Retrance music

Cryptic ball: inflation hedge?

What a day! As mentioned Tuesday, the public was due new US inflation data today. It came out at 1h30pm UTC, showing a 0.6% increase since December and is a 7.5% year-on-year increase since last January. The media went wild as this was the highest read since 1982, but it was just 0.3% above analyst expectations. Bitcoin fell 2.5% in 5 minutes, which is a huge drop, further falling up to 4%.

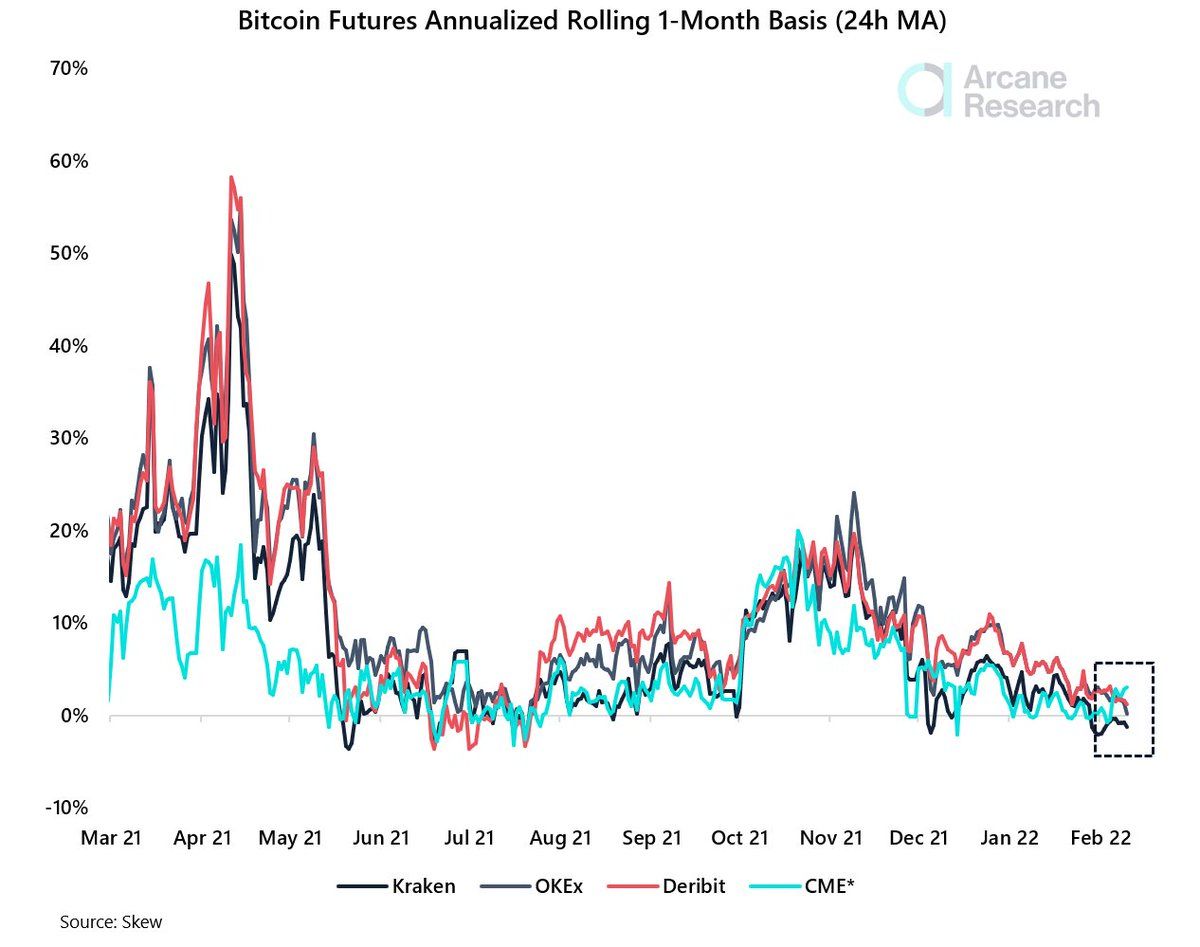

But bulls were well-rested and bought the dip within the hour, even printing a new yearly high at $45.6k! Why is this? Well, today's chart art comes from Vetle Lund, an analyst at Arcane Research, an outlet I like to follow, and visualises bitcoin's basis in futures markets. It shows us the difference between the price of a futures contract and the spot price on a rolling rate to avoid expiry discrepancies.

Overall, a rising basis with rising prices indicates strength in a market, as spot prices are leading and rising faster than futures - showing real demand. So it's interesting to see the CME futures basis is leading this rise, hinting that institutions are back accumulating corn. While this relationship can be damaged by arbitrage traders, it's at least worth considering - even if only for hopium. Fortunately, Vetle Lund argues there are real flows behind this move.

Chart art: institutions hedging?

Three things: hedge your risks.

- Shitc0in shares the ultimate micro-cap hunting thread, "outlining some useful tools to help filter through the noise to hopefully find those shitc0ins that can go 100x+". And that's all you need today.

Tweet tip: hedge your algos.

Meme moment: hedge your biases.

B21 App: safe and convenient.

Get started: download the B21 Crypto app!