Calm weather in June sets the bitcorn in tune

Cryptic ball: choppy waters make stronger traders.

Bitcoin is trying to break out of the meme pennant we described this Monday, albeit, as you can see below, not in the strongest way. Still, it has so far successfully tested its previous resistance as support, a positive behaviour. But it needs to confidently pump more in the next days to entice the bulls - especially with the weekend volatility likely ahead. Still, if it fails to do that and falls below again that's not necessarily bad, as things will be fine as long as we remain trading sideways.

Keep an eye on the historical support level between $33k and $35k, though, as clearly many traders have placed their stop losses there, which incentivises larger players to hunt them by aggressively selling at higher levels, which eventually drives the price down until they are able to fill fresh buy orders at a great new price. Lastly, even if we're confident we'll continue bouncing for a while, the first real test will be around $42k - the level which began the liquidations cascade on May 19th. If bitcoin recovers it then it's party time. If not, prepare for more chop!

Chart art: we told you the triangle was a meme, but it works.

Market musings: a meme swarm in June is worth a silver spoon.

Zooming out, the total market has also appreciated 2.8% over the past day, with some popular alts, from Solana's SOL to Algorand's ALGO and Filecoin's FIL, jumping 15% to 25%. Not bad for what some are calling a bear market, right? However, the rest of the world is showing worrying signs. The meme stock craze is back, as briefly approached yesterday. For example, AMC, the movie theatre chain, has pumped 200%, which is 3x, in the past 5 days. Those are crypto like returns!

Meanwhile, society's fear of inflation is getting realer. First (after real estate and semiconductor chips, that is) it was only some commodities - timber and plastic, for example - suffering from higher prices. And specialists blamed that on optimised stock levels that broke due to COVID, together with increased post lockdown spending in the western world. Then, used cars and furniture became the spotlight. And now it seems global food prices are the next victim! This means central banks can start trying to tame inflation, which will be bad for all markets. So far, consensus is that this is just a temporary spike in just some categories and the stimulus measures will continue. Let's hope it continues that way.

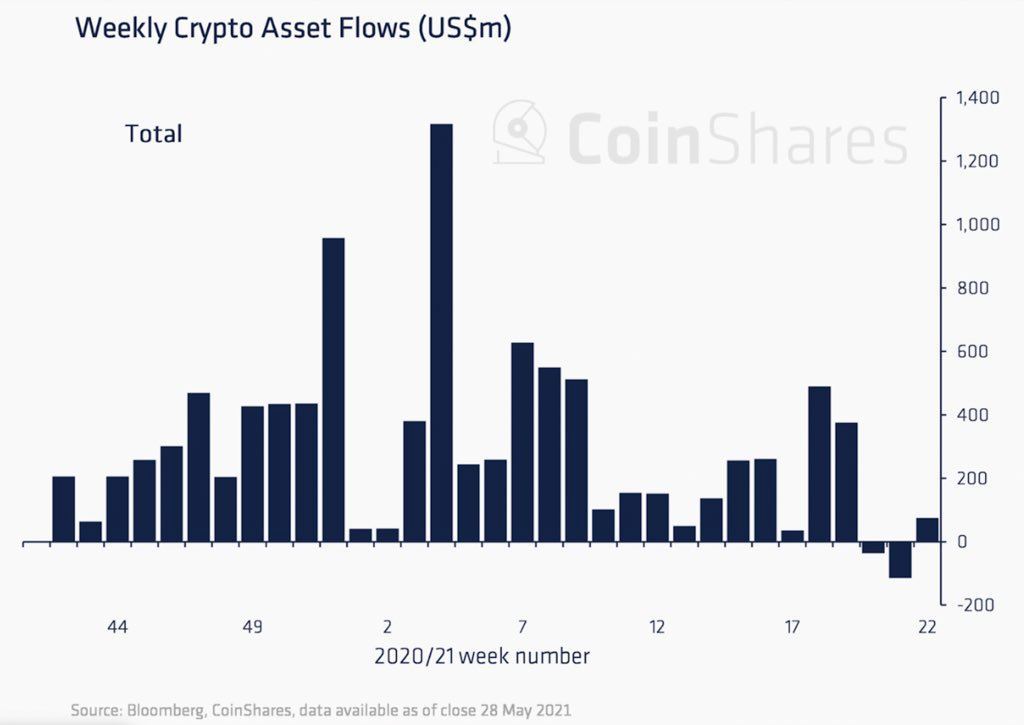

Visual block: institutional inflows are back.

Three things: read about DeFi if you want that berry.

- Do you know what's likely the most forked contract in DeFi? Ling Young Loon tells you what it is in a good analysis of how to be early in yield farming.

- Do you know what Experimental Lending Platforms are? Luke Posey, from Glassnode Insights, tells you all about the risky corner of the DeFi space.

- Do you know the potential of DeFi? Paul Brody, Global Blockchain Leader for EY, tells you all you kneed to know about DeFi's promising innovations.

Tweet tip: when real world Pancake perks?

Meme moment: "boomers had sex, drugs and rock & roll, millennials have AMC, GME, and BTC".

Girl Gone Crypto: new interview with B21's Nitin Agarwal.

COVID Crypto Relief Fund: made with help from B21.

Email eagerness: add us as a contact.

Get started: download the B21 Crypto app!