At the beginning of January, take the bulls to fields of heather

Cryptic ball: the fear of alternatives.

Welcome to the last newsletter of the year. Bitcoin finally tested $45.5k in the first hours of this Thursday, UTC. However, we didn't get the extreme liquidations and negative funding that would be comforting to see before assuming a change in trend. Remember a high volume of liquidated longs happens once price moves against over-leveraged traders, who are forced to automatically close (sell) their positions. It is aligned with local bottoms as all the unintended selling takes place very fast, which turns funding rates negative on perpetual futures exchanges - incentivising traders and bots to buy to collect the funding fee that is paid, and disincentivising shorts which have to pay to bet that prices will fall more.

Without such an extreme move, it's more common to see a slow-bleed until sentiment changes. If the bleed is not that slow, sentiment won't change and bears will dominate the larger trend. If instead we remain trading sideways, then it's possible alts start pumping, reigniting animal spirits. But what can happen this weekend? I see two scenarios: on the one hand, as written yesterday, we can see BTC testing $42k, which would drag down the entire market; on the other hand, if Friday's $6B options expiry turns out to be uneventful, we can finally clear the FUD and have that bullish January without needing to inflict more pain.

I'm more inclined to the latter, as today's bounce would have been the perfect opportunity for bears to wreack havoc - and that did not happen. Moreover, it seems the options market is creating incentives for BTC to close the year around $48k. After that, it's all about waiting to see when the orange coin breaks upwards of $52k and then the whole market will be ready to pump. In the meantime, don't forget to read Cobie's latest post and reflect upon what the year ahead may bring us. Keep on learning and I'm sure we'll all gonna make it in 2022!

Chart art: the gravity of liquidations.

Three things: the appeal of predictions.

- Do Kwan talks about what will happen to crypto in 2022.

- Paul Veradittakit shares his 2022 Crypto Predictions.

- Finally, to end the year on a non-crypto note, check Sahil Bloom's 2021 year in review for a good curation of useful tips related to life and finance.

Tweet tip: the subtleness of parody.

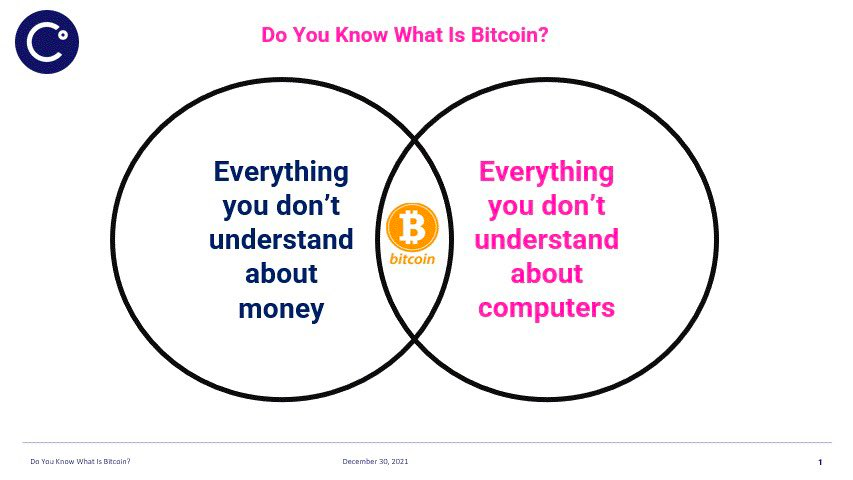

Meme moment: the honesty of comedy.

B21 App: get your bonus.

Get started: download the B21 Crypto app!