Tragedy of the bears

Cryptic ball: think less about prices.

My short-term views haven't changed since yesterday. So until next Monday you'll have to bear this rant. As you may be aware, it seems the Turkish Lira is the only volatile and fairly cryptic currency these days aside from Terra's LUNA). It just bounced up to 60%, following an uncontrolled depreciation of more than 50% over the past couple of months! This highlights the importance of credible monetary policy to ensure rogue governments can't hurt people like this (and should also remind you that if an asset falls 50% and then rises 60% it's still down 20%).

Now, most Bitcoin maximalists would argue credible monetary policy is a fixed money supply, to completely guarantee no one can change it. But one of the most interesting changes in this crypto cycle is that more and more people understand the power of combining good, resilient governance with well-tested incentives to lead users away from acting in a selfish manner which could also hurt them in the long term - such as the infamous tragedy of the commons. It's not about the tech, but about the money - specifically, how we organise ourselves around money.

While everyone loves fixed supply assets (think real estate or Bitcoin), fixed money supply ends up hurting people as it transforms currency - something we invented to be widely used and moved around - into a speculative investment (a little bit like what happened with the original cryptocurrencies, which are now deemed cryptoassets). Because, in the long run, currencies tend to appreciate as the economy grows. So, global currencies would increase in value as long as everyone expected the world economy to continue on the rise (literally, to the moon).

This would compound the inequality problems that already exist, as the first adopters of a currency - especially those that could save a bit - would have a massive advantage compared to the new generations that would have access to less of it. A little bit like crypto newcomers barely holding even a fraction of BTC, whereas, before, most people in the space used to hold plenty of orange coins. Moreover, as an author I used to follow in the past bear market once explained, in such a fixed supply monetary system "anyone’s increase in savings comes at the expense of someone else". And I hope you understand how that's bad.

But why did I write all this? For once, to give you something else to think about apart from prices and trades. But also to show how the Austrian narrative which dominated crypto market cycles (have you heard about the Bitcoin Standard book?) is finally falling out of favour. And while I'm not yet sure I buy that Bitcoin itself will be flippened by a particular alt, it's clear that it's also losing combined dominance and we may need to consider watching out for a market top in 2022 where BTC doesn't blow off around $100k. Supercycle or not, here we go!

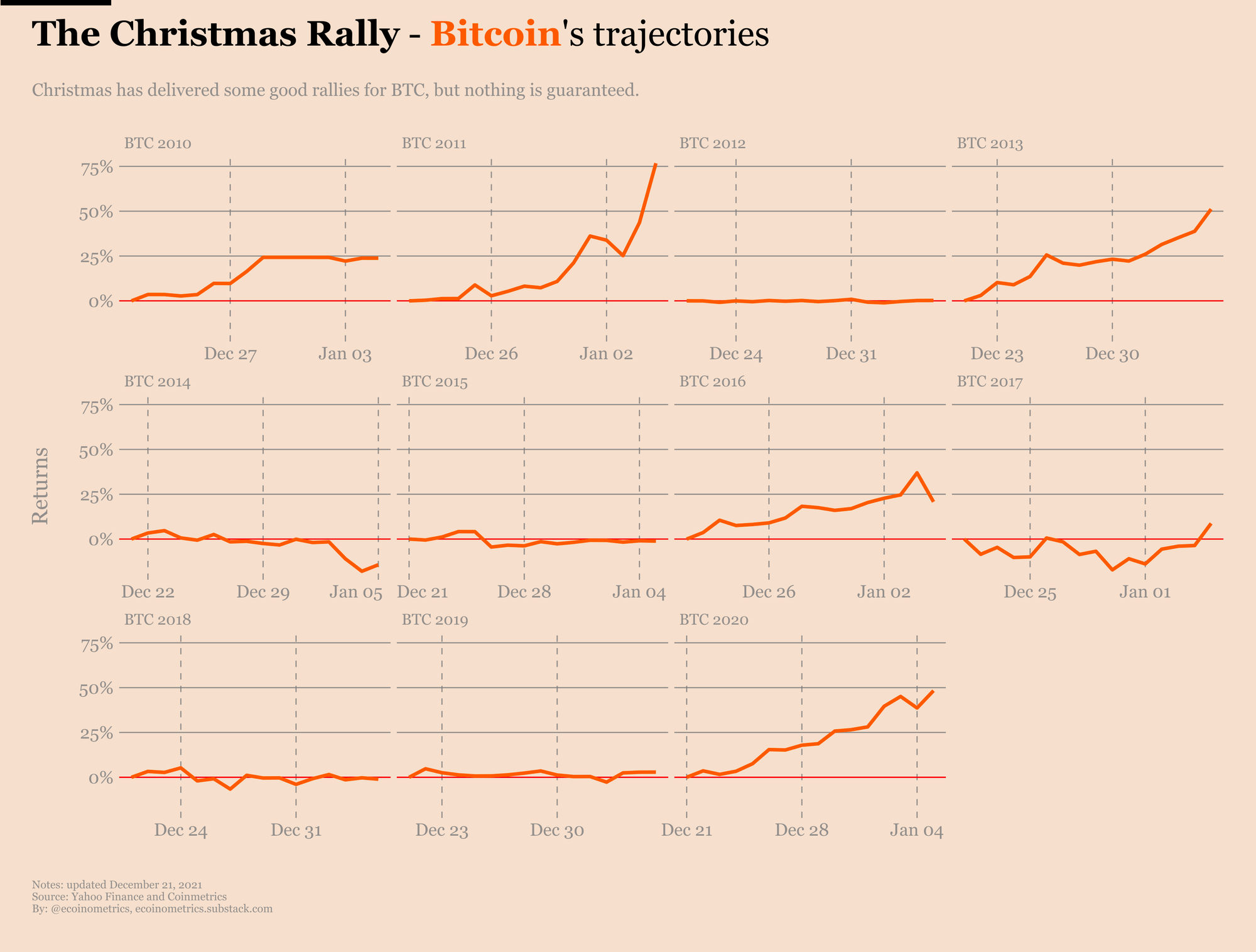

Chart art: think more about short squeezes.

Three things: think less about the power of three.

- Think critically about Axie Infinity's potential.

- Think nostalgically about this year's critical crypto moments.

- Think visually about 2021's "state of the network(s)".

- Think optimistically about what might happen in 2022.

- And just think about what makes crypto really revolutionary.

Tweet tip: think more about good curation.

Meme moment: think less about more.

B21 Card: think more about profits.

Get started: think less about the desktop.