198̶4? No, 1994!

Cryptic ball: who controls the past controls the future.

May 4th is here and we got the mild pump I talked about yesterday. Bitcoin is up 5% since the daily close, and the total crypto market slightly less than 4% - which shows the strength of the original token amid such uncertainty. What next?

- In roughly one hour, 23h30 IST, the Fed releases its FOMC statement, where it updates its monetary policy. Half an hour later, at midnight IST, the FOMC press conference begins and Jerome Powell shares more insights into the deal.

- The market consensus is that the world's most powerful central bank will raise reference interest rates by 0.5%, a drastic move which hasn't happened since the first half of 1994. But back then it caught the world by surprise.

- Still, history teaches tough lessons and many still fear the lack of control felt back then. But at the time the world was recovering from a mild economic crisis and the aggressive hikes actually ignited an economic boom.

- More interestingly, in the previous century, the Fed was very secretive and now it is obsessed with transparency. It acts by saying it will act out loud and waiting for the market to adjust its expectations - which it just did!

- That's why all global markets except commodities have suffered in 2022. While I believe they will continue to suffer for a while, at least until the summer ends, I also feel it's time for some relief - which, if it happens, will help crypto.

- We just need to be patient and see how tech stonks and growth stocks react over the next days to whatever policy changes the Fed announces. Remember it's not only the 0.5% hike that's on the cards, but also the QT details.

- I've talked often about the Quantitative Tightening program the Fed has been teasing since late last year, but I'm not expecting anything surprising to come out there - except if the media wants to manipulate the narrative.

- Still, if something is more bearish than anticipated on that front then one can expect today's bounce to be faded. It's possible, I assign a low probability to it, but it's a possibility you must prepare to given the feeble support we're in.

So, let's sit tight and see. Maybe - due to the poor Q1 GDP reports that came out last week concerning the US economy - the Fed will be more relaxed and go with a 0.25% hike instead. If that's the case, then the bounce will be even stronger!

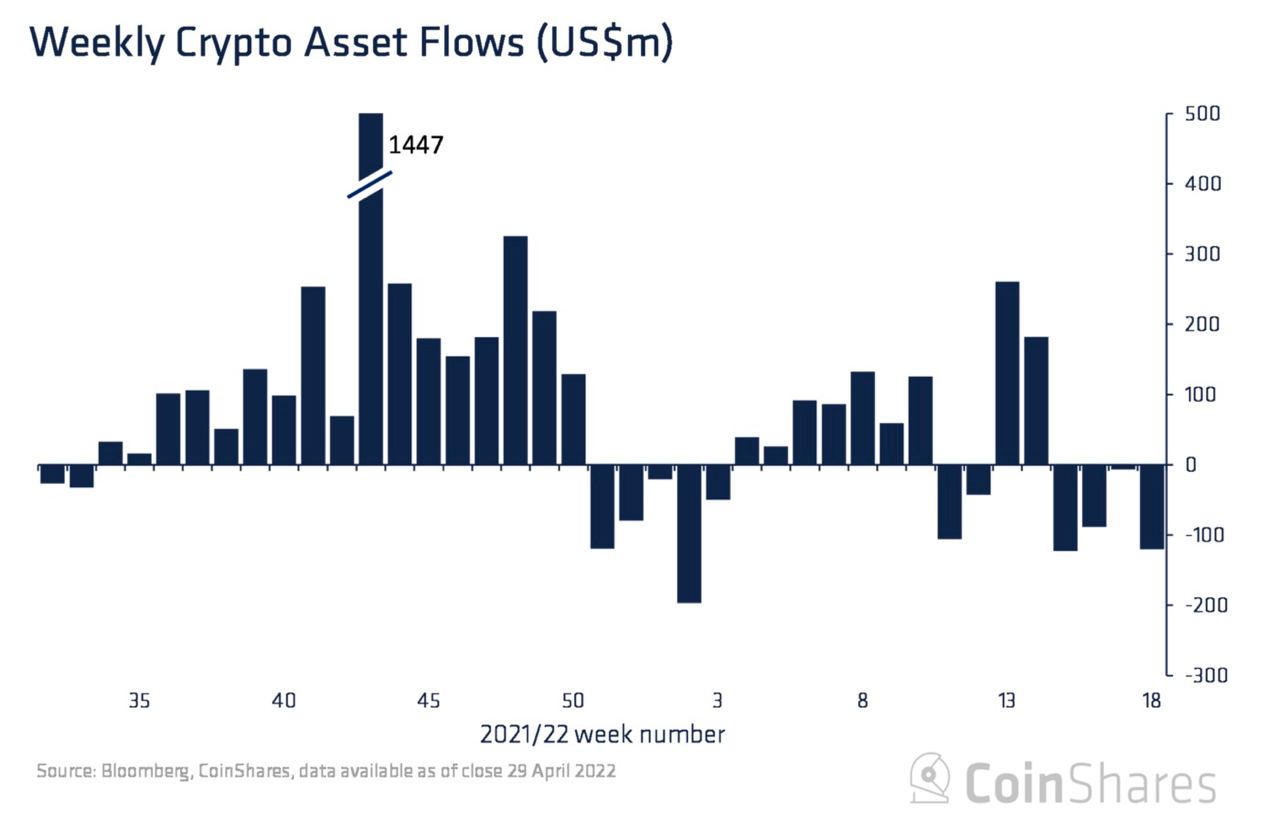

Chart art: in the face of pain there are no heroes.

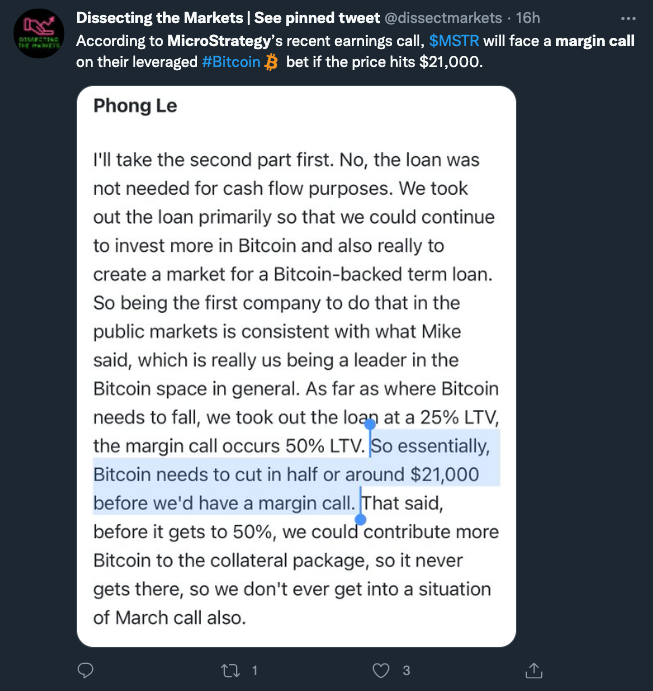

Three things: what you know already.

- Smol Degen shares his "quick thoughts for the average retail investor".

- Pantera Capital shared May's letter to crypto investors. As always, a must.

- Route2Fi shares "17 important truths about crypto and DeFi". Do read!

Tweet tip: the place where there is no darkness.

Meme moment: who controls the present controls the past.

FV Bank: new user interface.

Get started: download the B21 Crypto app!