Crypto crocs my world

Cryptic ball: it's also Crocs.

The weekend was mostly boring as bitcoin was stuck in the range mentioned last Friday, without getting close to its edges: $41.5k and $45.5k. Overall, for the week ahead I maintain my conviction that the only good trade is to follow volatility, as no directional bet can be safe in this environment - as bulls and bears can write sufficiently compelling words to justify their cases.

So, either you are very knowledgeable of options (or use this opportunity to learn about this increasingly dominant side of the crypto market) and find a venue to express your views, or else you wait until things warm up. Still, everyone should cherish such quiet times. Because it's not only Walmart that is building a massive metaverse venture, but all the startups receiving checks from the VCs who just raised hundreds of millions in capital, currently being deployed!

Just make sure you don't expect your favourite alt to moon soon (except if it's ATOM or NEAR - and even those can only grow some 3 to 5x from here, at least until BTC and ETH resume going up), and are ready for it to dump by at least half. Lastly, remember that I don't believe we've seen the top of this cycle yet and am growing fonder of the multicycle hypothesis. Just like the stock market, crypto will have its dips but it's less likely we'll see +90% drawdowns like before.

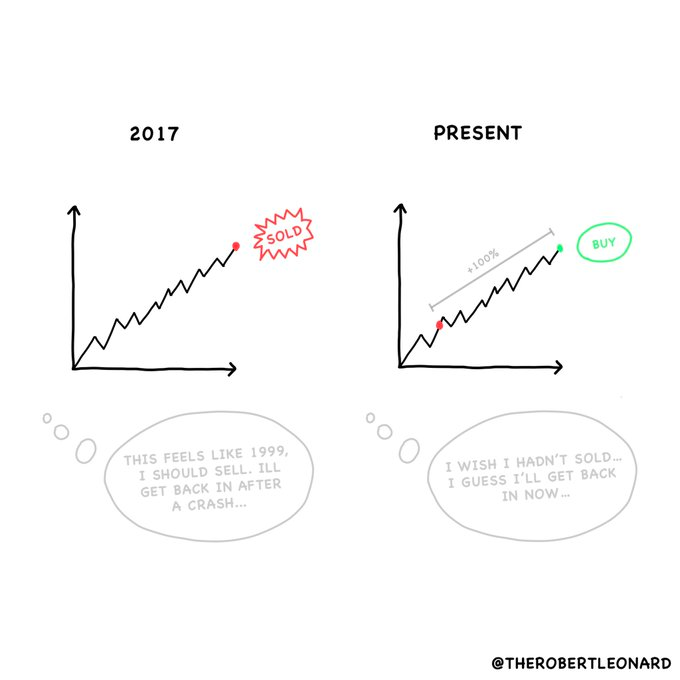

Check today's tweet and meme for a great example regarding the dot com bubble, how many still feel the whole tech world is continuing to experience another bubble, but also how the market is able to continue grinding up longer than bears can remain mentally healthy. You must be ready for bitcoin to break $40k again and fall up to 50%, but also note that if you don't feel you can time the market, then it's better to average you're way in and out. And to read Ben's article below.

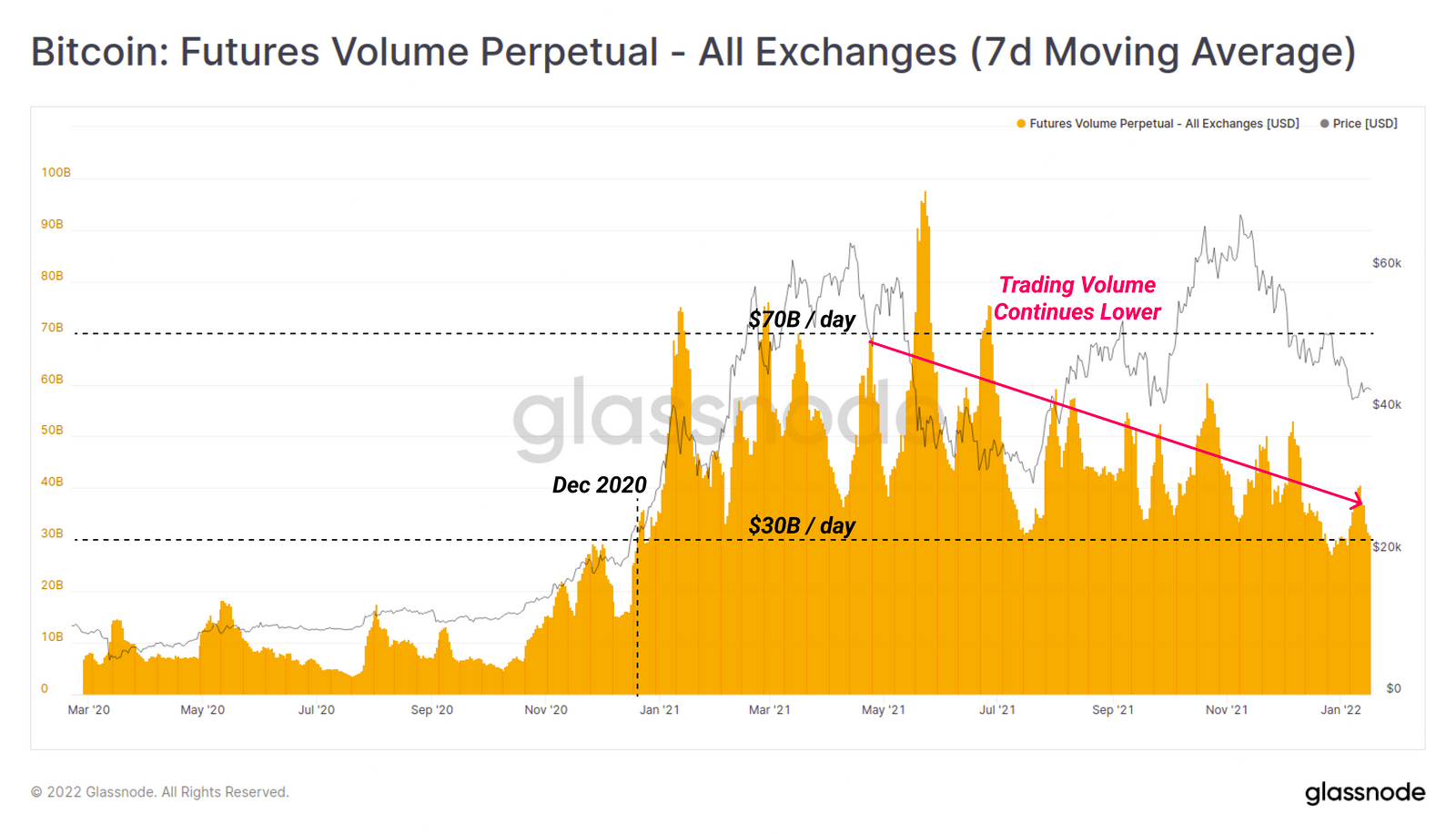

Chart art: it's also boring.

Three things: it's also HODL.

- Benjamin from Jarvis has also updated his view following Arthur Hayes' doomsday piece. But Ben believes the markets didn't tank because of the Fed, as those news were priced in. Instead, we're just entering the next phase of the macro market cycle, and approaching an epic meltup (not so soon, though). Anyway, it's a major must-read and I'll keep talking about this view.

- Howard Marks from Oaktree wrote another memo (not a meme) about the importance of (not) selling out (and of hodling it). Again, a must-read, but remember he is talking about stock markets, not crypto.

- If this sounds exciting and you want to quit your day job to start working in crypto, check Vitto Rivabella guide to becoming a Web3 developer.

Tweet tip: it's also true.

Meme moment: it's also equities.

B21 App: easy and safe.

Get started: download the B21 Crypto app!