Peak limbo

Cryptic ball: minimum funding.

And we're back to the limbo. Over the weekend, I told you that the bottom could be in if we were to recover $20k before Sunday. That happened last night but the bears are attacking again and the bounce hasn't been very convincing. What now?

- The S&P 500 is attempting a modest recovery, but it feels stonks aren't done dumping yet. So the best bet for crypto is that we're finally seeing the end of the strong correlation between equities and bitcoin, as explained Saturday.

- To be fair, the total cryptoasset market cap is up nearly 15% since Saturday's bottom, when ether hit $880 and BTC nearly touched $17.5k. At least we're in a market where traders can rejoice at these nice price swings, right?

- Moreover, at that dreadful moment (at least for the permabulls) bitcoin finally touched its 200-week moving average, a key level that has not been breached since 2014 and has acted as solid support in the previous crypto winter.

- However, that's just a technical level and nothing says the crash can't go on. As I wrote in the last newsletter, unless $20k is seriously conquered, then it's very likely we'll see further downside especially if stonks continue to crash.

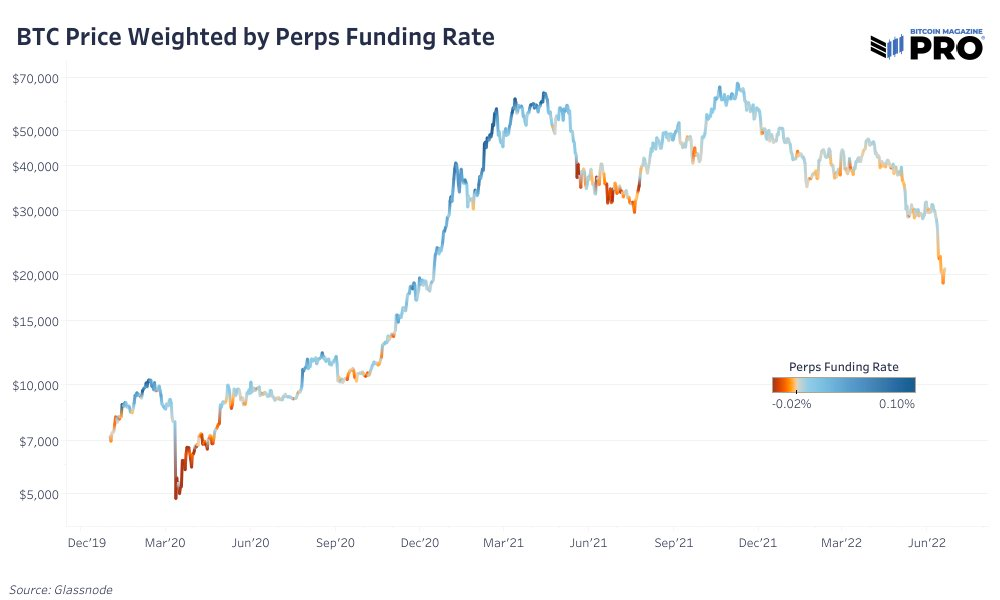

- The bright side is that bears are getting greedy. As you can see in today's chart, funding rates - which I used a lot last year to successfully time April's top, but then became less relevant with time - are becoming relevant again.

- After months of apathy, we're seeing funding rates approaching interesting values. Albeit not too extreme, they have got lower - implying heavy shorting activity - after the dump has already taken place. Again, bears are greedy!

Still, we must leave limbo first. As the summer doldrums approach, the market will become less interesting as traders leave their desks. And that diminished liquidity may allow for one last extreme move before I can say confidently the bottom is in!

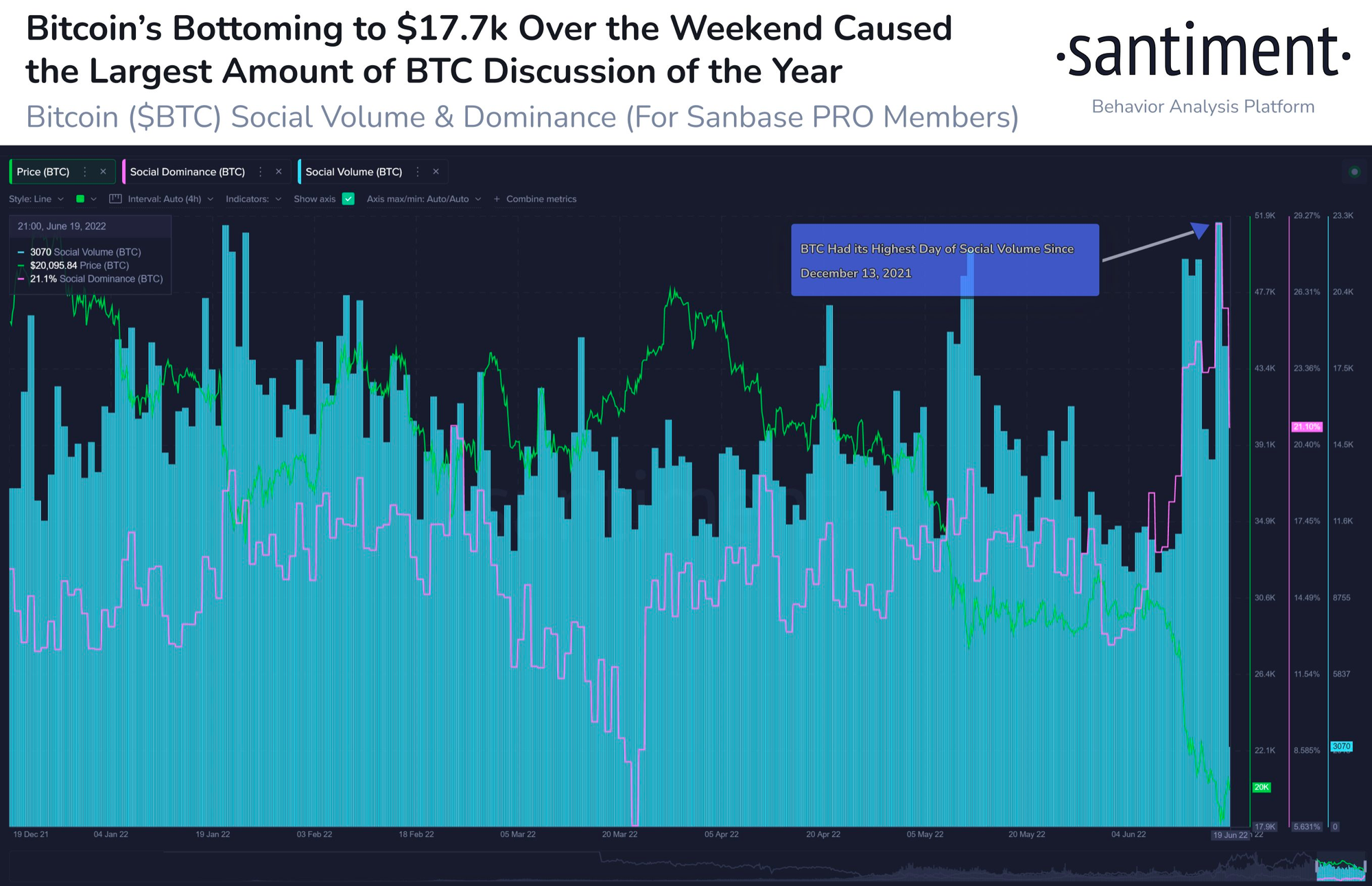

Chart art: peak chatter.

Three things: minimum tinyness.

- Pothu summarised a16z's "state of crypto" report. Old but gold.

- Gigantic Rebirth "speculates on some altcoin trends". Short, but key.

- Sleepy explains how one can hack dApps on Ethereum. Good to know!

Tweet tip: peak boss.

Meme moment: minimum greed.

FV Bank: back from Consensus.

Get started: download the B21 Crypto app!