A Clockwork Orangeth

Cryptic ball: buy the whitepaper, sell the scaling.

One month ago, ether was about to break $2k and start navigating through new all-time highs. If it would to do so confidently, you could expect an alternative April - or so we told you. Now that has happened, what about May, this springy month that feels like summer? Again, it's all about ETH. Alts won't continue to pump in a consistent manner once it puts in a local top and fails to break it again.

So, what could cause that? In our eyes, three things: 1) bitcoin starts pumping, which likely won't happen until this alt season leg is over; 2) something goes wrong with Ethereum's London hard fork, anticipated for July, and the market bears incorporate this new piece of information; 3) the alt season rally starts losing steam, like it happened in the end of August 2017, but now that would likely be earlier - given all the hype around Ethereum's scaling improvements in July.

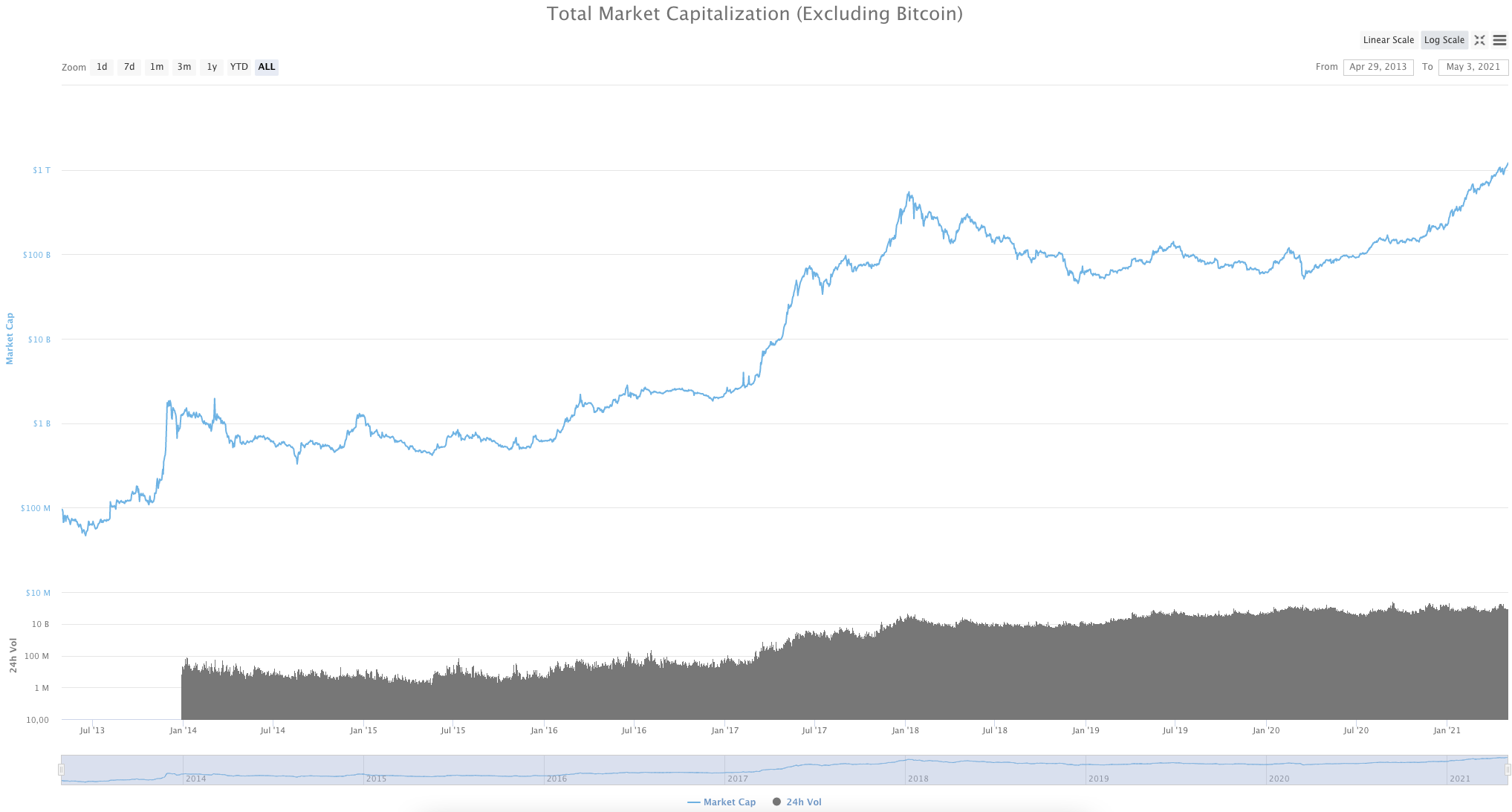

Chart art: imagine if alts reach gold's market cap.

Market musings: it's all about London.

But how do you know if ETH has reached the last all-time high for a while, thus becoming a local maximum which could scare the bulls for some months? Well, there are things to look for: 1) euphoria in the generalised alts markets that prompts crypto projects to liquidate their digital holdings for cash; and 2) strong volume on a parabolic, blow-off top with high funding, hinting that buyers are getting exhausted and that the road to bet against the exuberance is safe again.

For now, euphoria is high - but only among those hard core enthusiasts who know how to find gems on decentralised exchanges. And today's $3.2k top reached a third of the volume of this year's high. Additionally, funding is low, further implying this rally, which has pumped ETH nearly 18% since Friday's open, has been driven by the spot market, i.e. potentially new investors and not traders borrowing funds to speculate with leveraged futures. So, buckle up and be safe!

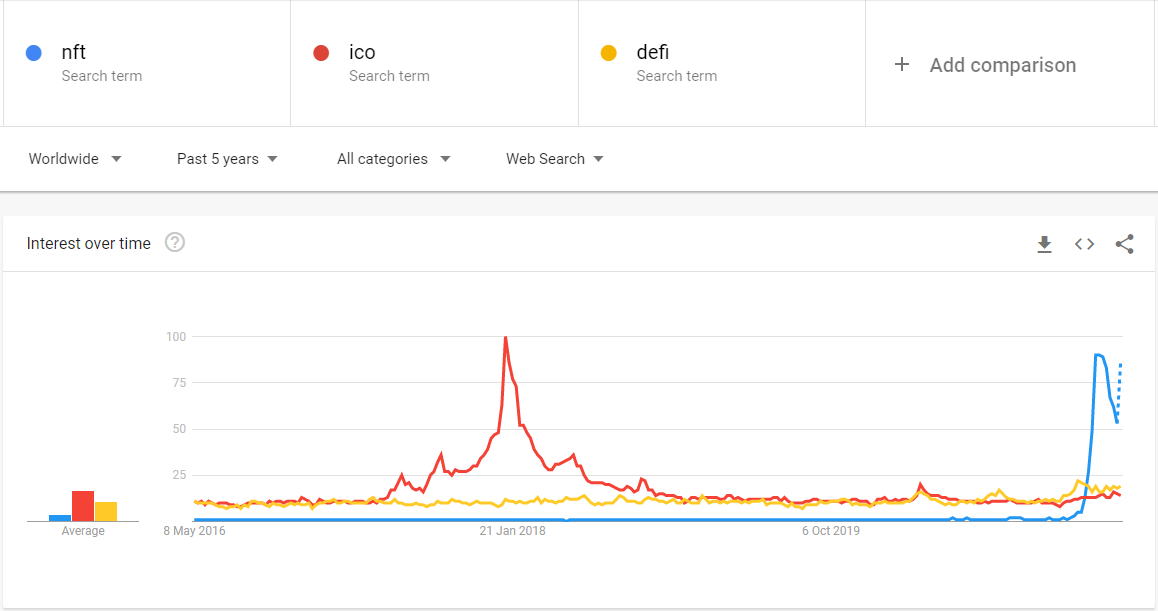

Visual block: those were the times.

Three things: you know we only recommend the best stuff.

- Are you experiencing NFT FOMO? Lex Sokolin covers the top five NFT trends for 2021. It's a must-read.

- Do you have a friend who doesn't understand what is Bitcoin? Share with them this great webinar by James Benett! It's tomorrow at 1pm London time.

- Have you read Andreessen Horowitz's crypto thesis? Now that the popular VC firm has announced a new $1 billion crypto fund it's a good time to read it!

P.S. Last Friday we misplaced the Arthur Hayes interview link. Here it is!

Tweet tip: disrupt or be disrupted.

Meme moment: base 10 and decimals are inferior.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!