Do not JUMP ship

Cryptic ball: let's hope Saylor isn't next.

Another day in the crypto carousel. Bitcoin dipped to $29k once the latest CPI data was released, popped back above the $30k and is now flirting with $29k again. Bulls and bears are fighting hard and only the bravest will survive. What next?

- As said yesterday, $30k is the key level to ensure we don't enter into a multi-year bear market like the 2018 to 2020 one. Many companies bought bitcoin at an average price close to that level and they surely made deals with big players to bid there in order to prevent them from booking unrealised losses.

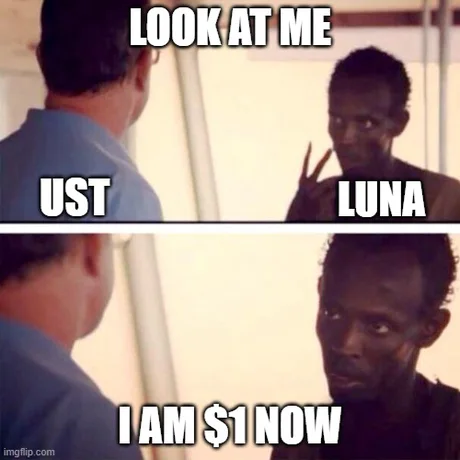

- That's why every time the orange coin falls below it we can see it surge back up shortly after. But that will work until it doesn't, just like UST's peg failed once the market makers run out of ammo to play the arbitrage game. I hope it holds, but if it fails note the next support is at $20k and the crash won't be nice.

- Overall, even if I feel we've reached peak fear and $30k is ought to hold, the aftermath of the pain felt over the past couple of days will reverberate and could provoke unexpected moves. Even if no more protocols are destroyed remember 2020: BTC hit $29k in May, June, and July before it truly bounced.

- Moreover, if UST was indeed broken by BlackRock or Citadel, as the rumour goes - and even if not at least it's clear it was broken on purpose by some group (due to the obvious incentives to break it and profit from a short) - then we are standing in the perfect conditions for the next attack to the crypto market.

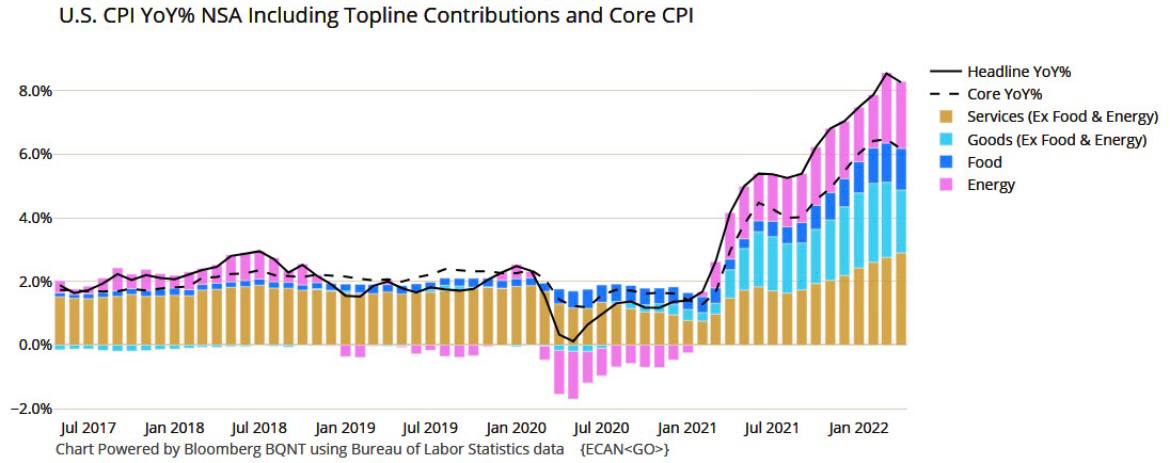

- Lastly, we can't forget it's still all about the macro backdrop. As you can see below, it looks like inflation is peaking, but today's CPI data was still slightly higher than the expectations. That prompted US equities to fall and both the S&P 500 and the Nasqd have reached new two-year lows.

- More importantly, it doesn't look like stocks have hit a bottom yet so this may be the prevailing factor driving further losses in cryptoassets. Let's keep following TradFi and see if traders relax by the end of the week. If stonks recover then it could be time for a nice short squeeze pump!

Oh, and note that Luna crashed all the way to $0.45 this morning. It was still trading at $60 this Monday. It's now at $1.5 and at a certain point even reached $5. Remember the project may never recover its credibility and even if it does it won't pump back to $60 in a couple of days. Be patient and careful as it would be a shame to capitulate now in case the extraordinary volatility resumes. Hold tight!

Chart art: let's hope June is also lower.

Three things: let's hope the rugs are over.

- ZachXBT clarifies "what constitutes a rug pull for NFTs".

- Mario Gabriele aggregated "the best threads on Terra and UST".

- AB explains the dynamics behind the secondary market for NFTs.

Tweet tip: let's hope the worst is beyond us.

Meme moment: let's hope kwontitative easing returns.

FV Bank: new user interface.

Get started: download the B21 Crypto app!