The first day of spring

Cryptic ball: will animal spirits wake up?

And we're back! After February 17th's intermission announcement and a very tough last week that drove me away from the keyboard, you can now expect this newsletter to be back to its regular schedule. Without further ado, it's time to talk crypto again, understand what happened and the possible scenarios ahead.

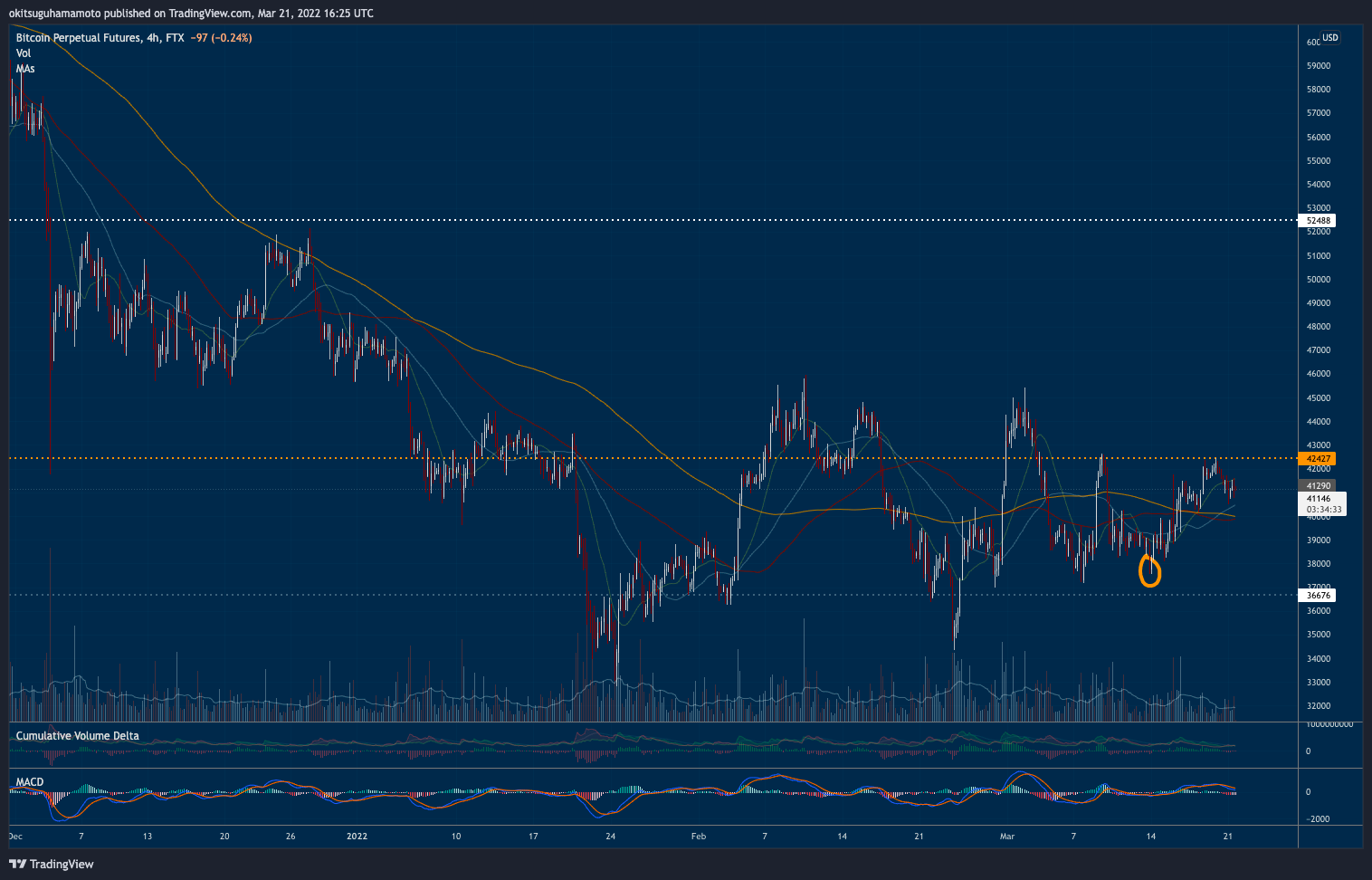

- On March 11th I wrote that in the absence of further escalation of the conflict in Ukraine, one should expect cryptoassets to continue to range - potentially with some small upside in case bitcoin bulls were able to defend $37k. And, as you can see in today's chart, that has been the outcome so far, with bitcoin and the crypto market both rising roughly 10% over the last week.

- US and European equities had an even more impressive move, with the S&P 500 appreciating nearly 8% in the same time frame, in what was dubbed the best weekly rally in more than a year for the less volatile stonks. Yes, Wednesday the Fed confirmed a 0.25% hike in the reference interest rate, with a 8-1 vote. But I told you that was priced in, so it was time to buy the news.

- More interestingly, Jerome Powell said the probability of a recession is "not particularly elevated". But, in a news conference today, the Fed's chair is arguing "the inflation is much too high" and this harms economic recovery. In other words, bitcoin needs to prove it can really decouple from traditional assets or else the Fed's policy will still influence the orange coin.

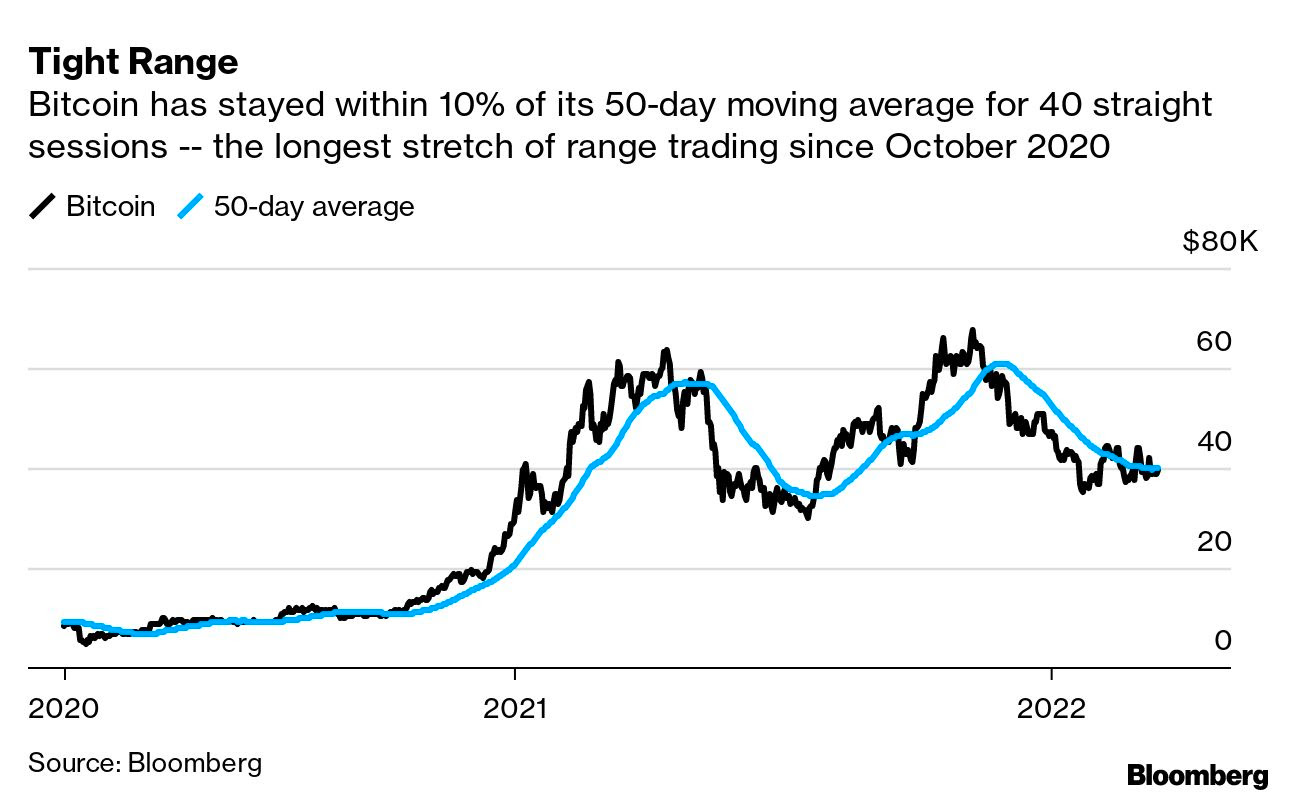

- What next? The past couple of months saw tight range trading, as you can see in today's visual block. But derivatives traders are now pricing in a rise in volatility for the next weeks, even if implied volatility is still relatively low. Overall, I believe the current trading area favours longs, with further confirmation if $42k becomes support. But I'm still thinking about the current state of affairs and will provide further updates tomorrow!

Chart art: will we finally break free?

Visual block: will sideways never end?

Three things: will institutions finally buy?

- Tom Dunleavy explains why this isn't the 2017/2018 cycle and why the institutions are finally coming to crypto.

- The Generalist tells the story of Multicoin Capital, possibly "the best performing venture fund of all-time".

- Kevin Roose made a cool "latecomer's guide to crypto" that you can share to onboard your friends!

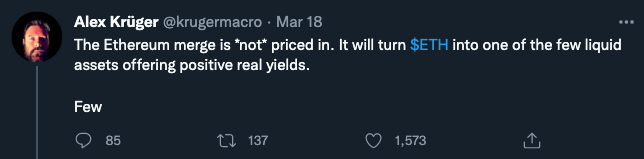

Tweet tip: will the merge finally happen?

Meme moment: will you stack sats?

Bitcoin Miami: meet us there.

Get started: download the B21 Crypto app!