Don't sell this news

Cryptic ball: they grant legitimacy.

We're halfway through Uptober and sentiment couldn't be more bullish. Bloomberg is listing ProShares ETF in its popular terminal, which almost always indicates the US SEC has tacitly approved the first Bitcoin ETF, as explained here Wednesday. The magazine is also quoting insiders who claim the ETF will be launched Monday. While there are rumours a second one was also approved, those are just a product of confusion. What was approved was its subsequent listing by Nasdaq, but only after the SEC blesses it (which can also happen next week).

Nevertheless, things look great. Whereas earlier in the year I was of the opinion that an ETF approval would mark the year's top, now the situation is different. Such scenario would only be applicable if the ETF was approved later in the cycle, at a time when everyone is euphoric. Currently, it feels most people are in disbelief while the rally is just starting, with bitcoin finally trading above the key $60k resistance. And, so far, the orange coin is moving towards $65k at a parabolic rate!

Coincidence or not, last year's break of $12k, a key level back then, also took place in mid-October. And what happened next is history. Now, all eyes are on two things: the weekly close and alts! As for Sunday, we believe it's very likely bitcoin will be testing the current all-time high of $65k, and hopefully breaking it on Monday. As for alts, so far ETH and company are behaving nicely, which aligns with the 'sustainable pump' scenario explained yesterday. Let's see if that holds.

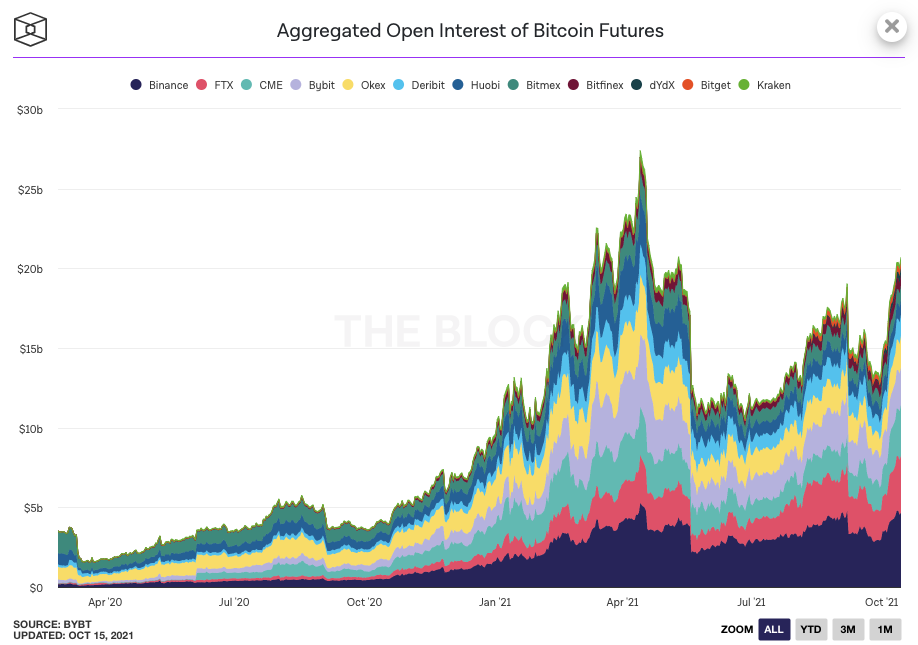

Lastly, it's time for the usual volatility reminder. Remember bitcoin can crash hard when it seems it's going up only. Things will get wild, especially if open interest - a sign of leverage - keeps rising. Note also that both Tesla and Microstrategy are currently sitting in a 2x return on their bitcoin investment, and this will also attract shorters (not now, but their manipulation will start sooner rather than later). All-in-all, enjoy the weekend and don't leave money on the table!

Chart art: don't forgetf.

Three things: moonvember is coming.

- Not even USDT FUD is stopping BTC today. The stablecoin was fined $41m by CFTC today, while also settling charges with this regulator.

- Not even regulation is stopping BTC today. Coinbase shared its "Digital Asset Policy Proposal", and you can comment it on Github!

- Not even other stablecoin's FUD is stopping BTC today. Jump Capital believes the stablecoin market can become a multi-trillion dollar one.

Tweet tip: followed by bullcember.

Meme moment: then january and bearuary.

B21 Staking: happy Dussehra!

Get started: download the B21 Crypto app!