CPI vs. C-3PO

Cryptic ball: the possibility of successfully navigating chop.

Not much happened in the markets over the past day. The S&P 500 index remains hovering around 4,100, previously a key support level now turned resistance. Crypto also continues stuck, as everyone's waiting for the CPI print. What's next?

- Well, ranges are boring until they break and half of the market finds itself trapped. Right now, there's a fight between those who believe the fall of commodity prices indicates inflation has peaked and those who believe the rise of oil and energy prices will continue to fuel a rise in the consumer price index.

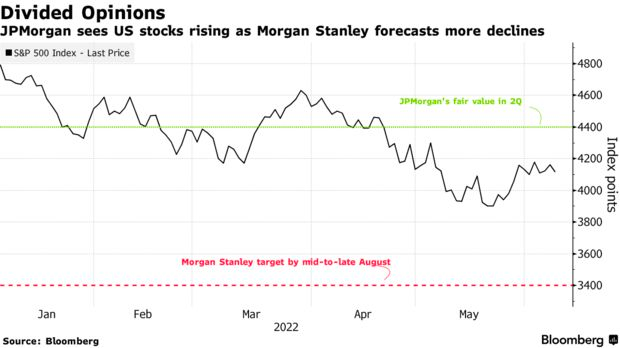

- As you can see in today's chart, different top US banks are publicly espousing conflicting views on this matter. Again, I'm not saying we can't trust such PR work - after all, the JP Morgan strategist who backs the bullish target below also agrees with Morgan Stanley's bearish target in an "adverse scenario".

- What's the point here? That long-term scenarios are pointless until either inflation fears subside or are overcome by a more urgent fear of economic recession. And those fears will rise and fall as more data comes in.

- This brings us to tomorrow's CPI print, which will be released at 12h30 UTC, or 18h IST. The consensus forecast by the WSJ is predicting a 0.7% MoM increase in consumer prices and an 8.3% YoY increase (which is the same as April's).

- Bloomberg agrees, but the prior forecast indicated a 0.3% MoM rise, so we may be in for a bad surprise. The White House also "expects the next inflation numbers to be elevated", but they could be trying to manage expectations.

Lastly, and talking about short-term scenarios, if the print comes out slightly higher than 8.3% or 0.7% MoM then bears will attack. If it is as expected then we may leave the chop - hopefully with bulls winning this fight, as net exchange flows have finally turned negative, implying there's less selling pressure ahead! Overall, it's clear inflation won't disappear soon. But the markets can get used to it.

Chart art: i don’t believe we have been introduced.

Three things: i suggest a new strategy.

- Dan McArdle replies to the claim "BTC hasn't been an inflation hedge".

- Gabriel Shapiro shares his thoughts on a "landmark crypto bill" in the US.

- Robin Ju and his team analysed "the latest tokenomics benchmarks and trends to help you plan your critical token decisions".

Tweet tip: we're doomed!

Meme moment: oh, dear.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!