Relief Rally 2

Cryptic ball: Terra 2.

My apologies for missing yesterday's newsletter, but the market was smooth. This Thursday, however, we've seen something very interesting. US and EU equities pumped while crypto was stagnant, stuck in the range shared Tuesday! Why?

- Bitcoin was neutral on the day, mostly trading around $29k. But the original cryptoasset did briefly test $27.9k. The level was clearly and rapidly bid, meaning that the range I talked about is important for market participants.

- Moreover, the buying at that level suggests some kind of short-term bottom, at least. During this period, fear that the range could break compounded - causing major and minor alts to suffer more than the orange coin.

- For example, ether and many L1 tokens were down 11% to 18% and are not showing signs they want to follow the crypto leader. This is bad as bitcoin's bounce could be killed by a lack of enthusiasm in the wider market.

- Still, it was positive that ether bounced from last summer's lows. We need that level to hold if the supercycle theory is to stand the test of this bear market. Otherwise, the pain we're about to feel is larger than most can fathom.

- Back to stocks, the S&P 500 is about to test the previous support level now turned resistance. Bears will want to kill the hope of the bulls tomorrow or Monday at most, so let's keep a close eye on how this fight plays out.

- What happened and why did stonks pumped? Because it became known in the latest minutes from the last Fed FOMC meeting that a 0.5% interest rate hike is expected in June and July, ending the uncertainty around that key decision.

- This could be the bottom for stocks, as the majority believes it is just a relief rally and traders will just sell their positions as soon as it starts to fade. But it could have the opposite effect instead, as those waiting to buy FOMO in.

- After all, the S&P 500 has fallen 24% on average in the previous recessions, and in this one it has lost 21% of its value. While tech stocks remain overvalued, the average PE ratio is not that high and inflation expectations are falling!

Lastly, note Terra 2 is here and will launch this Friday through a massive airdrop. Either it goes spectacularly wrong or spectacularly well. Check why some believe there will be "minimal dumping" involved. But be careful with the story.

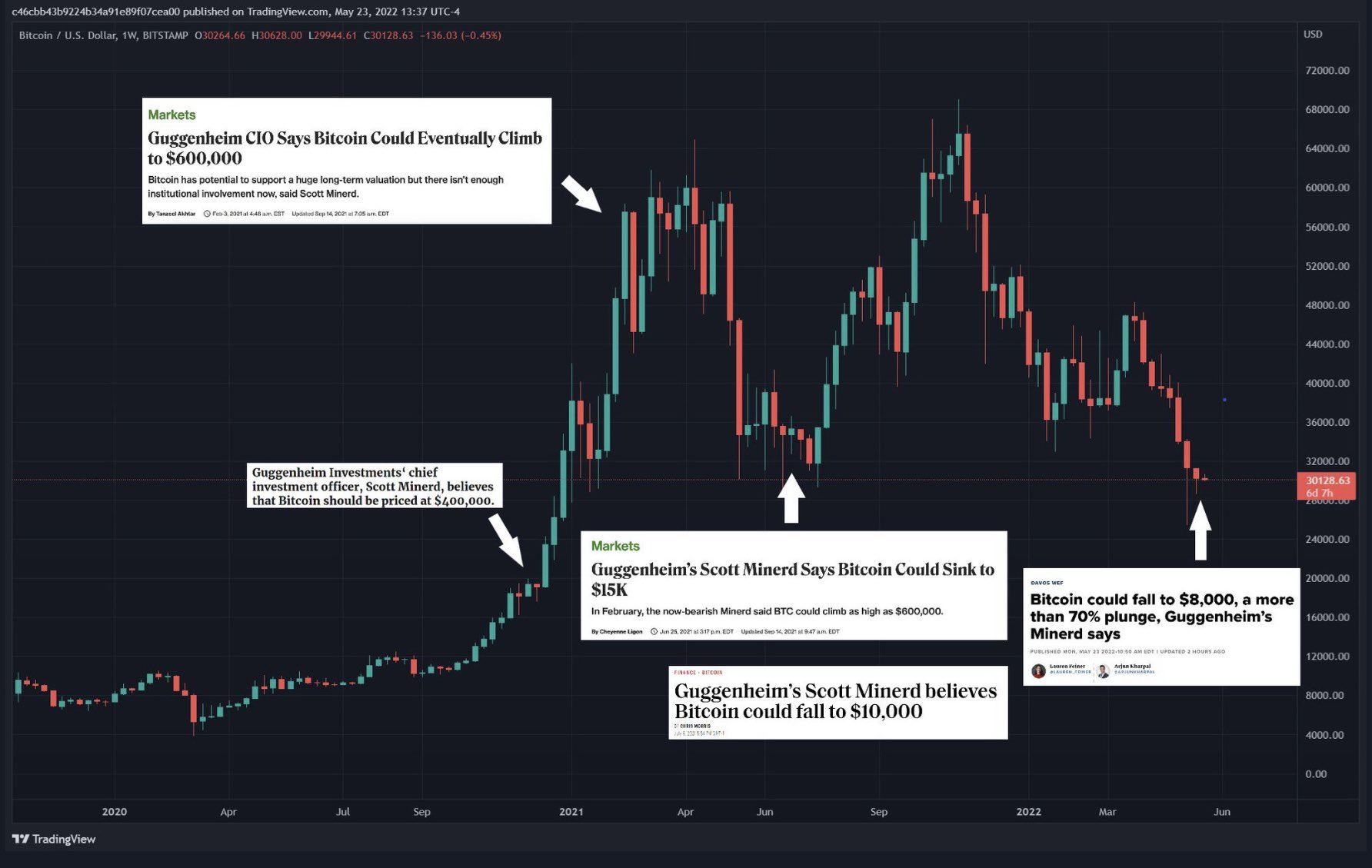

Chart art: Minerd two.

Three things: Elon too.

- Balaji Srinivasan explains how Elon Musk can truly win over Twitter users by decentralising it and airdropping a governance token.

- Fred Wilson explains why he believes the market will take some 18 months to bottom.

- Korpi explains why "staked ETH won't be unlocked at the merge".

Tweet tip: S&P 500 too.

Meme moment: 3AC 2.

FV Bank: let's talk too.

Get started: download the B21 Crypto app!