Safe newsletter

Email eagerness: add us as a contact.

Cryptic ball: safe sub-title.

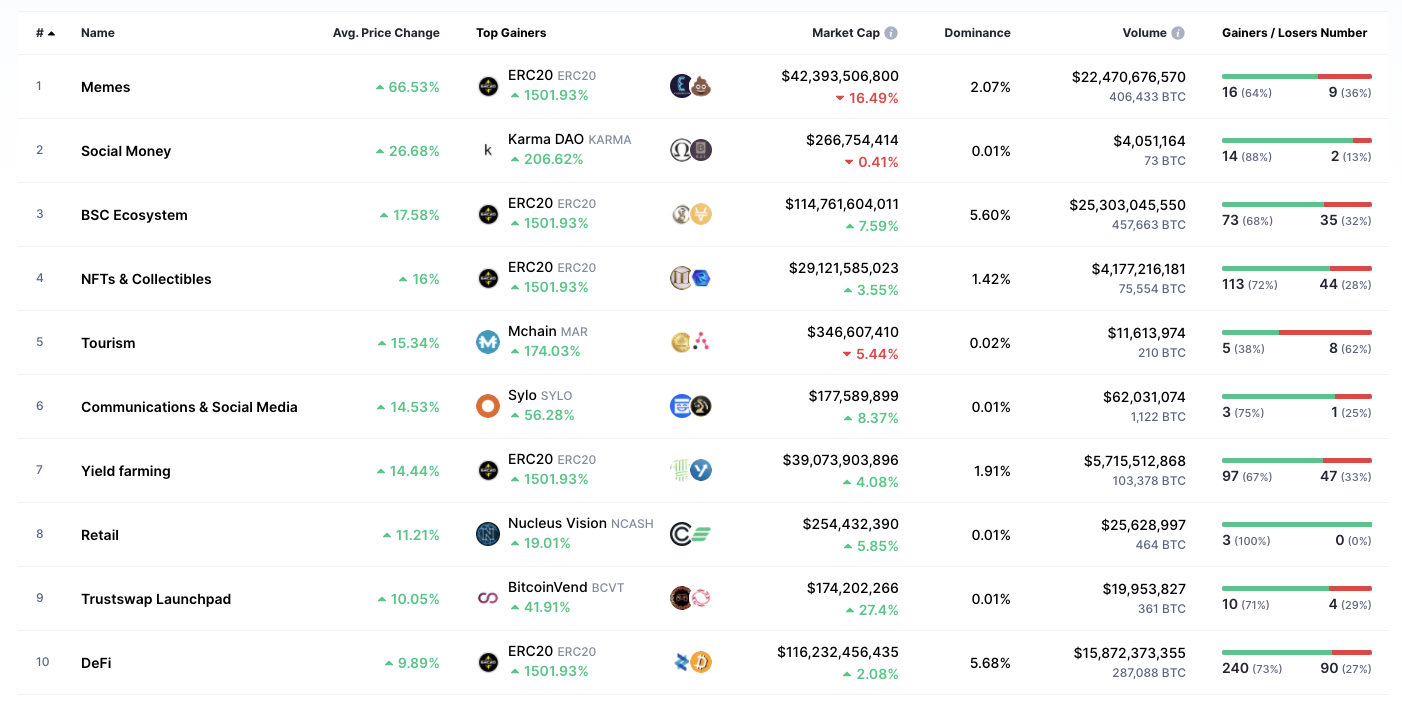

Another motionless day in the crypto markets - if we look at the average of all tokens, that is. Because even though total market cap remains still, a bit above the $2 trillion mark, this is alt season. As explained yesterday, even in boring times there are alternative cryptoassets pumping left and right. And today, with ether jumping 8%, many alts felt the need to surge too. While many hard-working projects are included in this pump, meme projects jumped 66% over the past day!

However, doge hasn't joined the price increase, even if not dumping can already be considered remarkable, given its recent exponential growth. But what does all this bode for trading? Well, overall it's good. It could mean last weekend's crash was all bears had to offer. However, it's bad that the market is rising due to meme coins feeling the awe of age-old pump and dump schemes. But, if you're profiting from them, that's not so bad! Remember to take profits as they can quickly evaporate. If you're not in them, it's all about due diligence and risk management - so be careful.

Chart art: this July ETH has London.

Market musings: trade your emotions away.

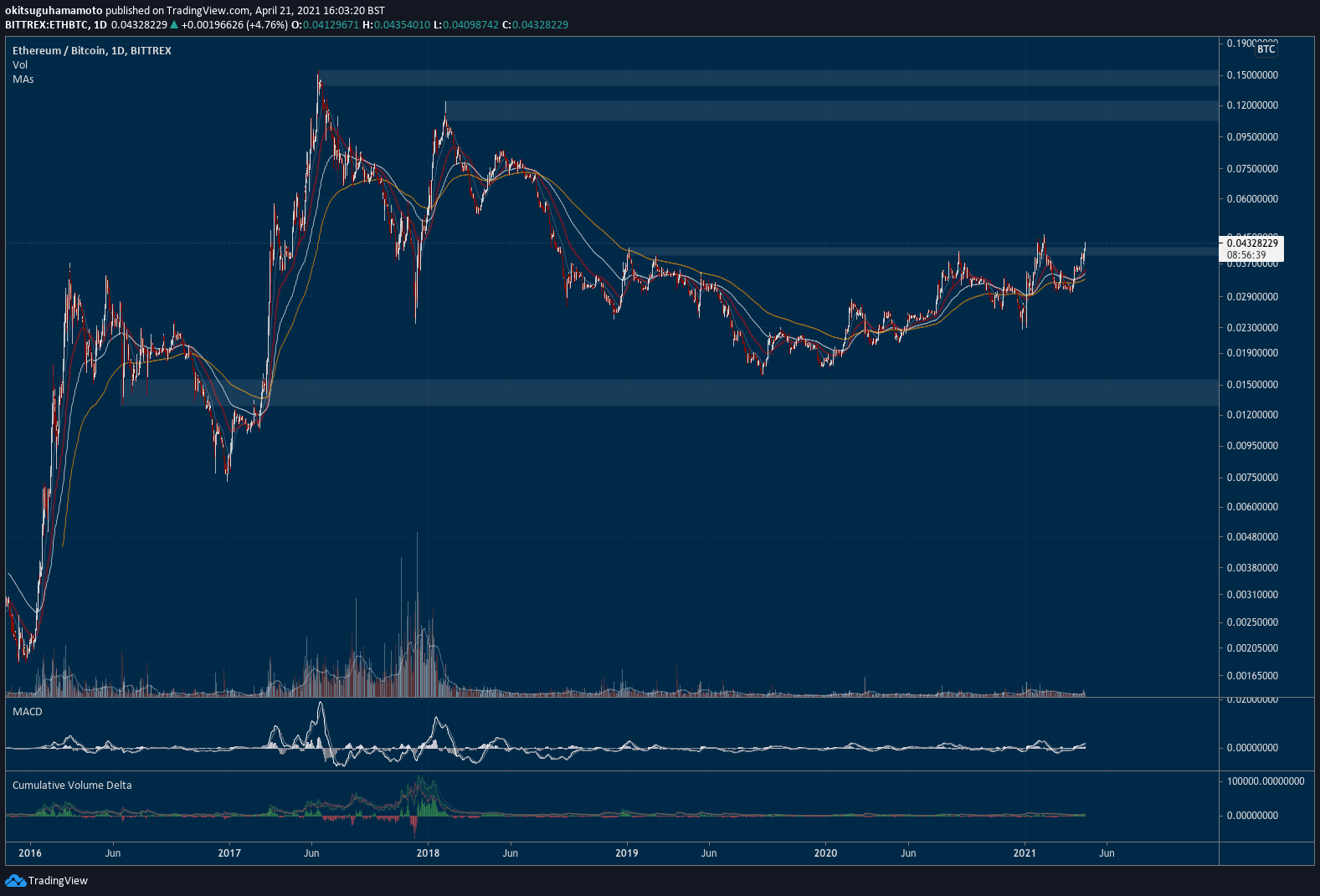

Okay, B21. Enough of this abstract conversation regarding planning one's trading and investment activities. We want to know what's going to happen in the near-future! It would be nice of we knew. But, as no one does, we can provide some scenarios to help you navigate these stale waters. Firstly, go back to the ETH/BTC chart we've talked about last week to analyse the path of this alt season.

Right now, ETH has just broke upwards of its historical support against BTC. If that breach is confirmed over the next days, we can expect alts to continue blooming over the next weeks. Alternatively, the ETH/BTC pair can remain at that level for a while if both ether and bitcoin fall at the same time. So, secondly, look out for more FUD-inducing pieces of news (remember FUD stands for fear, uncertainty, and doubt) that could wreck further havoc in the crypto market.

Lastly, if ether fails to break upwards, even in the absence of FUD, then this would be seen as a sign of exhaustion of the current trend. And, if funding rates remain high with low trading volume - which can be considered a proxy for generalised market interest in an asset at a given price level - then there are enough incentives for large market players to short the leading cryptoassets again. Which could then further scare everyone else who forgot to take profits on their 100x gains.

Visual block: it's all about memes now.

Three things: why even work?

- Do you work in traditional finance? The Block is organising a webinar around how banks can embrace digital assets tomorrow. Register here.

- Do you work in cryptoasset mining? Anicca Research released Part II of their great "The Intelligent Bitcoin Miner" series.

- Do you even work? Show us proof! Or at least get to know Bitcoin's consensus algorithm, aptly named Proof of Work. Did you know this fundamental piece of the original blockchain wasn't created by Satoshi, but by Adam Back? Learn all about it from Adam Back himself in today's episode of The Investor's Podcast.

Meme moment: ready or not, here it dumps.

Get started: download the B21 Crypto app!