The Great Bear

Cryptic ball: the fallen knight.

This was a smooth day in the markets, albeit more positive for crypto than for stocks. While bitcoin continued its bounce from Wednesday's bottom-of-the-range test, the S&P 500 made a lower low and the Nasdaq failed to impress. What's next?

- As explained Friday and Monday, Wednesday marked this week's volatility peak. Now it's time to wait for the weekend, noting that speculation about the Fed's plans for its July 27th press conference will increase next week.

- So far, Fed officials have been claiming a 100bps interest rate hike is out of the cards. But similar comments have been made in the past regarding the 0.75 percentage points hike - so few trust them. Let's see how that goes now!

- Back to crypto, it's good to see that things look reasonably solid, even amid rising contagion fears in the aftermath of the bankruptcy of Celsius, which today disclosed it has a $1.2 billion hole in its balance sheet (for now!)

This could be the last piece in the falling crypto house. I still believe the dominoes have already collapsed and these are just the ashes, but I may be wrong. After all, retail has nothing left to sell, so maybe these forced sellers can be absorbed!

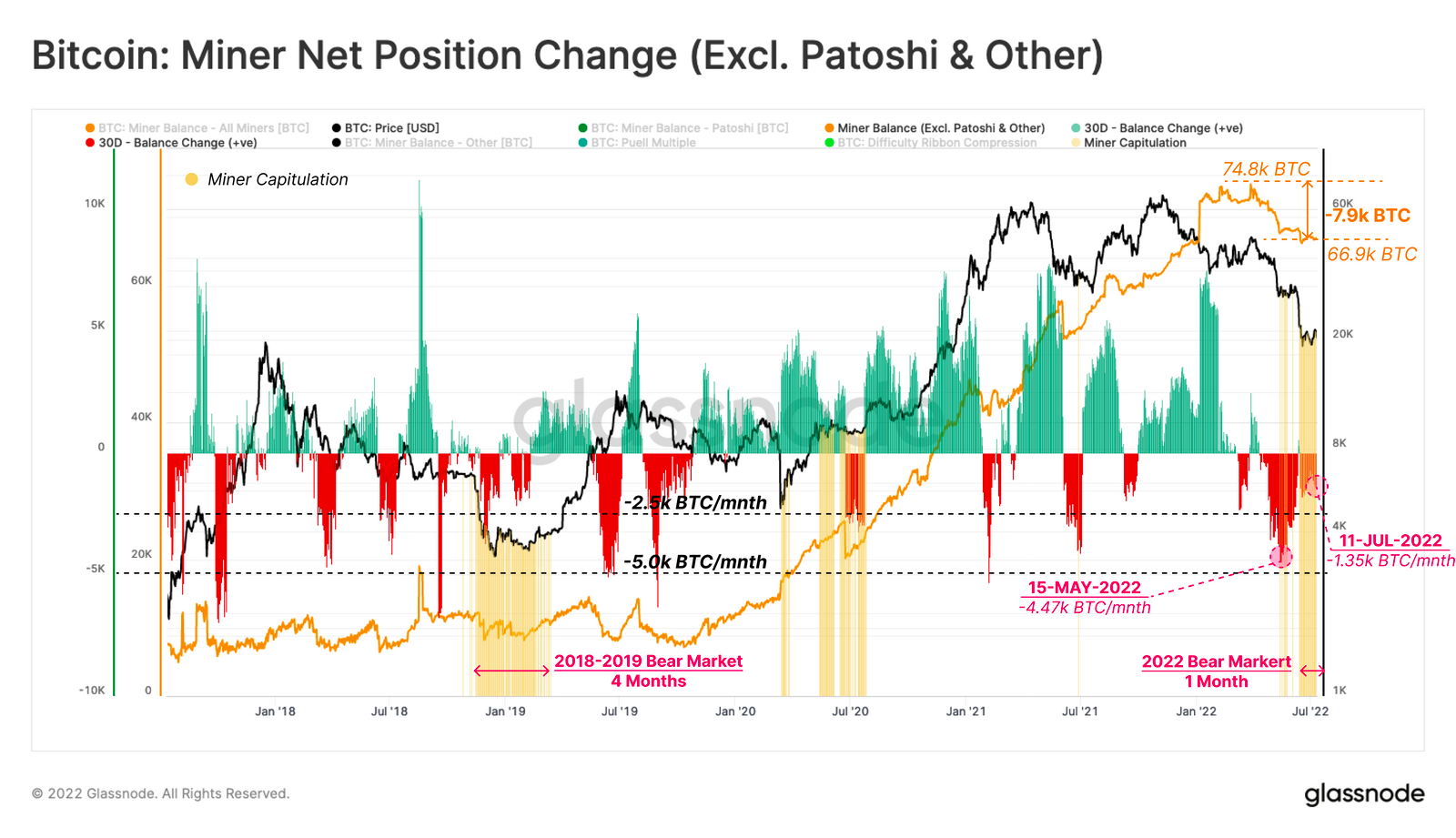

Chart art: the mining yankee.

Three things: the honourable samurai.

- Arthur Hayes is back with the tale of "A Samurai, a Knight and a Yankee".

- Ben Lilly is back with "part 3 of the Jarvis Labs Macro Cycles series".

- Sahil Bloom is back with "the six principles of incentive design".

Tweet tip: the yankee curve control.

Meme moment: the yahweh moment.

FV Bank: where to find alpha.

Get started: download the B21 Crypto app!