Punk it

Cryptic ball: punk and funk.

Stonks initially dipped this Thursday, but managed to close the day in the green. However, this Friday it seems the buying pressure will be reduced across the board, as crypto is also showing signs it needs to wait a bit before moving on.

- Overall, we're just experiencing some uncertainty before next Wednesday's FOMC press conference. Once that's out of the way and the Fed moves on with the already priced-in 75bps hike, then we can continue the pump.

- Until then, you'll have some time to phase your buys and look out for the best entries on your favourite assets. Remember bitcoin is still king in these bearish conditions, but one can't overlook the ETH opportunity nor some major alts.

- Now, we can't forget that all this newfound excitement can fade if Ethereum's core team fails to implement the anticipated "Merge" on time. This upgrade will see the leading dApp platform switch from PoW to PoS, which is not easy.

- If such a delay happens, the current pump can easily become exhausted. But, before that, I believe it's time to enjoy the ride upwards while being careful and protecting one's profits. Meanwhile, you can always follow Punk whales!

- As you can see in today's chart, unearthed by QCP Capital, it seems high trading volumes of Ethereum's most popular NFT collection are highly correlated to extreme moves in ether. That's something to have in mind!

Chart art: heavy methal.

Three things: MEV is in da house!

- Nic Carter explains why the credit crunch "isn't the end of crypto lending".

- Libevm explains how "a regular code can become an MEV expert".

- Bond Protocol explains "why DeFi is dysfunctional".

Tweet tip: macro fusion.

Meme moment: eurotronic pop.

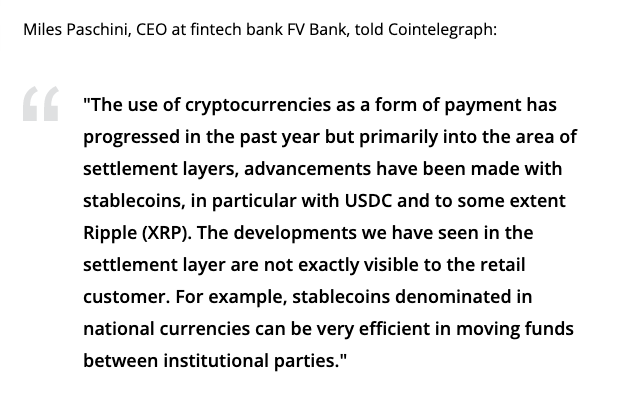

FV Bank: the future of settlement.

Get started: download the B21 Crypto app!