To the stars

Cryptic ball: ad astra, per aspera.

Topkek, right? What a nice dip! If you learn one thing in this market, it should be that crypto is all about these "small" hardships and you need to know how to navigate them if you want to enjoy the massive gains this space provides - as Kyle Davis, a trader who literally handles billions every day, notes with this popular Latin saying. Now, I hope you noted yesterday's newsletter, where I remarked the next days were going to be hard, and how one should distance themselves from short-term price action, unless one was actively trading.

So, let's continue to zoom out to analyse the larger trend and see what may lie ahead. To begin, Crypto Twitter and some amateur crypto-traders, heavily focused on textbook technical analysis, continue to argue the charts look awful and we'll continue going down. In theory, that makes sense, especially with some anticipated Thanksgiving selling (to buy gifts) over the next weeks. But they seem to forget that cryptoassets tends to reverse suddenly and, more importantly, whale sentiment remains solidly bullish - which is aligned with the strong buying bitcoin saw at $58.7k, right where its key 50-day moving average was.

Moreover, I believe this dip wasn't aggressive enough to change those feelings. While we can't trust the big funds when they say they aren't selling (yet), because they would need some exit liquidity when that time comes, it's also the case that smaller, historically successful investors, as well as top industry analysts, all agree that this 5% to 10% dip across the board is quite normal. Furthermore, we must remember aggressive dips tend to hurt a bullish trend when they liquidate leverage traders. But we didn't have significant liquidations (above what we saw in the past two months) or even aggressive funding rate changes over the last day.

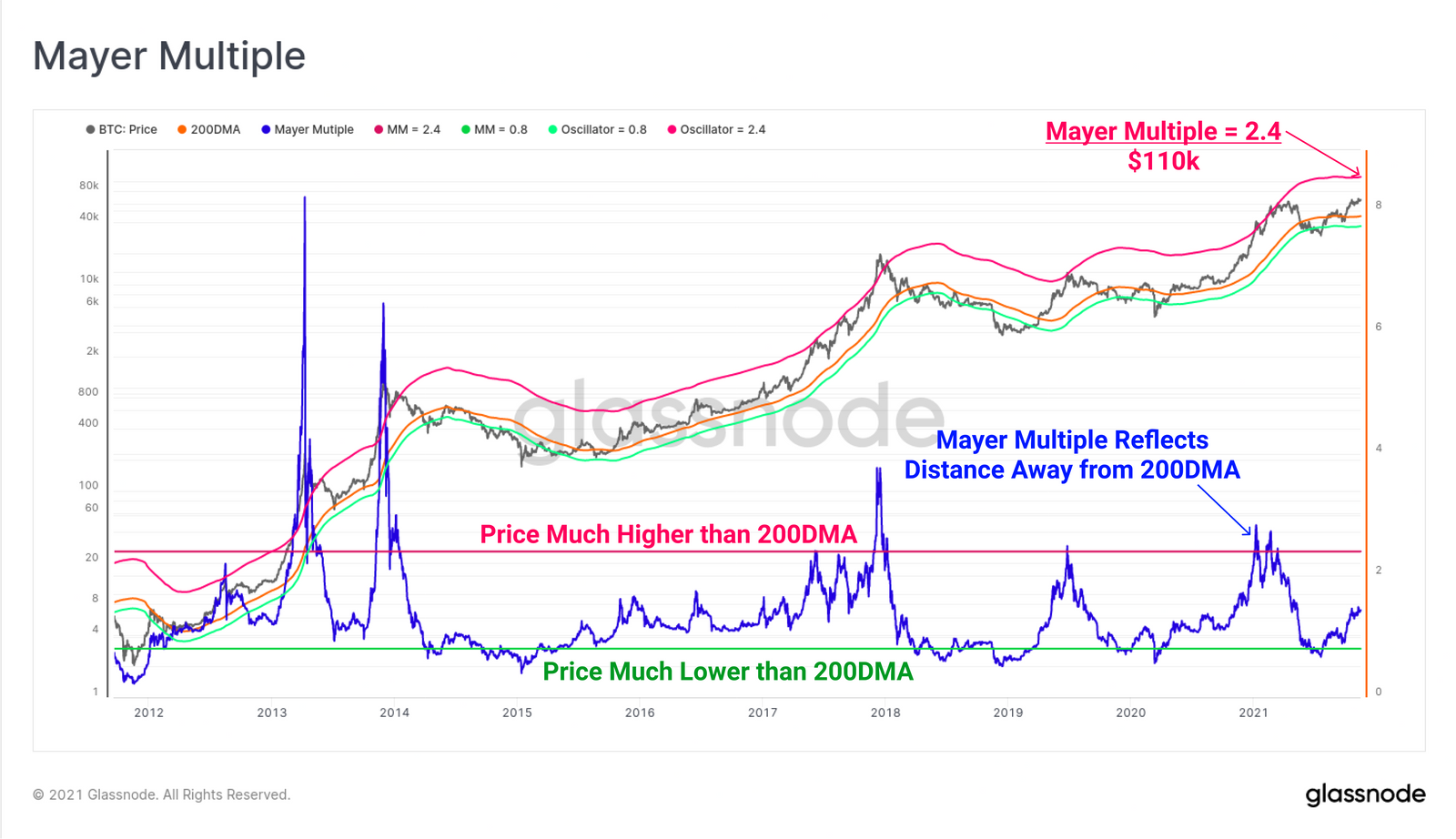

This means the pullback was driven by spot selling and that most futures traders weren't that overleveraged, or else the liquidations cascade would have been dramatic. Still, it seems funding has now reset so the next days may be rather boring, as long as BTC doesn't fall below $58k. That would mean we're indeed experiencing a dead cat bounce, but I'm assigning a low probability to it as the market is clearly not overheated and the flush below $60k was solid. Still, if you need some hopium check the charts below. Just be prepared for the risk of catching a falling knife if buy the dip - so phase your entries if you can't resist the early Black Friday preview, and make sure you have a plan!

Chart art: zooming out.

Three things: alea jacta est.

- If you were one of the few liquidated today, then you must read Joe McCann's advice on "how not to blow up trading crypto with leverage".

- If you are confused about all the bullshit around inflation, then you must read Dan Morehead's latest letter to Pantera's investors. Very bullish.

- If you don't understand how some VCs are pouring money into $100M seed rounds, post-money, then you must read Fred Wilson's analysis on how the VC world has gone mad. Very aligned with Pantera's letter.

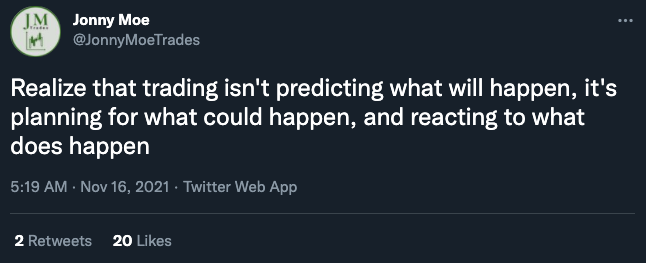

Tweet tip: time to react.

Meme moment: again, don't focus on prices.

B21 Card: three more countries.

Get started: download the B21 Crypto app!