Drag racing

Cryptic ball: beauty queens.

Bitcoin remains range-bound between $56k and $57k, but its lack of strength continues to be a negative influence to all alts, including ether - which is about to lose support at $3.4k, with the next target in the downtrend at $3k. Total market cap is also down a couple of percentage points, with few coins escaping the gravity (again, FTM is on a roll). But worry not, this is what was expected, right?

To build on yesterday's explainer, note that it's not only the case that alts go down when BTC appreciates in this phase of the cycle. But alts will also go down further if BTC falls a bit. But I don't expect it to fall much right now. As written last week, it's good that the orange coin consolidating below $60k, a tough resistance to break. Because it signals that any profit-taking is being absorbed.

That's important because, right now, most traders are expecting a dump across the board so they can buy back lower. They are assuming the average trader is underwater after having entered the market late, around the end of summer. But they are missing the average trader is spot long, and so there are not many positions to be liquidated in the futures market to fuel such a capitulation.

But these aren't the participants with the most money. As markets work like a Keynesian beauty contest, the more sophisticated traders - who think about what the majority thinks the majority are thinking, and so on - are likely anticipating this. And are buying what those taking profit right now are selling. In other words, they are accumulating. That's why bitcoin is flagging while alts are dragging.

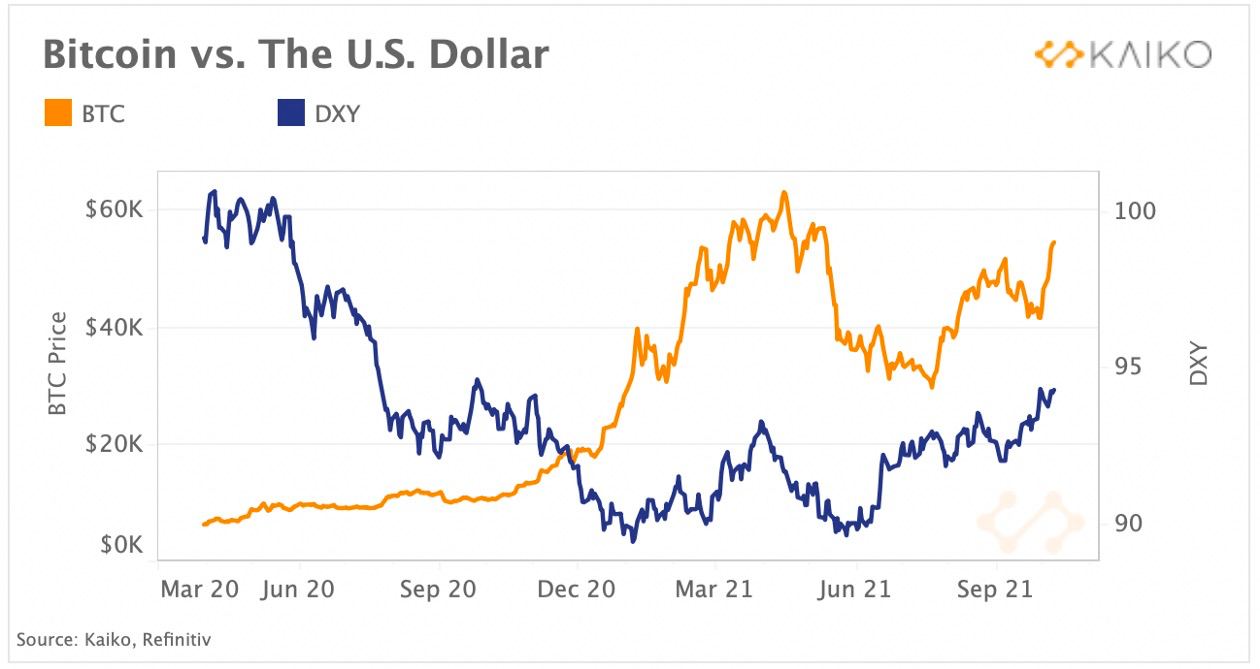

Chart art: dollar kings.

Three things: metaverse lords.

- Bill Miller is a legendary value investor, early on Amazon and Bitcoin. Hear his remarks on the potential of cryptoasset exchanges and BTC.

- Edward Snowden requires no introduction. Hear why the privacy advocate believes "Central Banks Digital Currencies will ransom our future".

- Benedict Evans is a long-time popular tech analyst. Hear his sharp and funny take on "the buzzword of the moment, the metaverse!".

Tweet tip: long-term gods.

Meme moment: hodl fairies.

B21 TV: The Desi Crypto Show.

Get started: download the B21 Crypto app!