Farm hay in May

Cryptic ball: watch today's monthly close.

The end of the month is here, a period typically associated with cryptoasset volatility. However, the current variation is just business as usual in an alt season, so there's nothing to worry about for today's daily close that you shouldn't be worried with every day - say being overleveraged, being excessively exposed to shady alts, or with any piece of news creating a sudden movement either way.

But there's something interesting happening today with bitcoin. After ten days of decline, this Monday BTC pumped nearly 11% - resting for a while until today. Now, it has pumped another 6% from Monday's top, sitting at $57k - finally above that key level we've been talking about for a while. More interestingly, if by midnight UTC it closes above $58.9k, then April will mark the first seventh consecutive monthly candle in history of the original orange coin!

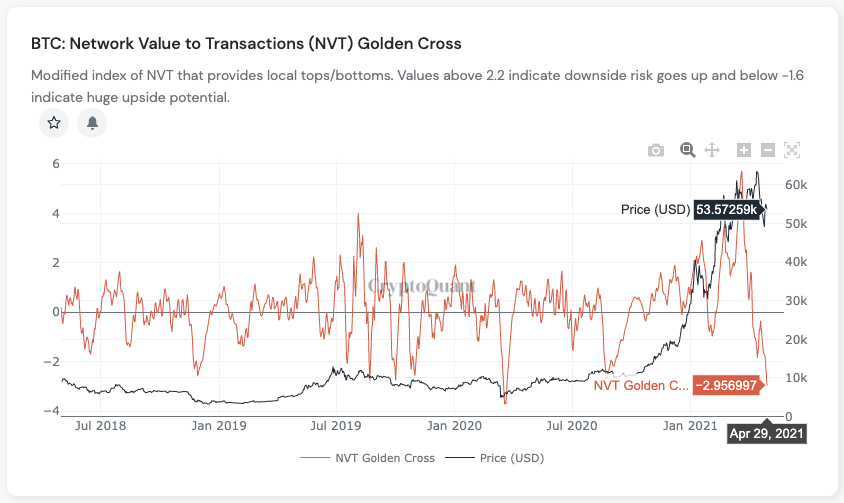

Chart art: note bitcoin is not overbought.

Market musings: bookmark this email.

While any monthly close won't be special in and of itself, a seventh green candle would surely be another point for the bullish narrative of 2021. And, even if it closes at this level, not much changes. In other words, we could anticipate 2017's history to rhyme: that is, BTC should remain fairly stable over summer, with some minor episodes here and there. Meanwhile, alts would continue to pump until ether finds a local top - which could eventually happen in late June / July - whenever Ethereum's London hard fork successfully takes place.

Then, by the end of August, bitcoin would start mooning again - as the ensuing Ethereum mining war can trigger attacks on its blockchain that impact ETH - and, by December, alt season reaches a peak. Conversely, if this doesn't play out like this, it would most likely be because we reach the euphoria phase earlier - either because all the decentralised exchanges tokens which did 200x and 500x make people (and regulators) go mad, or because central banks calm stock markets down, triggering fears of an economic slowdown that can affect crypto too.

Alternatively, it's because we were wrong. In any case, enjoy the wild ride!

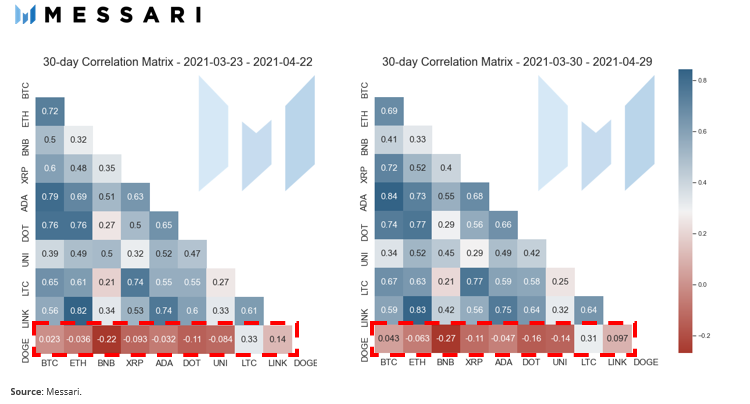

Visual block: diversification requires uncorrelation.

Three things: learn during the weekend.

- Spencer Noon, a popular investor, believes ether is on its way to $10k and provies ten reasons to back up his view. Well, it's only than 3.6x from $2.8k!

- Arthur Hayes, former CEO of BitMEX, believes bitcoin will continue to rise as long as the US Fed keeps expanding its balance sheet. Another must-read here.

- Lastly, we believe you should listen to Laura Shin's fresh podcast episodes on NFTs (interview with Open Sea) and DeFi (interview with MetaMask).

Meme moment: this is why you can't afford a nice house.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!