ETF Game

Cryptic ball: it may be a calm weekend.

And the weekend is here. As anticipated, SHIBA hasn't continued pumping (maybe in a few weeks) and bitcoin failed its second attempt to break out of $55k. This makes me feel like the weekend will be rather muted for those alts who have been rising so far - except, perhaps, for FTM, which is on a tear (80% up in 2 days!)

Conversely, it is likely that other projects that were depressed in face of BTC's rise will finally catch up, such as SOL - which found clear support at $150 and seems ready to find a new all-time high next month; and AVAX - which is still in a downtrend, but which is also forming a bullish pennant that will resolve soon.

Meanwhile, oil prices continue to rise and US jobs creation data failed to meet expectations - by a lot. This is good in the sense that it will ensure the Fed thinks twice before spooking the markets with tapering of its monetary stimulus this year. Indeed, equities were recovering yesterday, but are dropping slightly today.

Despite the fall, note that the bounce of the S&P 500 and the Nasdaq is still playing out nicely, which will surely allow for a clean start of the week. To further help that, the US debt ceiling was raised as expected - at least until December. Lastly, remember what I wrote Wednesday: it's all about bitcoin breaking $60k! So, watch out in case it gets close to that level earlier than what I've anticipated!

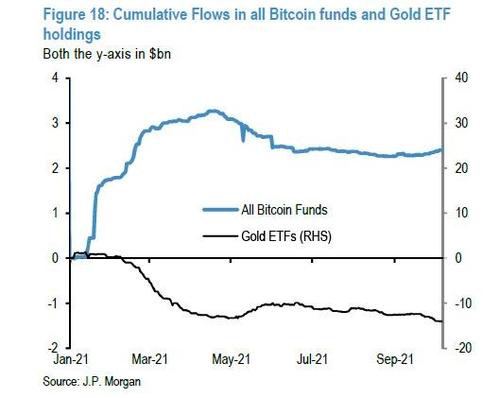

Chart art: it may be an inflation hedge after all.

Three things: it may be that this is all a meme.

- Nansen.ai explains how Fantom (FTM) solves "the blockchain trilemma".

- William Peaster explains how Polygon (MATIC) helps Ethereum scale.

- Harry Jones explains "the meme economy" and its very real future.

Tweet tip: it may be better to be like water.

Meme moment: it may be a small supercycle though.

B21 Card: please update to order your free card.

Get started: download the B21 Crypto app!