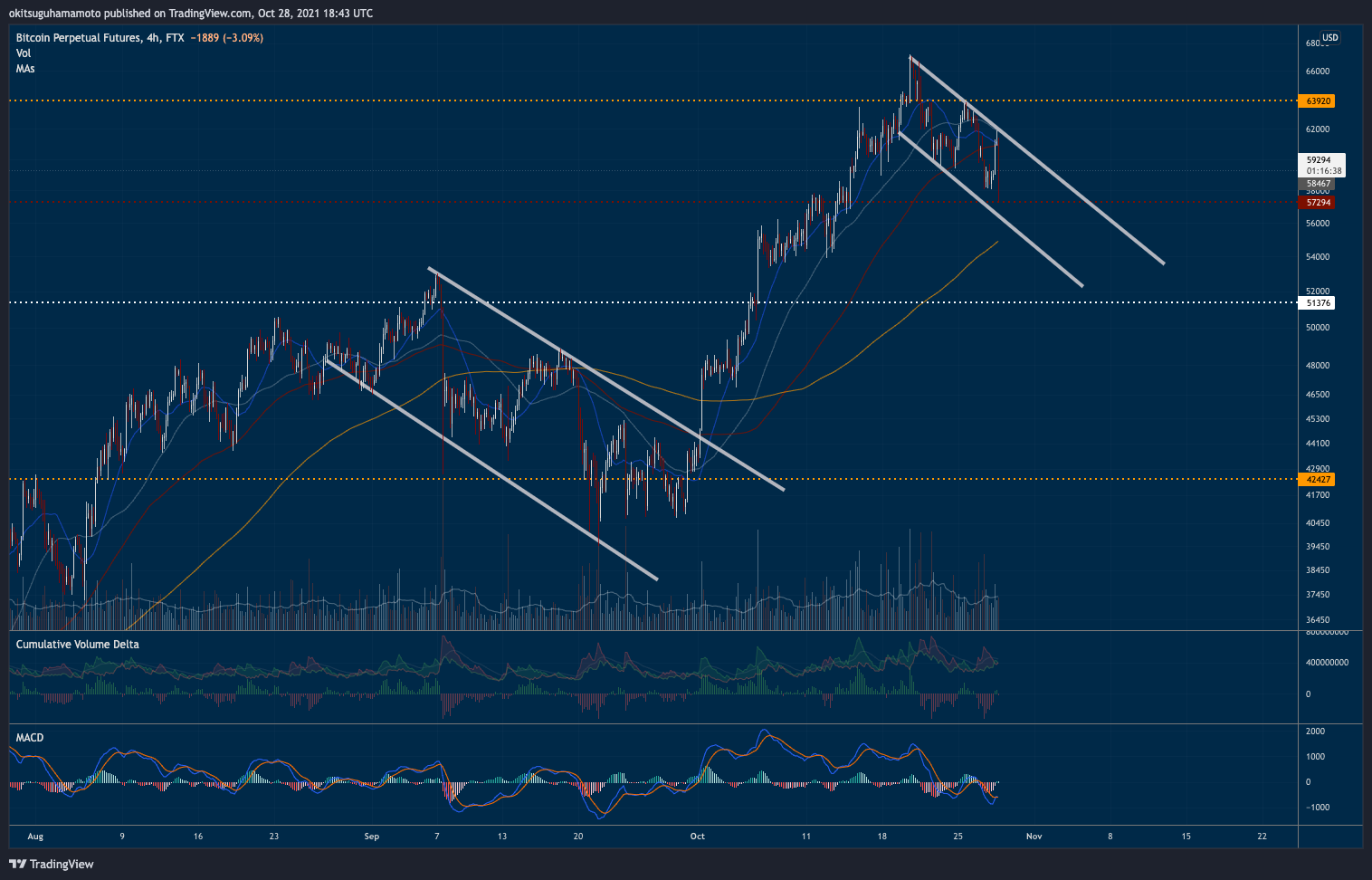

I was writing that not much had changed since yesterday, but BTC just ruined the party. Let's recap. To begin, meme coins continue to pump, especially fellow canine projects among Ethereum's competitors, such as Solana's SAMO. True, the original SHIB is down 15% since yesterday's 70% pump, but the overall market resembles last May. Then, bitcoin had nicely bounced at $58k and then paused around $61k - a diagonal resistance similar to that which plagued September, charted below. That was normal, but to complicate things BTC has just dumped 6% in 15 minutes as I was about to press send. Now, should you worry?

So far, it is bouncing back, making it look like it was just a liquidation-focused move aimed at triggering the stop orders at $57k that I talked about yesterday - also curiously timed to match Marc Zuckerberg's announcement that Facebook will change its name to Meta and its ticker to MVRS. But the ensuing volatility may further scare traders. Yes, it's true that the market is not that overleveraged and Open Interest is not that high as most think it is, as Alex Krüger explains due to new ETFs. And it's also true that greed levels are also calming down a bit.

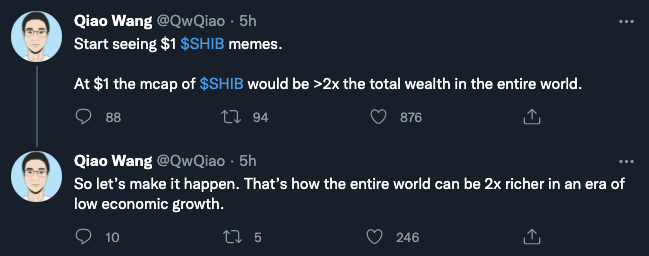

But the generalised euphoria makes me wonder whether we'll see a generalised rinse this Halloween. That's why, if we don't get a good bounce until today's daily close (UTC time) I'll be preparing my hedges going into the weekend, ready to bark at the moon in case we clearly move out of the woods. Meanwhile, I remind you we're not at the top yet. But, as SHIB is definitely reaching a top, as explained in below's tweet tip, I'm reminded of something important for the final stages of this bull run: community. Because the coins that pump the hardest are the ones with the strongest backing from the crowd.

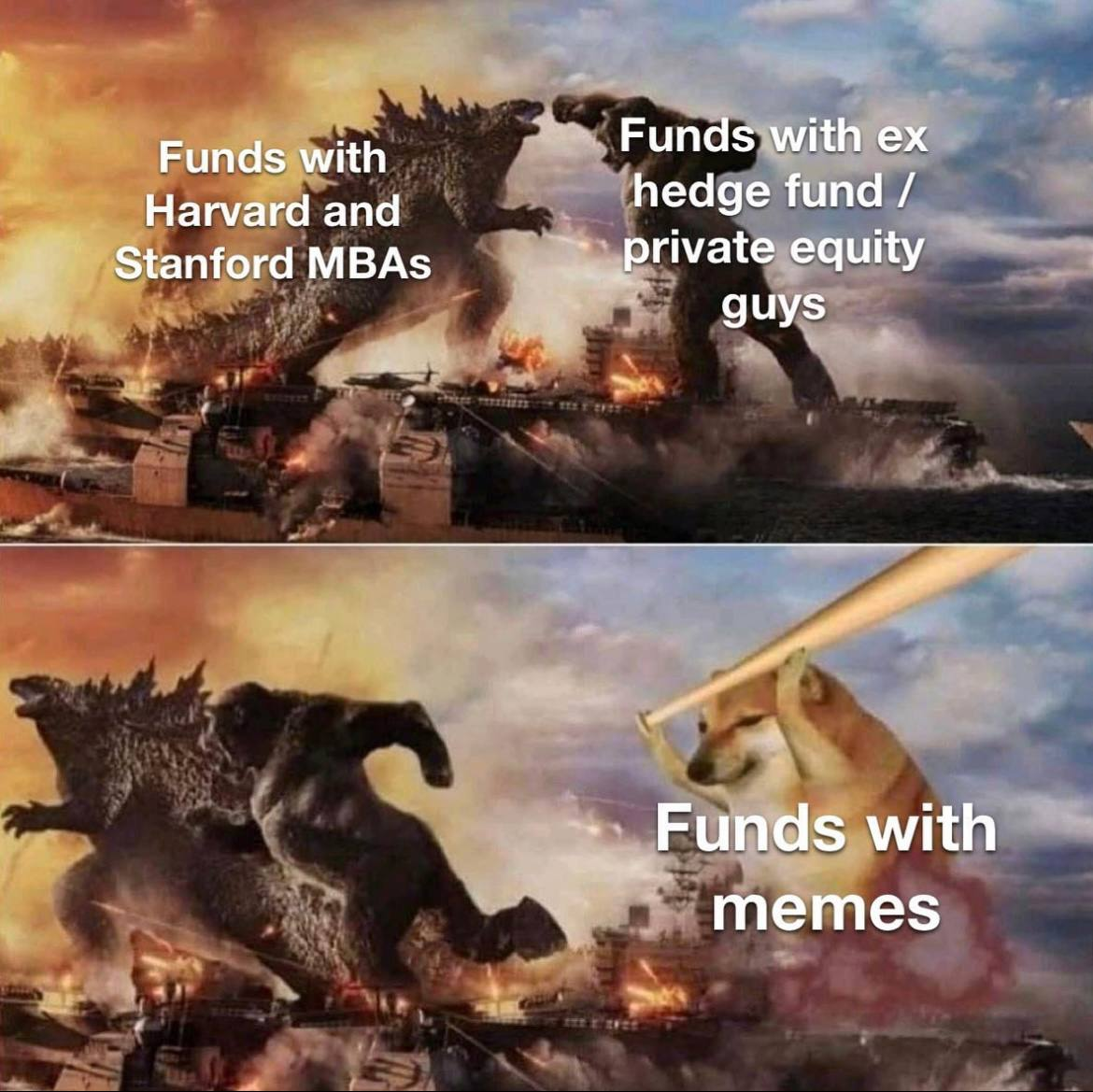

Naturally, it's not only animal tokens that follow that rule. As volatility will drive people away from the wild moves of SHIB and its friends, hopefully back to Layer-1 blockchains, it's time to go back to the Battle of the Protocols, which I first covered here on April 26th - illustrating the nine hottest Ethereum killers, and highlighting Solana. Back then, SOL was priced under $25 and Mark Zuckerberg was a couple of months away from announcing it would transform Facebook into a metaverse company. Well, the protocols that have appreciated the most since have been those who have invested more in their communities - through ecosystem funds, conferences, and VC support to the new projects.

So, as things get flimsy, let's put our research hats on and investigate those dApp platforms which are yet to announce plans to support developers and users and build an exciting environment for growth. I'll keep an eye on and share what I find with you, as there's nothing better than peaceful research when prices crash!

Chart art: feeling a bit channelled.

Three things: feeling a bit bullish.

- CoinCenter argues "the long-awaited FATF crypto guidance is not as bad as it could have been, but is still flawed".

- Will Clement modelled the bitcoin top and believes it "currently sits just above $114,000 or just over $204,000".

- Ben Thompson explains why "crypto is still very early in its lifecycle; and why 2017 wasn’t the big crash, nor will the next one be".

Tweet tip: feeling a bit careful.

Meme moment: feeling a bit memetic.

FV Bank: B21's sister company.

Get started: download the B21 Crypto app!