The bounce that wasn't

Cryptic ball: the dove that wasn't.

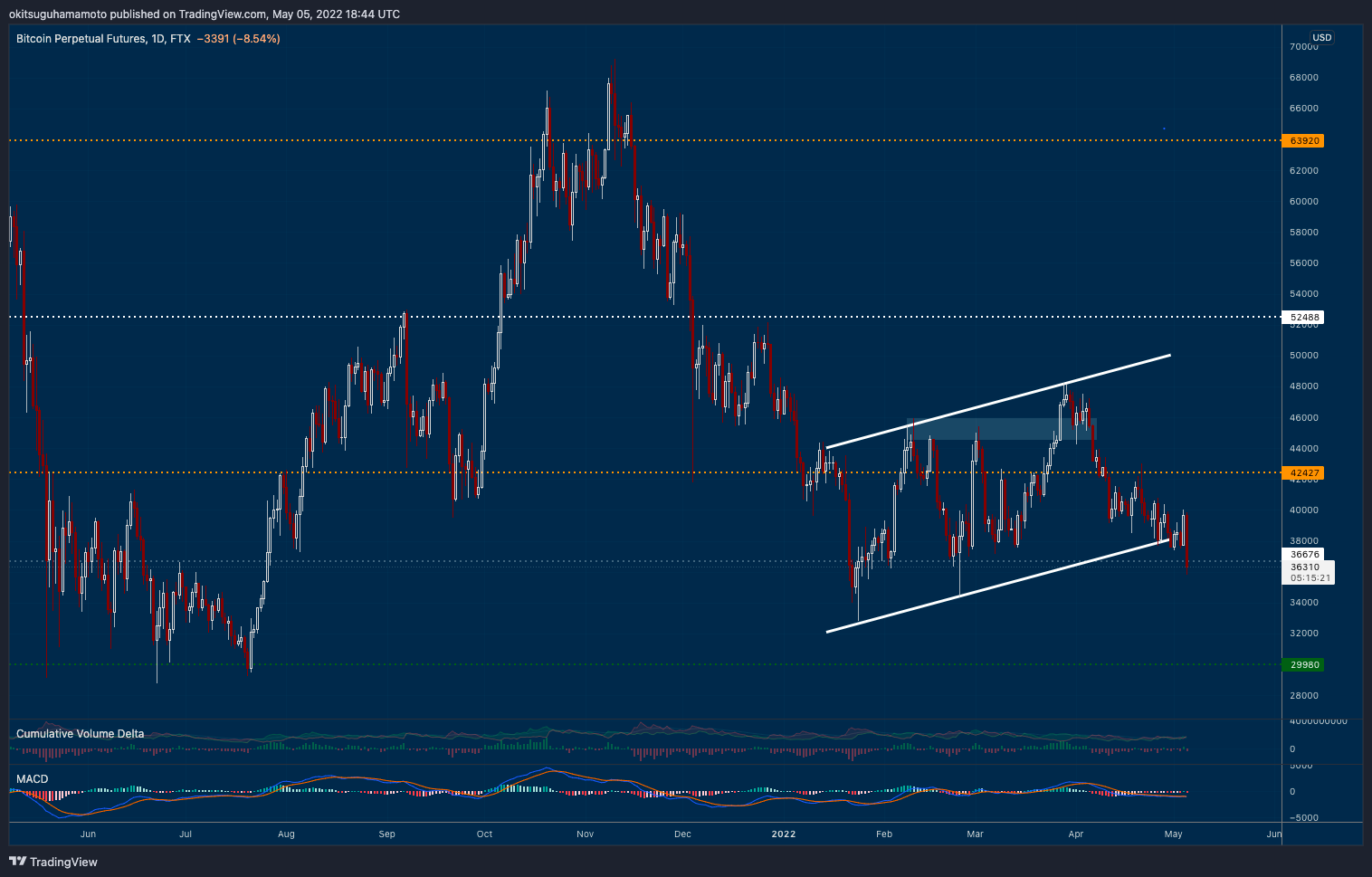

Holy cow. My plan was correct, but I wasn't expecting stocks to crash so hard today after that sweet relief. Tuesday's mild 5% bounce got some follow-through yesterday, after the positive remarks by the Fed, but something went wrong. What?

- Firstly, we can't forget the bearish backdrop we're in and that I've been extensively covering. The trend is down, but one day it will reverse. I was hoping that such a day would be this Q2 but we need a good Friday to recover.

- Then, note that, as expected, the Fed "just" hiked interest rates by a 0.5% point - unseen since 2000, but fully priced in by the market. Moreover, Jerome Powell said that the Fed wasn't considering higher hikes than that - and so US stocks had their best day since May 2020. Crypto naturally followed.

- But bulls just lacked the strength! Bitcoin briefly tested $40k, waiting to see what the stonks would do today after the NY session opened. Bears chose to attack at that moment, bringing the S&P 500 and the Nasdaq back down to those crucial support levels I've been writing about last month. Curiously, it seems the Nasdaq will close this session as the worse day since June 2020!

- Why did bears attack? Because they can. The macro situation continues to look bleak and many fear the Fed shouldn't be so optimistic about its capacity to shrug off an economic recession - which hurts profits and thus equities. And, in these correlated markets, that also means it hurts bitcoin and crypto at large. It's cruel, but right now a dovish Fed is bad for bulls as it harms its credibility!

- All-in-all, Satoshi's gift is down nearly 10% today, a significant intraday drop. It had recovered this year's minor uptrend but now, after a second loss, it seems we're due to test $30k over the next months. And after that, bears will feel encouraged to try to liquidate Microstrategy, as I memed recently.

Our only hope now is for the US market to bounce, which also sounds unlikely. Still, on the grand scheme of things remember the situation must change well before the Midterms in November, for obvious political reasons. Let's hope.

Chart art: the trend that wasn't.

Three things: the BS that wasn't.

- Matti tells you how to "sell your BS web3 idea to a VC".

- DeusExDAO tells you "how to grow crypto communities".

- The DeFi Edge tells you how to create your own crypto support group.

Tweet tip: the price action that wasn't.

Meme moment: the meme that wasn't.

FV Bank: new user interface.

Get started: download the B21 Crypto app!