Inflated expectations, part II

Cryptic ball: because Christmas is red.

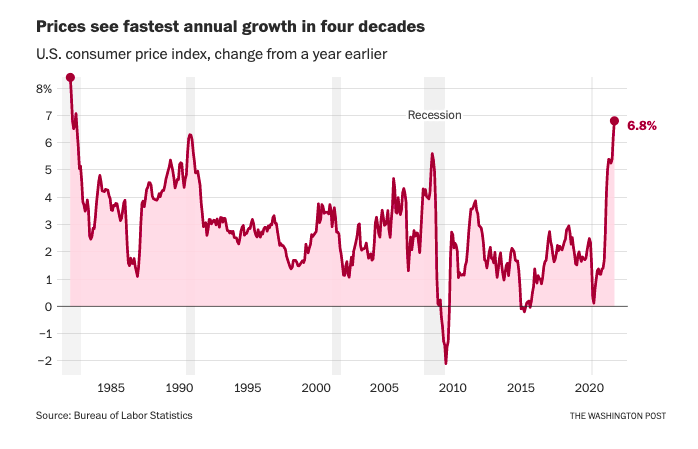

The latest US CPI data was released today and November's prices are 6.8% higher than last year (and 0.8% higher than in October). That's the highest YoY rise in 39-years - a combination of very low inflation one year ago, pandemic-induced supply-chain shortages, and the "money printer going brrr".

However, that value was still lower than the market expected, so crypto and stonks started the day with a small pump. Unfortunately, while equities remain near their ATH, bitcoin and alts experienced a failed breakout, as BTC's test of $50k was rejected despite the low volume. In other words, the weekend doesn't look good.

The orange coin has dropped below Wednesday's higher low, at $48k, and is now standing right in the middle of the range formed by last Saturday's dump. And, as fear increases, it's possible the profit taking needed to sustain the holidays season ahead may put it in the same kind of doldrums experienced last May to July.

Now, what should you look out for in the next days? If the $46k support fails, expect a test of $42k. That isn't likely to fail, but if bulls don't wake up, then the next months are going to be bad. Anyway, that's just so that you can prepare for the worse, as I still believe we'll continue trading sideways for some weeks - especially as mean reversion traders start buying the dip with confidence.

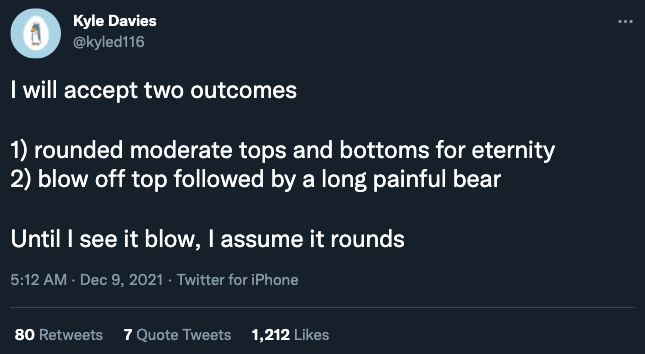

Zooming out, check today's tweet tip regarding the multicycle hypothesis and how tops and bottoms inform us whether we're living in that world or not. And let's hope inflation has indeed calm down, as the Fed would surely be less aggressive with its monetary tightening programs if inflation is perceived as being under control - which would prop up the stock and crypto markets alike.

Chart art: because inflation is here.

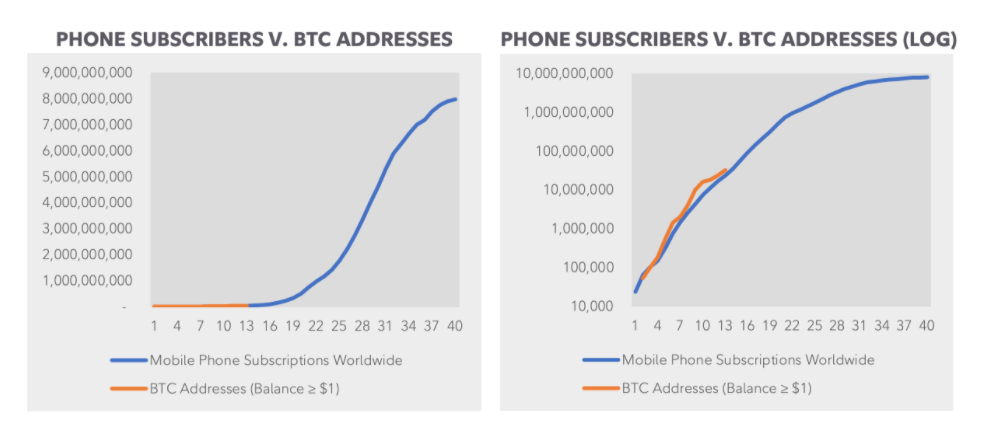

Visual block: because we're still early.

Three things: because they are magic beans.

- Sarah Du asked "50 people why they're interested in web3".

- Venkatesh Rao asks "what is the best mental model for NFTs"?

- Ryan Sean Adams wonders "how to value DeFi tokens"?

Tweet tip: because we didn't have 2) yet.

Meme moment: because alts are all correlated.

FV Bank: meet us at CoinAgenda.

Get started: download the B21 Crypto app!