Monday blues

Cryptic ball: just a Monday in May.

As expected, the weekend was peaceful. Bitcoin even tested $31.5k this Sunday! Unfortunately for bulls, it's back around $29.5k after US stocks started the week in the red. So far, things look stable, but what's the outlook for the week ahead?

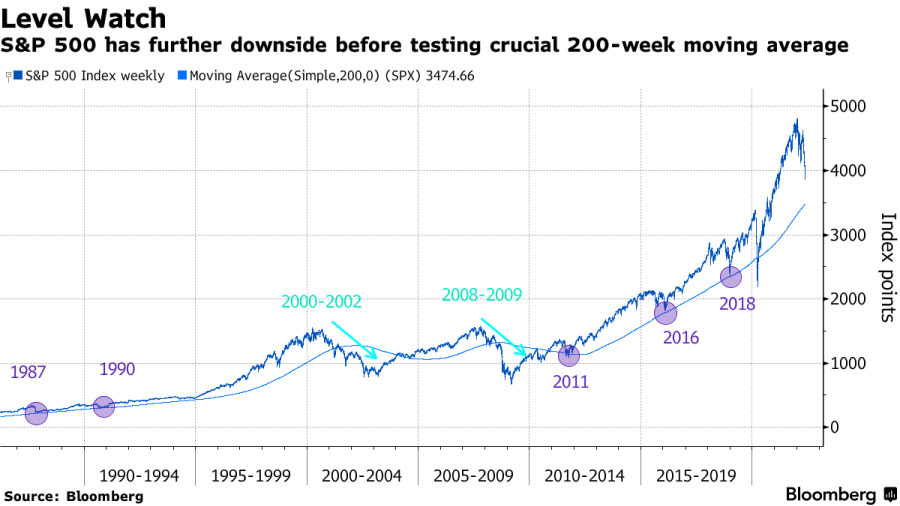

- US stocks have been losing value for the past five weeks. While this doesn't look like a bottom (for stocks), it's likely we have some peace after such a prolonged carnage - especially as there's no major US data set released over the next days.

- However, Jerome Powell is speaking this Tuesday at a WSJ conference around 6pm UTC, so we can expect some fireworks as traders try to interpret what the chair of the US Federal Reserve really wants to do to tame inflation.

- Apart from that, there's no anticipated risk event this week. So, with crypto in recovery mode after last Monday's UST implosion, I'm expecting all markets to be fairly boring, at least until June's FOMC meeting shows up on the radar.

- Even then, it's clear what will be announced in the meeting until September: 0.5% interest rate hikes. As Alex Krüger argues, this creates the conditions for the markets to range over summer - in absence of any policy changes, that is.

In the meantime, Do Kwan has announced "the community's" revival plan for Terra. It's possible this gains some steam as there's an airdrop and a new chain, but if you want to speculate on it you must know what you're doing!

Chart art: just an average dip.

Three things: just some block space.

- Ciarán Murray discusses Bloomberg's interview with Galois Capital.

- Punk 6529 discusses bear markets and how he has survived since 2013.

- Chris Dixon discusses why blockspace is the best product of the 2020s.

Tweet tip: just some bad trading.

Meme moment: just another rug pull.

FV Bank: new user interface.

Get started: download the B21 Crypto app!