The big bounce that failed

Cryptic ball: a sign of humility.

This Monday I told you I fell the stock market would be calm this week. Boy, was I wrong. At least I wrote this didn't fell like a bottom, that was on point as all US stock indexes dropped like a rock today. What happened?

- The S&P 500 lost 4%, experiencing the worse intraday fall since June 2020. The Nasdaq fell roughly 5%, but the tech-heavy index had experienced a worse crash this May 5th. The shares of Target, a major retailer, dropped 25%!

- That's the kind of dump experienced only by shitcoins, right? And all this because the retailer's profits were hurt. And this reminded investors that the fear of an inflation-driven recession is a real - a natural concern.

- Now, I'm expecting the stock market to continue the carnage this Wednesday and test last Friday's yearly lows. Curiously, even though bitcoin also descended to around $28.5k, the original cryptoasset has been resilient.

- However, I'm not very confident bitcoin can resist much more in case macro bears do continue this attack - which is likely. On the bright side, as today's tweet tip shows, it also seems likely we're fast approaching a bottom.

All-in-all, even if there's not the risk of a fast crash in crypto now, this is a typical slow bleed - so watch out! And if life fxeels bad right now, remember that Mike Novogratz doesn't regret the Luna tattoo he did this January - saying instead that it is a "constant reminder that venture investing requires humility". LMAO!

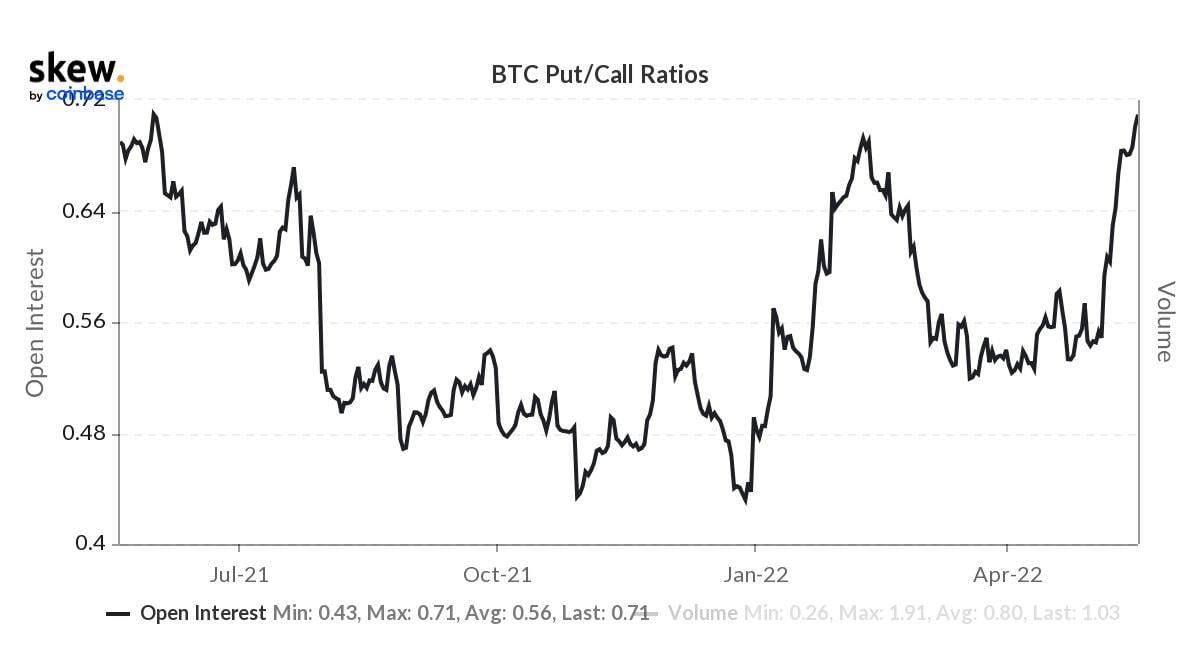

Chart art: a sign of bearishness.

Three things: a sign of wisdom.

- Chris Ollari explains "why lower liquidity creates increased volatility".

- Vitalik Buterin explores some of his blockchain contradictions.

- Avi Felman discusses how the reflexivity of crypto works both ways.

Tweet tip: a sign of potential capitulation.

Meme moment: a sign of genius.

Yug Network: a sign of the future.

Get started: download the B21 Crypto app!