McDoNFT

Cryptic ball: the trend is your friend, until it isn't.

As argued yesterday, the crypto market remains healthy and today's generalised pump supports our view. But with bitcoin closing March in the green, the six consecutive month for the first time since 2012, it is never the moment to lower one's guards. But, as often explained here, bitcoin can cool off while alts continue to spring. Just take a look at today's Chart art section to see how can that happen.

Moreover, note that the average bitcoin volatility in April is 99% (note this this value can be higher than 100%) and historically it's the most volatile month. And, after November, it's also the month with the highest average returns. However, you know the drill: "past performance is not indicative of future results". And this year we tend to agree. Even if bitcoin bulls prove us wrong and we're short BTC and long alts, we'll surely ride a spectacular trip to the moon. You may be asking yourselves what if bears drag everything down.

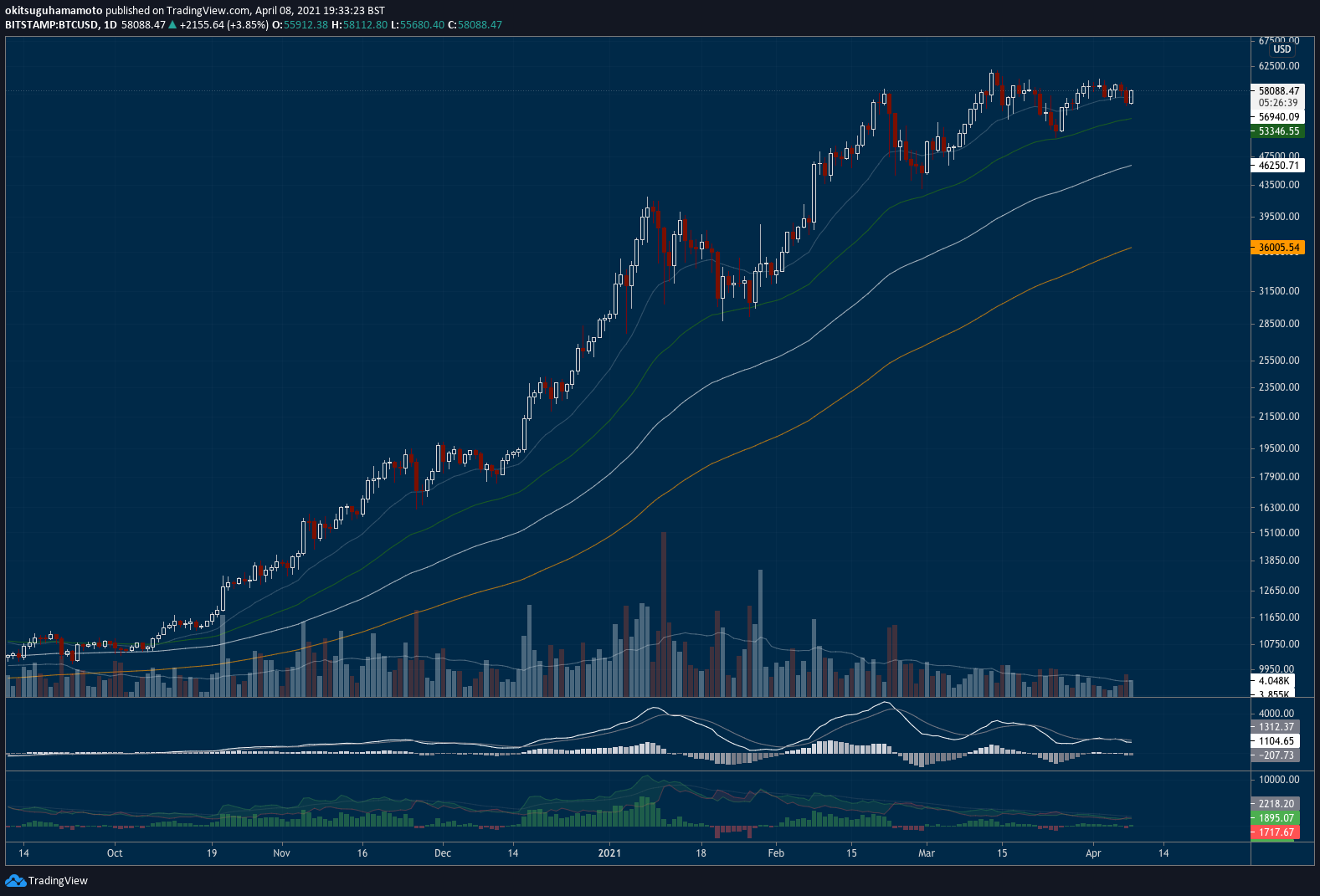

Well, that's why stop losses exist! Jokes apart, manage your risk, educate yourself about the difference between trading and investing, and note that as long as bitcoin doesn't dramatically close a daily candle below the 50-day moving average, marked in green in the chart below, we should be able to sleep peacefully. Sit tight!

Chart art: a technical Thursday.

Market musings: it's not all about profit.

Non-Fungible Tokens are the talk of the day (but what the hell are they). First it was Saturday Night Live selling the parody sketch they made about this topic as an NFT itself for roughly $365k. Then it was Sotheby's further dipping into the space announcing a new digital art collection, after last March's record auction of a collage done by Beeple, a renowned artist, for $69 million, which was sold as an NFT. Now it's Playboy announcing it will sell "artwork" as NFTs! Well, at least the company behind the iconic bunny also declared they will "support emerging and underrepresented artists entering the NFT art community".

Alas, even McDonald's France was lifting the veil on what could be a nifty line of pixelated burgers and sundaes! Well, after all that's the nice thing about this emergent asset class - its hype is driven by price (and note these hyped artworks won't necessarily fetch the same high prices once they are resold), but NFTs represent a shot at democratising art investment, which could improve the funding of creative pursuits. Even if the NFT community is currently quite exclusive, that will surely change. It shouldn't be all about decentralising finance, right?

Visual block: let it bloom, berg.

Three things: inform your bull self.

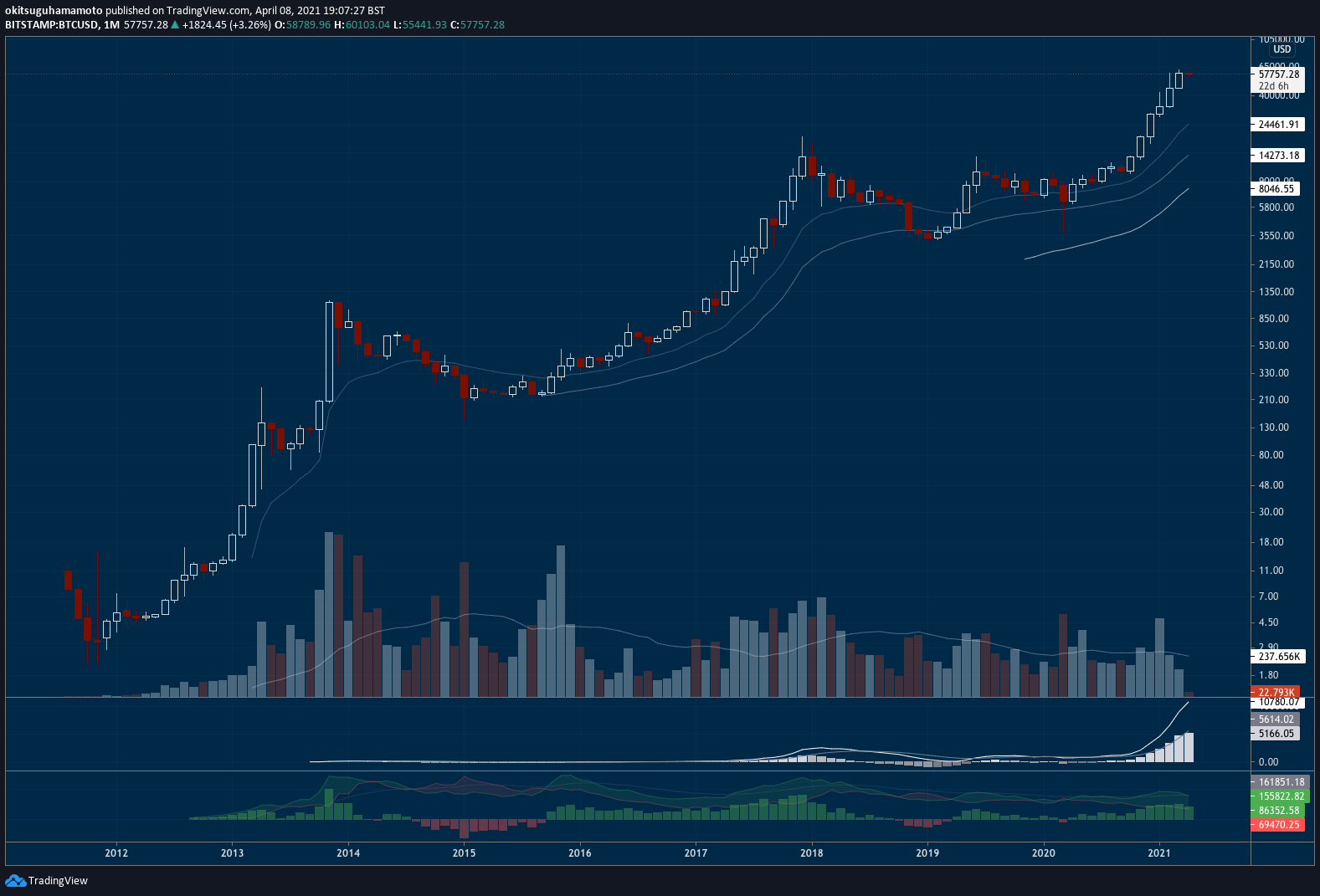

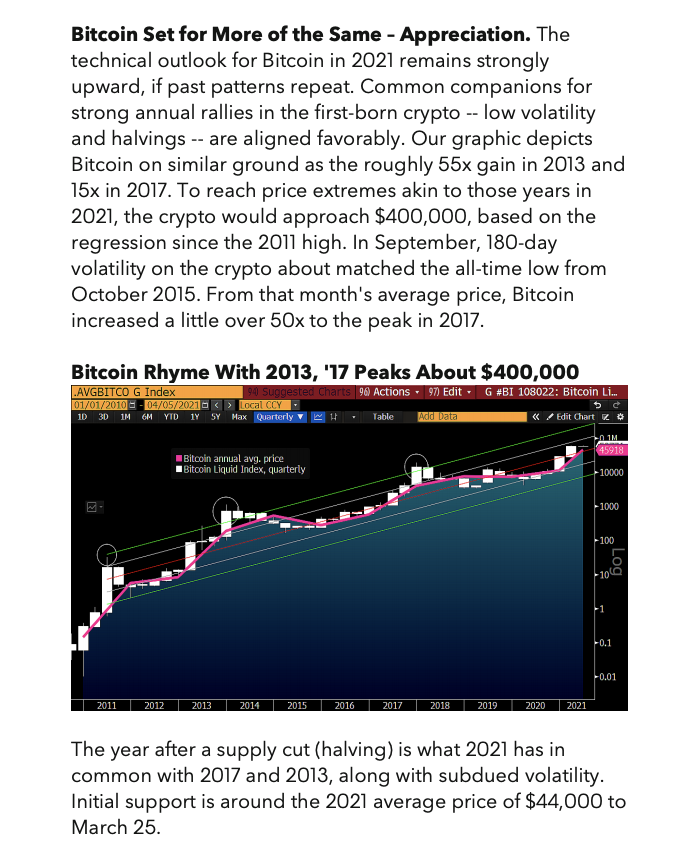

- Bloomberg's Crypto Outlooks are a must. And they just updated their 2021 edition this April.

- Kraken Intelligence’s monthly "Market Recap & Outlook Report" are a must. And their March issue was just published.

- ByteTree's Charlie Morries' blog posts are a must. He just shared why gold doesn't need to lose for bitcoin to win!

Meme moment: not all times are easy like these.

Get started: download the B21 Crypto app!