The dumpeeer

Cryptic ball: the analysooor.

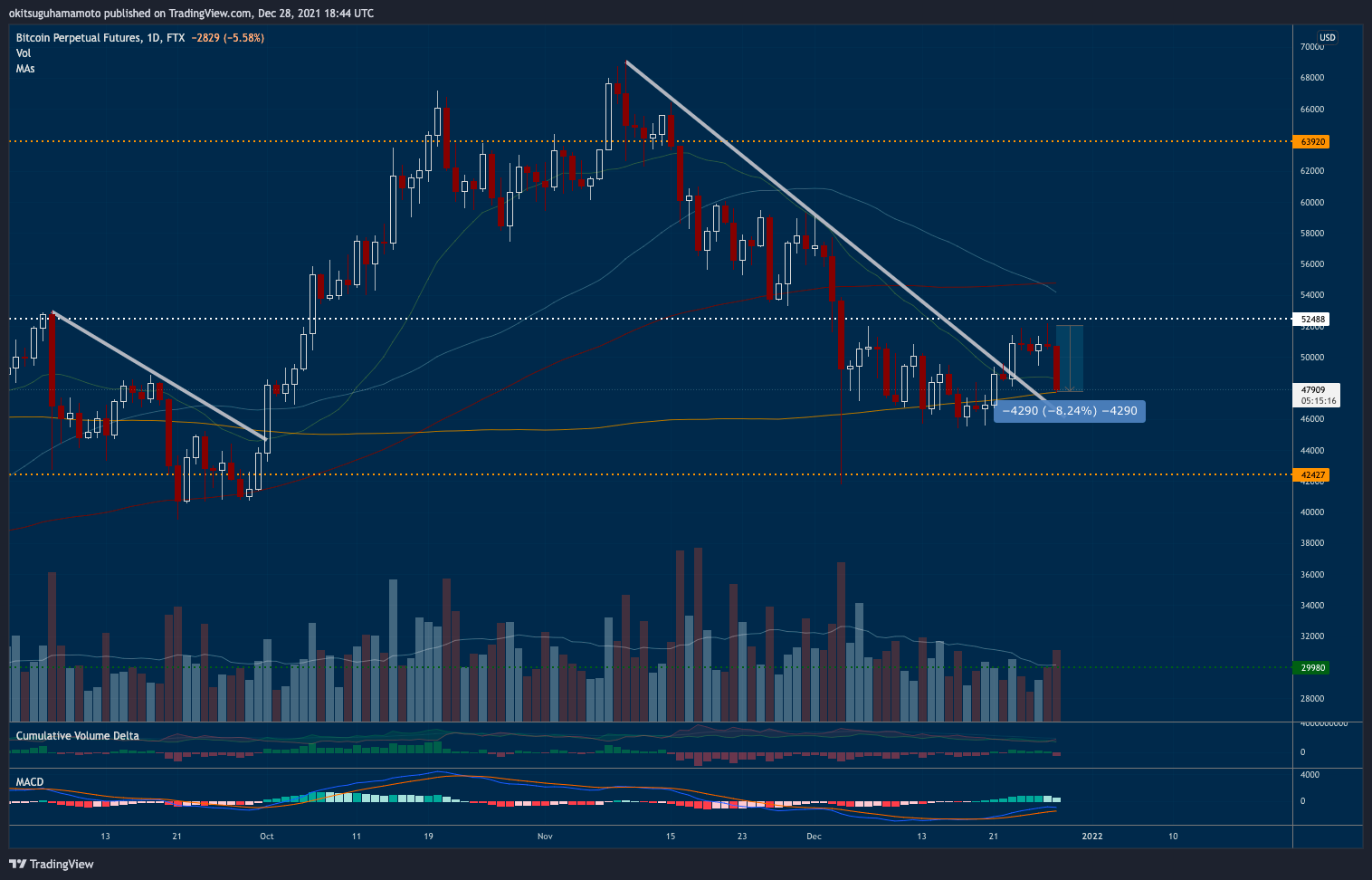

Well, well. It seems bears are attempting to get revenge from yesterday's not so innocuous subject line. Bitcoin and the total market dropped 8% since, prompting many in noisy Telegram groups and on Crypto Twitter to call for doom again. Is this all that the Christmas rally had to give? Or will we bounce without having to first test $45k a fourth time? As always, no one knows. But let's analyse.

To begin, the S&P 500 just hit a new all-time high and Nasdaq looks poised to do the same in the next days - even if 2021 will be the first year since 2016 where tech stocks outperformed America's top stonks index. There are also no potentially bearish events ahead in January, except for the Fed's FOMC meeting at the very end of the month. Secondly, we're still in a low liquidity environment, so it's normal for moves to be more extreme, even in absence of any particular trigger (liquidation cascades aside, which was what happened today).

So, unless you're a scalper, it will pay to be patient. While it's possible we see another test of $45k - which would drive fear to record levels, a little bit like on the fourth retest of $30k this summer - I remain convinced January will open with a nice bullish continuation. But this dip is surely hurting momentum, so the market will remain sideways for a while. What we need to get out of it? Well, the current SUSHI pump reminds me of how the DeFi summer of 2020 produced tales of profits that ignited the current bull market. Is it time for a warm DeFi winter?

Chart art: the raaaaaanger.

Three things: the substackeeeeer.

- Jon Stokes contrasts Web3 with Web2, or the old, adversarial web

- Arthur Hayes is back and argues how the crypto culture should evolve.

- Cobie doesn't stop and explains our scarce attention drives token prices.

Tweet tip: the multi-chaiiiiiiner.

Meme moment: the shooorter.

B21 Earn: easy staking.

Get started: download the B21 Crypto app!