What do you think?

Cryptic ball: ConstitutionDAO failed.

This has been a wild week in terms of crypto sentiment, but bitcoin is back in the same range it has been since October 15th. Mad, right? Hit reply to this email and tell me what you think - the best quotes will be featured next week! Overall, this price action shows how nervous the market is in regard to the expectations it had for Q4 2021. Bitcoin even fell to $56k overnight, a place that bears could have used to easily prolong the dump - as explained yesterday - but BTC is back where it was yesterday, with many alts bouncing even higher, almost gaining 20%!

In other words, either the bears are not that interested in selling (even though we had significant volume over the past days) or bulls are putting up quite the fight. As we aren't seeing the typical prints associated with such bullish demand, I can only posit that what we're just experiencing is the scenario b) I outlined last week: the combination of a more mature crypto market (where major coins don't pump maniacally like they used to) with the seasonal selling (associated with Thanksgiving and Christmas) is extending the market cycle - which used to be shorter. Now, given this convoluted activity, I'm expecting two alternatives:

On the one hand, this could be the beginning of that smaller bearish cycle that was mentioned in scenario b) - what before used to be a quick 30% dip is now a prolonged sideways range / small downtrend period, which could bring bitcoin down to the lower $50s. Today's bounce seems to be disproving this, but the weekend ahead may compound the fear and confirm this. On the other hand, scenario a) may still be valid, with the current bearish activity being just a short-term attempt at wrecking retail traders, while whales have some more time to accumulate bitcoin and alts before the pump continues as it should.

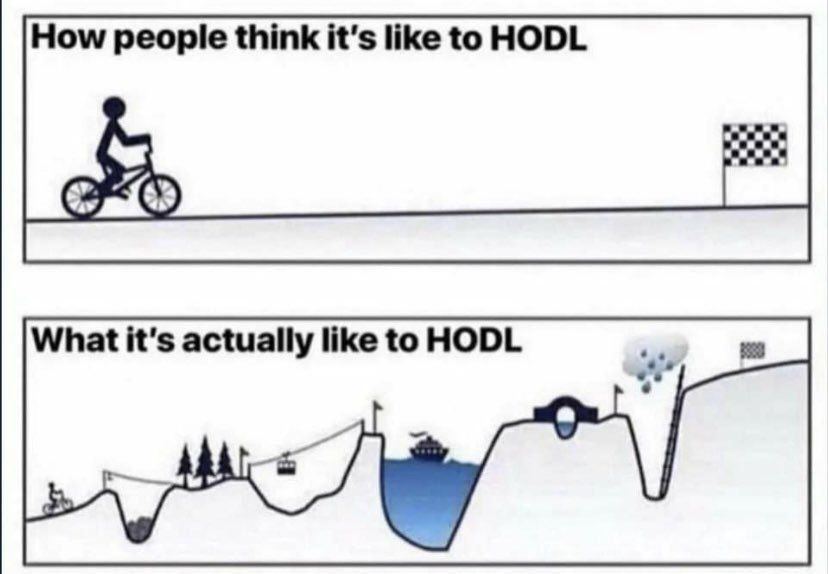

Overall, one thing is clear. Sideways ranges hurt those who trade excessively. So, unless you're a market maker, arbitraging inefficiencies away, you should stick to your medium to long-term plan. As I've been explaining, it's very clear for bulls that such plans shouldn't change until we see peak euphoria, a blow-off top, and whales moving their coins. After all, that's why this past Monday I advised you to look away from the charts and ignore prices for a while. Enjoy the weekend!

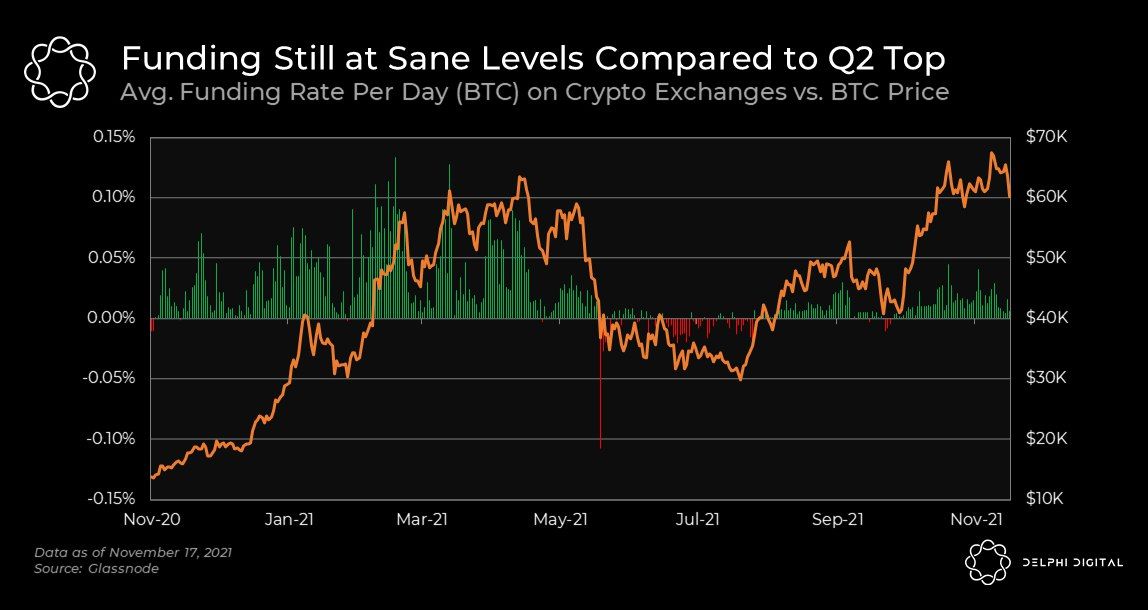

Chart art: funding rates never fail.

Three things: it was narrowly outbid.

- Learn the full story behind ConstitutionDAO, the world's "largest crowdfund for a physical object and most money crowdfunded in 72h".

- Learn how you can secure your NFTs, with Punk 6529's good guide to "passing down your Grails to your grandkids" (if they don't become worthless!).

- Learn "what are the best resources for understanding Web 3.0", with Brian Feroldi's curation of the top 10 resources about the future of the internet.

Tweet tip: hash rate never fails.

Meme moment: old but gold.

B21 Card: three more countries.

Get started: download the B21 Crypto app!