It's Mayhem

Cryptic ball: bid another day.

And the rollercoaster goes on. It seems we haven't reached peak fear yet as the dip keeps on dipping. Bitcoin is down 20% on the week, ether roughly 30% and most popular Layer 1s and meme tokens are down 40% to 50%. Is the end near?

- Firstly, note that bitcoin failed to hold $30k, falling down to $25k this morning. That level was heavily defended, and BTC bounced hard to $30k again but, again, failed to conquer that key level - which is typically a very bad sign as it hints the orange coin will keep its downtrend and make a lower low soon.

- Why? Because it shows bears are in control and stronger than the bulls. However, not all is lost. While $25k didn't see the highest volume ever in BTCUSD, today was the "highest volume day in crypto history", according to Sam Bankman-Fried - and these days tend to align with bottoms.

- Secondly, if I was wrong about the original cryptoasset at least I was right about Terra's LUNA. Traders who tried to buy it at $1 thinking it could only go up fell into a trap, as those trying to cash out of UST by burning it in exchange for minting LUNA pushed the price down below to $0.003, less than one cent!

- This goes to show that there's no rush to buy the dip outside of a clear bull market. While someone will eventually make nice money betting on Terra's recovery, most will just catch falling knives and lose all their capital. Remember this is a time to survive and save one's portfolio to bid another day.

- It seems I was also correct about this being the perfect context for further attacks on the crypto industry. Tether's USDT - a once truly infamous stablecoin, but which is now kind of accepted by the industry and even by regulators - temporarily lost its peg (maybe because it sounds a bit like Terra's UST?). Anyway, being well collateralised (one day I would like to say fully), it was easy for arbitrageurs to eschew the attackers away - at least for now.

- Thirdly, and most importantly, the stock market isn't collaborating and while sometimes BTC can lead the way in often surprising pumps, it's important to keep an eye on this important bellwether. Equity investors feel a recession is coming and continue to panic sell stocks for cash. Can the Feds do something?

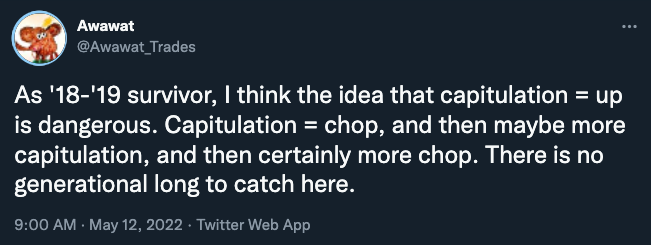

All-in-all, we've two scenarios ahead. As explained yesterday, either bitcoin chops from here until bears lose their patience and the Fed pacifies the markets (this will eventually happen), or else we enter a multi-year bear market as more and more traders jump ship and we truly arrive at Goblin town. Place your bets and be safe!

Chart art: chart another year.

Three things: work another week.

- Route2Fi explains what happened to UST and LUNA.

- Kadeem Clarke explains DeFi options trading.

- Mason Nystrom explains how to get a job in web3.

Tweet tip: wait another month.

Meme moment: laugh another time.

FV Bank: get your 25% discount.

Get started: download the B21 Crypto app!