One thousand pages

Cryptic ball: contrarian relief.

This was a nice Tuesday for most markets. Bitcoin finally caught up with ether, appreciating some 5% while the runner-up lost a couple of percentage points. And US equities pumped too, as corporate earnings and a weaker dollar provided relief.

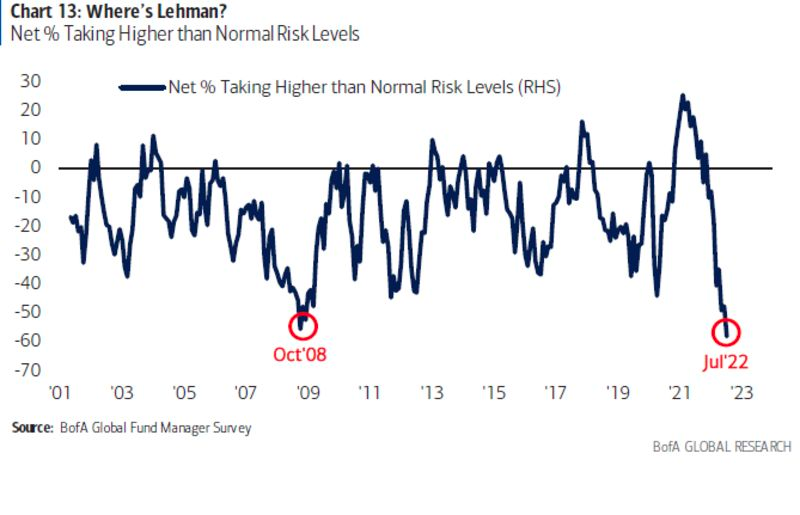

- Moreover, Bank of America's monthly global fund manager survey, highlighted in today's chart, also suggested the bottom is near or even behind us for stonks, as investors shared their risk appetite was at historical lows!

- The question remains whether this is just a nicely timed relief rally, taking advantage of the fact there's no forced selling currently going on and of the fact that most investors still need to allocate their capital and can't simply go short.

- As explained earlier, I tend to agree the bottom is behind us and that we'll see a true recovery as Q3 approaches, because the Fed will have to please both bulls and bears for November's midterm elections in the US.

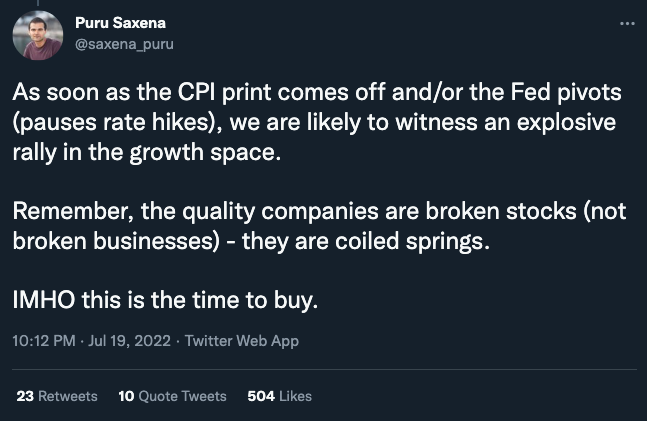

- Some of my favourite bears also agree that "the crash is already in the rear-view mirror". Check today's tweet tip for the final ingredients required for the lift-off of the stocks of quality companies and - I shall add - of quality alts!

Lastly, it's also key to remark that the scapegoats of this crypto cicle have been found - with a 1000-page legal document detailing the downfall of Three Arrows Capital. This is another sign which can provide comfort and signal a bottom!

Chart art: adversarial despondency.

Three things: confrontational anger.

- Dovey Wan explains "the darker triad" affecting crypto leaders.

- Ming Zhao explains "how (stonks) market structure works today".

- Wassie Lawyer explains "why 3AC went under". Must-read!

Tweet tip: reactionary relief.

Meme moment: conformist disbelief.

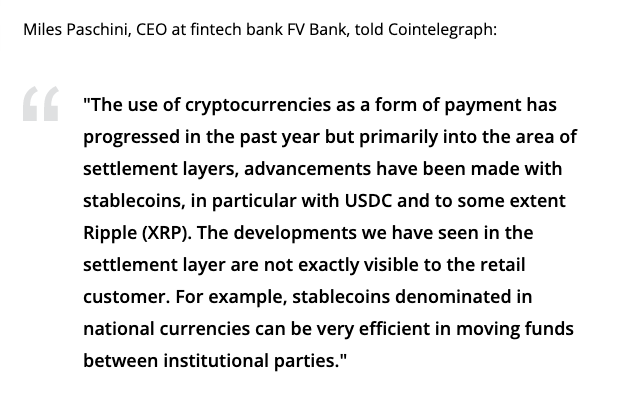

FV Bank: the future of settlement.

Get started: download the B21 Crypto app!