Let the Coinrace begin

Cryptic ball: manage exuberance, long fear.

The current alt season is much different than the previous ones. Whereas before one could expect a smooth ride up, since 2017, crypto futures markets have allowed bears to easily bet against bulls - helping smooth out the most popular pumps. That's why the total market cap has stalled a little after hitting $2 trillion yesterday, with bitcoin and ether dipping and testing important levels today.

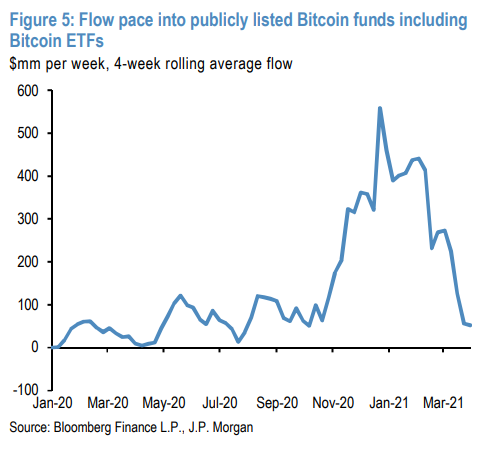

While some traders are getting scared due to a potential double top - a bearish technical setup that's compounded by data indicating that institutional buying of publicly-listed Bitcoin funds has diminished this March - we believe they are missing two critical things. Firstly, funding rates for leverage trading of BTC and ETH were (and still are) too high, which created incentives for traders to short BTC and ETH and liquidate reckless longs on the futures market.

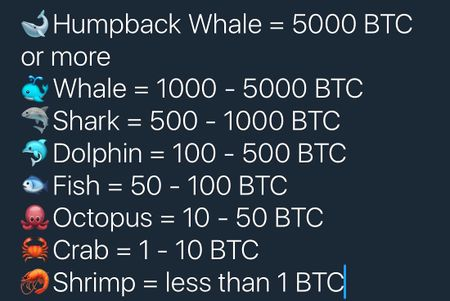

Secondly, the past months' bull run has created enormous wealth among crypto whales, sharks, and shrimps alike - categories detailed below. These people have deep knowledge of the cryptoasset market and technology and have been pouring gains into random alts on decentralised exchanges for a long time - trying to emulate the early access game typically played by experienced VCs.

You can't easily short these alternative tokens and while the top alts tend to follow and compound the direction of BTC or ETH's daily swings, like ADA just did, these obscure projects just keep booming as there are no easy ways to short them. So, it's normal to see a fall in BTC and even ETH. As long as they don't break key levels - in our view that would be $50k for BTC and $1.5k for ETH - then we'll be able to watch highly speculative manipulation of nascent alternative projects.

Still, note this part of the run will likely only last some months, and we'll see massive drops soon - hopefully before one last pump in the end of the year.

Chart art: first comes institutional love.

Market musings: then comes retail.

In addition to low-cap alternative tokens, another sector benefited from a nice pump over the past 24 hours: exchange tokens. We've been talking about the Coinbase IPO since the beginning of this newsletter, and the hype around the popular trading platform is lifting all the spirits of all other exchanges.

That's due to the financials behind the public listing, which provide an indicative benchmark for other traders to value their favourite trading platforms. If the current market cap of such a project is below the benchmark, then traders can expect a price appreciation, and vice versa. Naturally, all these valuations are too damn high, given the current bubble. But it's time to enjoy the ride!

Visual block: the food blockchain.

Three things: it's all about FUD and FOMO.

- Many criticise the environmental impact of Bitcoin. Learn why its impact isn't harmful with Coinshares.

- Many don't know how to safely store their cryptoassets. Learn more about the alternatives with Dan Held.

- Many believe a crypto ban in India is inevitable. Learn why that's not necessary with Ashok Rana.

Meme moment: for whom the bell tolls.

Tweet tip: sustain and justify.

Get started: download the B21 Crypto app!