Peak celling

Cryptic ball: peak inflation.

Just as anticipated Wednesday, right after dropping below $19k, bitcoin remained within range and began marching back towards $22k. It looks poised to test that level this weekend, but it's still unclear whether it can be broken. What's next?

- Firstly, as crypto remains very correlated with stocks, it's important to note this move piggy-backed on top of a relief rally performed by equities, which in turn was inspired by better than expected earnings in major banks.

- Still, the US stonk indexes I like to reference, the S&P 500 and the Nasdaq, closed the week slightly in the red - a bad sign; even if both are forming a potential bottom, which shouldn't be disturbed at least until the summer ends.

- Potentially, such consolidation - which first started in crypto, a market which also anticipated the equities crash as it has become a purer way to express one's thoughts about global risk assets - will be further helped by a true recovery.

- Remember these spectacularly high inflation figures are always reported in comparison with the price levels of the same month of the last year. These were relatively low, i.e. below 5%, until May 2021 - and escalated right after.

- That means it's increasingly difficult for the Consumer Price Index to continue printing elevated figures unless inflation itself is sustained at really hot levels - something quite probable in Argentina, but less so in the US and Europe.

In other words, as inflation fears subside, one can expect businesses to start investing again and sidelined money flowing back to tech stocks and crypto. But this won't happen rapidly. It's still time to be patient and a tiny bit cautious.

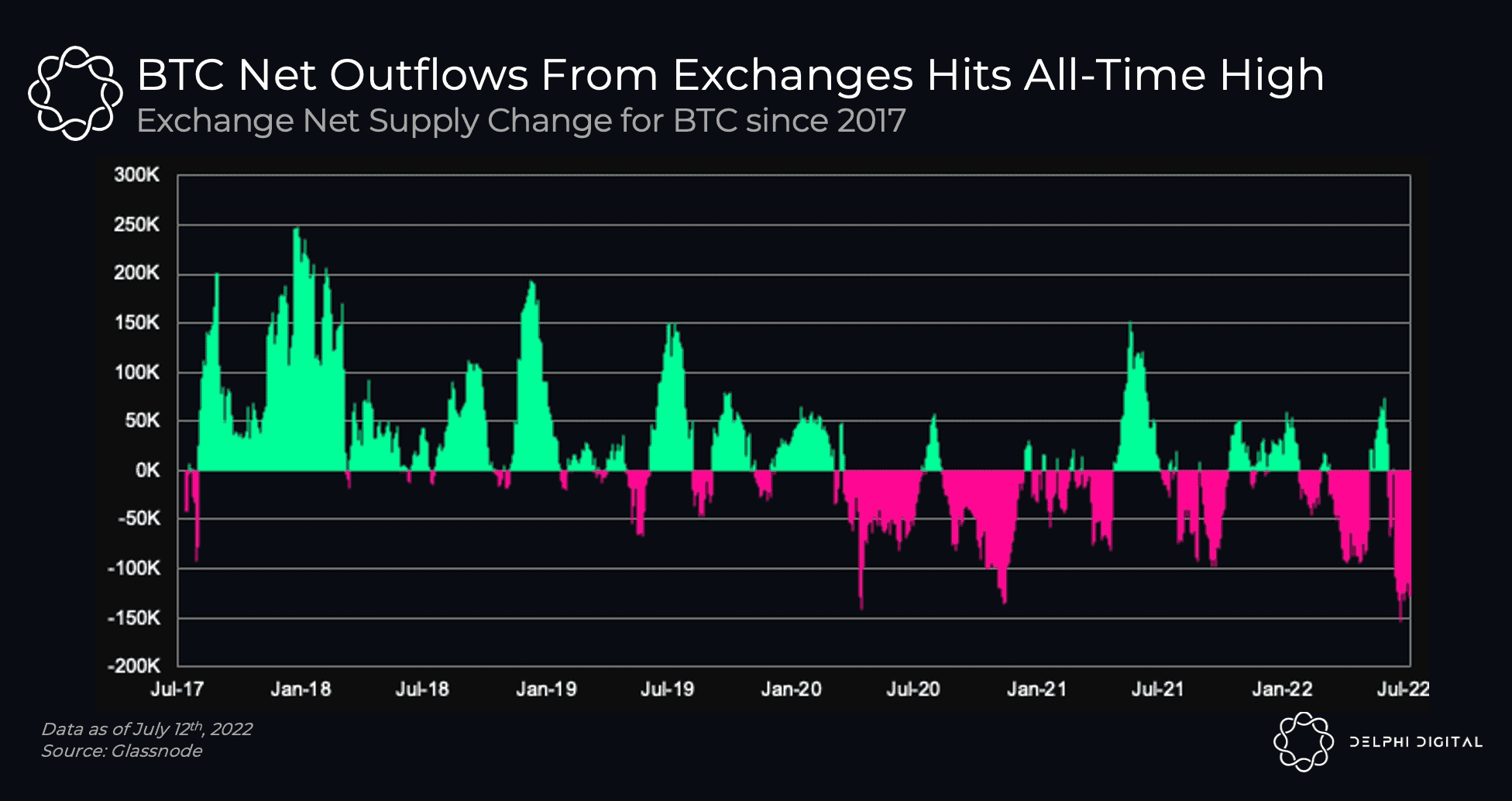

Chart art: peak fear.

Three things: peak hodl.

- Lyn Alden explains why the diverse Bitcoin community is powerful.

- Dan Matuszewsk explains how "CMS Holdings is holding up".

- Donovan Choy explains why DeFi will never die.

Tweet tip: peak survival.

Meme moment: peak correlation.

FV Bank: the future of custody.

Get started: download the B21 Crypto app!